In this article, I will discuss the concept of Credit Bond Finance and Security. Credit bond finance involves the issuance of bonds by corporations or governments to raise capital. These bonds allow investors to lend money in exchange for periodic interest payments and the return of principal upon maturity. Additionally, the aspect of security ensures that bondholders have a legal claim on the issuer’s assets in the event of default. Understanding the intricacies of Credit Bond Finance and Security is essential for investors and financial professionals alike, as it offers a valuable avenue for capital allocation and risk management.

1. What are Credit Bonds?

Credit bonds are financial instruments that represent debt obligations issued by companies, governments, or other entities to raise capital. These bonds are essentially a form of borrowing where the issuer promises to repay the borrowed amount along with periodic interest payments to the bondholders. They are widely used as an investment option by individuals, institutional investors, and portfolio managers seeking fixed income returns.

1.1 Definition of Credit Bonds

Credit bonds can be defined as fixed income securities that are backed by the creditworthiness of the issuer. They are also known as corporate bonds, government bonds, or municipal bonds depending on the type of issuer. These bonds have a predetermined maturity date, where the principal amount is repaid to the bondholders.

1.2 Types of Credit Bonds

There are various types of credit bonds available in the financial markets. Some common types include:

- Corporate Bonds: These bonds are issued by corporations to raise capital for business operations or expansion.

- Government Bonds: These are debt securities issued by government entities at the federal, state, or local level to fund public projects or manage budget deficits.

- Municipal Bonds: Municipalities issue these bonds to finance infrastructure projects such as roads, schools, or hospitals.

- High-Yield Bonds: Also known as junk bonds, these credit bonds offer higher yields but are considered riskier due to the lower credit ratings of the issuers.

- Convertible Bonds: These bonds can be converted into a specified number of common shares of the issuing company, providing potential equity upside along with fixed income.

2. The Role of Credit Bond Finance

Credit bond finance plays a crucial role in the functioning of financial markets and the economy as a whole. It serves as a vital channel for companies, governments, and municipalities to access capital for various purposes, such as funding investments, capital projects, or refinancing existing debt.

2.1 Importance of Credit Bond Finance

The importance of credit bond finance can be attributed to several factors. Firstly, it enables companies to raise long-term capital at a fixed rate of interest, allowing them to plan their cash flows and investments more effectively. Secondly, credit bonds provide investors with a relatively safer investment option compared to equity investments, as bondholders have a higher claim on the issuer’s assets in case of default. Lastly, credit bond finance contributes to economic growth by facilitating capital investments and driving job creation.

2.2 Benefits of Credit Bond Finance

Credit bond finance offers several benefits to both issuers and investors. For issuers, it provides an efficient means of raising capital at a predetermined cost, reducing reliance on bank loans or equity financing. Additionally, the interest payments on credit bonds are tax-deductible for issuers, resulting in potential tax savings. For investors, credit bonds offer a predictable stream of income through regular interest payments, diversification opportunities, and a wide range of maturities to match investment horizons.

3. Credit Bond Security Measures

To protect the interests of bondholders and ensure timely repayment of principal and interest, credit bonds employ various security measures. These measures safeguard investors against default risk and enhance the overall creditworthiness of the issuer.

3.1 Credit Bond Collateralization

Collateralization is a common security measure used in credit bonds, particularly in secured corporate bonds or asset-backed securities. It involves pledging specific assets of the issuer as collateral, which can be seized by bondholders in the event of default. This provides an added layer of protection and increases the likelihood of recovering the investment.

