In this article, I will explore the fundamental distinction between finance and credit. As an expert in the field, I am frequently asked about the differences, and it is my aim to provide a clear and concise explanation. Finance refers to the management of money and investments, encompassing various activities such as budgeting, lending, and investing. On the other hand, credit involves the borrowing and lending of funds, typically involving a contractual agreement between a borrower and a lender. By the end of this article, you will have a comprehensive understanding of the contrasting nature and role of finance and credit in the realm of financial management.

Difference Between Finance And Credit

Definition of Finance

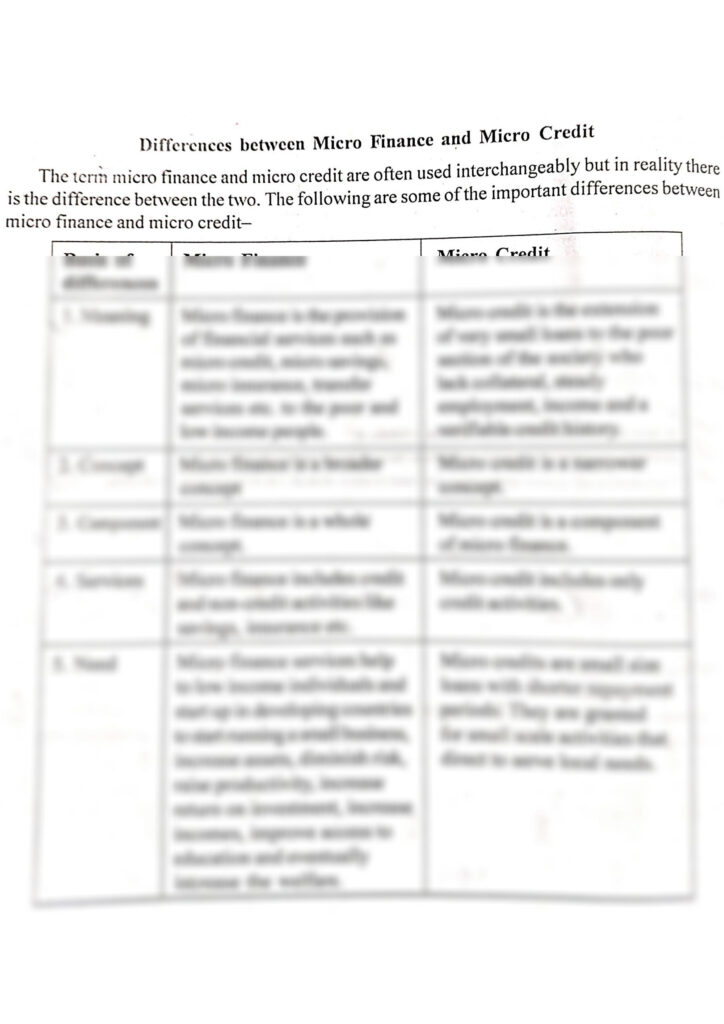

Finance refers to the management of money, particularly the acquisition and allocation of funds. It involves various activities such as budgeting, investing, and analyzing financial data to make informed decisions. In simple terms, finance involves the study of how individuals, businesses, and governments acquire, allocate, and use resources over time.