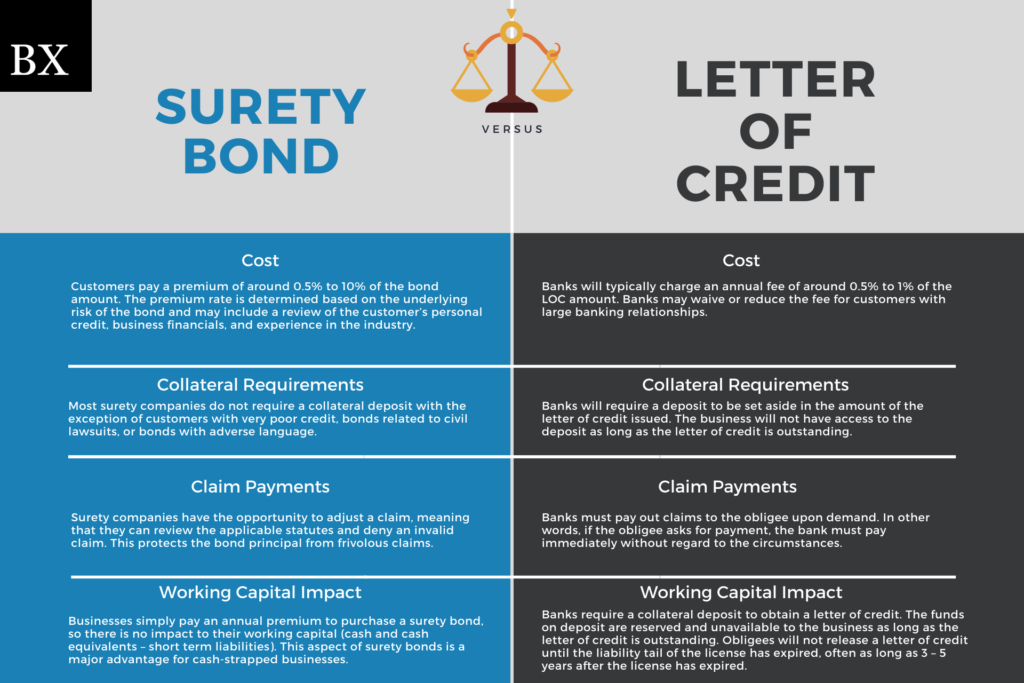

3.2 Guarantees and Insurance

In certain cases, credit bonds may also include guarantees or insurance to enhance their security. The issuer may obtain a guarantee from a third-party with a strong credit rating, ensuring that the principal and interest payments will be made even if the issuer defaults. Alternatively, bond insurance can be purchased to protect against default risk, where an insurance company agrees to compensate bondholders in case of default.

4. Credit Rating Agencies and Credit Bonds

Credit rating agencies play a critical role in the credit bond market by evaluating the creditworthiness of issuers and assigning credit ratings to their bonds. These ratings serve as a benchmark for investors to assess the default risk associated with a particular credit bond offering.

4.1 Role of Credit Rating Agencies

Credit rating agencies analyze an issuer’s financial strength, business operations, and repayment ability to determine its creditworthiness. They assign ratings based on their assessment, which range from AAA (highest credit quality) to D (default). These ratings enable investors to gauge the level of risk associated with a credit bond and make informed investment decisions.

4.2 Impact of Credit Ratings on Credit Bonds

The credit rating assigned to a credit bond has a direct impact on its pricing and demand in the market. Bonds with higher credit ratings typically offer lower yields as they are perceived as less risky by investors. On the other hand, bonds with lower credit ratings, such as high-yield bonds, offer higher yields to compensate for the higher level of risk. The credit rating also affects the cost of capital for issuers, as lower-rated bonds may require higher coupon payments to attract investors.

5. Factors Affecting Credit Bond Pricing

The pricing of credit bonds is influenced by several factors, including interest rates and credit risk. Understanding these factors is crucial for investors and issuers in determining the fair value of credit bonds and making informed investment decisions.

5.1 Interest Rates and Yield Movements

Interest rates have a significant impact on credit bond pricing. When interest rates rise, the yield on existing bonds becomes less attractive, leading to a decrease in their market value. Conversely, when interest rates decline, bond yields become relatively more attractive, causing bond prices to increase. This inverse relationship between interest rates and bond prices is important to consider when assessing the potential returns and risks associated with credit bond investments.