Definition of Credit

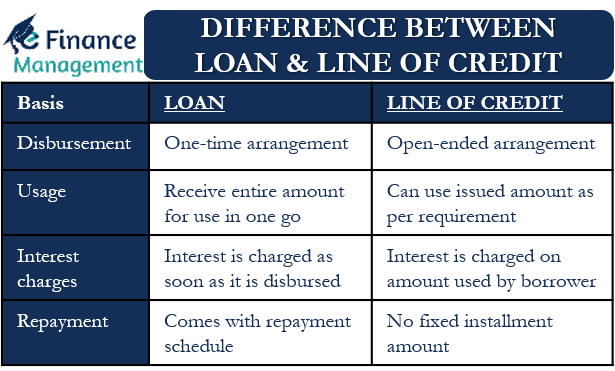

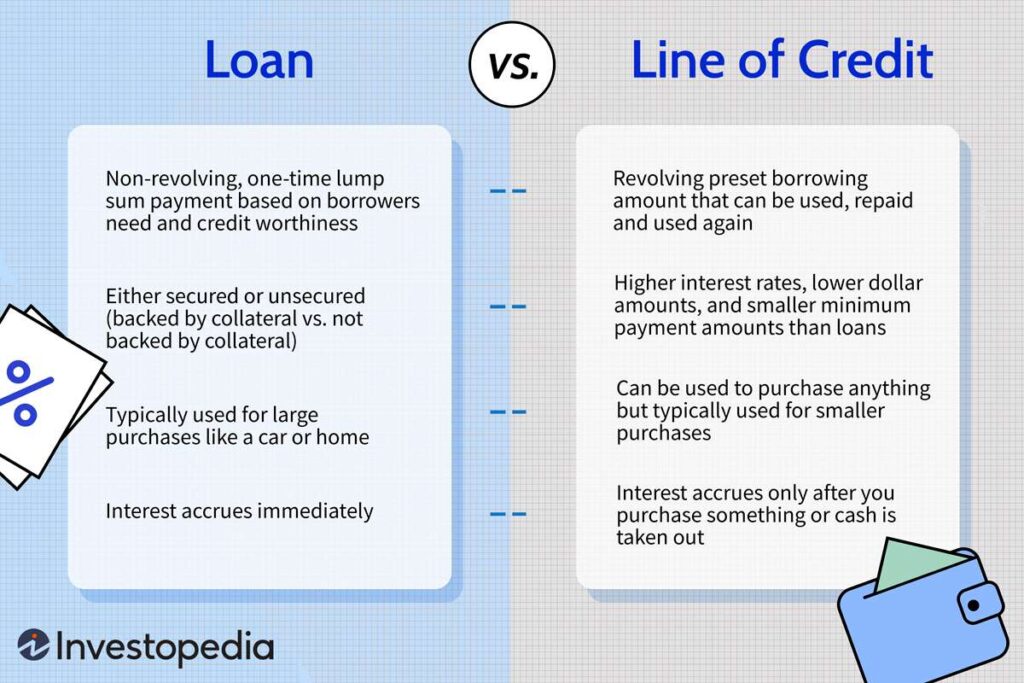

Credit, on the other hand, is a financial arrangement between two parties where one party provides goods, services, or money to another party with the expectation of future repayment. It is a form of borrowing and involves extending trust and allowing individuals or businesses to use funds or resources in advance. Credit can be in the form of loans, credit cards, or lines of credit.

Scope of Finance

Finance has a broad scope and encompasses various aspects of financial management. It includes personal finance, corporate finance, public finance, and international finance. Personal finance involves managing individual and household financial decisions such as budgeting, saving, and investing. Corporate finance focuses on financial management within businesses, including capital budgeting, financial planning, and risk management. Public finance deals with the management of government resources and revenue allocation. International finance deals with financial transactions between countries and global financial markets.

Scope of Credit

Credit, on the other hand, has a narrower scope compared to finance. It primarily deals with the borrowing and lending of funds. The scope of credit includes personal credit, business credit, and credit systems within financial institutions. Personal credit is used by individuals for personal needs such as buying a house, a car, or for education. Business credit is used by companies to finance their operations, invest in assets, or expand their business. Credit systems within financial institutions involve policies and procedures related to granting credit to individuals and businesses.

Types of Finance

Finance can be classified into various types based on the source of funds and the purpose of use. Some common types of finance include personal finance, equity finance, debt finance, and public finance. Personal finance involves managing an individual’s financial resources to achieve personal goals. Equity finance involves raising funds by selling shares of ownership in a company. Debt finance involves borrowing funds from lenders and repaying them over time, typically with interest. Public finance deals with the management of government revenue and expenses.

Types of Credit

Credit can be classified into different types based on its nature and purpose. Some common types of credit include consumer credit, business credit, and trade credit. Consumer credit is provided to individuals to finance personal expenses such as buying a car or furniture. Business credit is extended to companies to finance their operations, invest in assets, or expand their business. Trade credit is a form of credit extended by suppliers to buyers, allowing them to purchase goods or services on credit and pay at a later date.

Role of Finance

Finance plays a crucial role in the economy at both the individual and the macro level. At the individual level, finance helps individuals manage their personal finances, invest in assets, and plan for their future. It enables individuals to make informed financial decisions and build wealth over time. At the macro level, finance facilitates economic growth by providing businesses with the necessary funds to invest, innovate, and expand. It also helps governments manage their finances, allocate resources efficiently, and implement policies to support economic development.

Role of Credit

Credit plays an essential role in the financial system by facilitating borrowing and lending activities. It allows individuals and businesses to access funds they may not have immediately available, enabling them to make purchases, investments, or cover expenses. Credit also contributes to economic growth by stimulating consumption and investment. It helps businesses expand, create jobs, and contribute to the overall economic development of a country. Additionally, credit allows individuals to smooth their consumption over time and handle unexpected expenses.

Access to Finance

Access to finance refers to the availability and affordability of financial services and products to individuals and businesses. It is crucial for economic development and inclusion. Access to finance enables individuals to save, invest, and build assets, thereby improving their financial well-being. For businesses, access to finance is essential for investment, expansion, research and development, and operational activities.

Access to Credit

Access to credit is a subset of access to finance and refers specifically to the availability and affordability of credit. It is important for individuals and businesses to have access to credit to meet their financial needs, especially when they do not have sufficient savings or assets. Access to credit can provide individuals with opportunities to create wealth, invest in education, or start a business. For businesses, access to credit can facilitate growth, enable innovation, and support operational activities.

Importance of Finance

Finance is of crucial importance as it plays a vital role in individuals’ and businesses’ financial well-being and economic growth. The availability of financial resources and the ability to manage them effectively is essential in achieving financial goals, creating wealth, and securing a stable future. It also enables businesses to obtain the necessary funds to start operations, expand, innovate, and contribute to job creation and economic development.

Importance of Credit

Credit is important as it allows individuals and businesses to access funds they may not have immediately available. It enables individuals to make significant purchases such as buying a house or a car, invest in their education or start a business. For businesses, credit is essential for investment, expansion, research and development, and operational activities. The availability of credit stimulates consumption and investment, which in turn supports economic growth and development.

Risks in Finance

Finance involves various risks that need to be managed effectively. Some common risks in finance include market risk, credit risk, liquidity risk, and operational risk. Market risk refers to the volatility and unpredictability of financial markets, which can impact the value of investments. Credit risk involves the risk of borrowers defaulting on their financial obligations. Liquidity risk refers to the risk of not having sufficient funds available to meet financial obligations. Operational risk involves risks related to internal processes, systems, and human factors in financial institutions.

Risks in Credit

Credit also involves risks that need to be managed. Lenders face the risk of borrowers defaulting on loan repayments, which can result in financial losses. This credit risk is mitigated through credit assessment, collateral requirements, and risk management strategies. Borrowers also face risks in credit, such as taking on more debt than they can handle or facing higher interest rates or fees. Proper financial planning and responsible borrowing practices can help individuals and businesses mitigate these risks.

Regulation of Finance

Finance is subject to various regulations and laws designed to ensure financial stability, protect consumers, and promote fair and transparent financial practices. Governments and regulatory bodies establish and enforce regulations related to banking, securities, insurance, and other financial activities. These regulations aim to reduce systemic risks, prevent financial fraud, ensure market integrity, and promote consumer protection. Additionally, regulations are in place to monitor and regulate financial institutions and their practices to maintain stability in the financial system.

Regulation of Credit

Credit is also subject to regulations to ensure fair and responsible lending practices. Governments and regulatory bodies implement regulations to protect consumers from predatory lending practices, ensure transparency in credit agreements, and promote responsible borrowing and lending. Regulations may include restrictions on interest rates, disclosure requirements, and enforcement of fair lending practices. These regulations aim to strike a balance between allowing access to credit and protecting consumers from excessive debt or unfair lending practices.

Implications for Individuals

The difference between finance and credit has significant implications for individuals. Finance provides individuals with the knowledge and tools to manage their personal finances effectively, make informed investment decisions, and plan for their future. It empowers individuals to achieve their financial goals, build wealth, and secure their financial well-being. Credit, on the other hand, provides individuals with access to funds they may not have immediately available, enabling them to make significant purchases, invest in education, or start a business. However, individuals need to be mindful of the risks associated with credit and practice responsible borrowing to avoid excessive debt or financial hardships.

Implications for Businesses

For businesses, understanding the difference between finance and credit is crucial for their financial management and growth. Finance encompasses the various activities involved in managing financial resources, such as budgeting, investing, and risk management. It enables businesses to obtain the necessary funds for their operations, invest in assets, expand their operations, and innovate. Credit, on the other hand, facilitates borrowing and provides businesses with the financial flexibility to meet their short-term and long-term needs. However, businesses must be aware of the risks involved in credit and manage their borrowing and repayments responsibly to avoid financial distress.

Conclusion

In conclusion, finance and credit are two distinct but interconnected elements of the financial system. Finance involves the management of money, while credit refers to the borrowing and lending of funds. Both finance and credit play essential roles in individuals’ financial well-being, businesses’ growth, and economic development. Understanding the difference between finance and credit, as well as their implications and risks, is crucial for individuals and businesses to make informed financial decisions, manage their finances effectively, and achieve their financial goals.