5.2 Credit Risk and Credit Spreads

Credit risk, or the likelihood of default by the issuer, plays a crucial role in determining credit bond pricing. Bonds issued by entities with higher credit ratings usually trade at narrower spreads above government bonds due to their lower default risk. On the other hand, bonds issued by riskier entities or with lower credit ratings typically trade at wider credit spreads as compensation for the increased default risk.

6. Credit Bond Market Dynamics

The credit bond market comprises two primary segments: the primary market and the secondary market. Understanding the dynamics of these markets is essential for participants, including issuers, investors, and intermediaries.

6.1 Primary Credit Bond Market

The primary credit bond market is where new credit bonds are issued by the issuer and sold to investors. Issuers typically engage investment banks to underwrite and distribute the bonds to a wide range of investors. This market is crucial for providing issuers access to capital and establishing the initial pricing of the bonds.

6.2 Secondary Credit Bond Market

The secondary credit bond market involves the trading of existing bonds after their initial issuance in the primary market. Investors can buy and sell these bonds among themselves, and the prices are determined by supply and demand dynamics. The secondary market provides liquidity to investors who wish to exit their positions or acquire additional bonds.

7. Credit Bond Issuance Process

The issuance of credit bonds involves various steps and considerations to ensure a successful offering and effective capital raising.

7.1 Underwriting and Syndication

Underwriting is a key step in the issuance process where investment banks or underwriters assess the creditworthiness of the issuer and agree to purchase the bonds at a predetermined price. They then form a syndicate to distribute the bonds to a wide range of investors, ensuring broad market participation and efficient capital raising.

7.2 Offering Memorandum and Prospectus

During the issuance process, issuers prepare an offering memorandum or prospectus that provides detailed information about the credit bond offering. This document includes essential information such as the terms of the bonds, credit ratings, use of proceeds, risk factors, and financial disclosures. It serves as a comprehensive source of information for potential investors to evaluate the investment opportunity.

8. Credit Bond Trading Strategies

Investors can employ various trading strategies when dealing with credit bonds, depending on their investment objectives, risk appetite, and market conditions.

8.1 Buy and Hold Strategy

The buy and hold strategy involves purchasing credit bonds with the intention of holding them until maturity and collecting the periodic interest payments. This strategy is ideal for investors seeking stable income and who have a long-term investment horizon. It minimizes transaction costs and market volatility, while providing a predictable cash flow.

8.2 Credit Spread Trading

Credit spread trading involves taking advantage of changes in credit spreads between different bonds or market indices. Investors aim to profit from narrowing spreads by buying bonds with wider spreads and subsequently selling them when the spreads narrow. This strategy requires active monitoring of credit market conditions and analysis of credit spreads to identify trading opportunities.

9. Credit Bond Default and Recovery

Default risk is an inherent concern for credit bond investors. Understanding default risk analysis and recovery rates is crucial for evaluating potential credit bond investments.

9.1 Default Risk Analysis

Default risk analysis involves assessing the probability of an issuer defaulting on their credit bond obligations. It considers various factors such as the issuer’s financial health, cash flow, industry prospects, and economic conditions. Credit rating agencies play a significant role in providing independent assessments of default risk through their credit ratings.

9.2 Recovery Rates and Credit Losses

In the event of default, bondholders may face losses depending on the recovery rates of the defaulted bonds. Recovery rates represent the percentage of the bond’s face value that bondholders can expect to recover through the liquidation of the issuer’s assets. Higher recovery rates result in lower credit losses for bondholders, while lower recovery rates imply higher losses and increased default risk.

10. Future Trends in Credit Bond Finance

The credit bond market is continuously evolving, driven by technological advancements and regulatory developments. Understanding future trends can help investors and market participants adapt to changing dynamics and identify potential opportunities.

10.1 Technological Innovations

Technological innovations, such as blockchain and electronic trading platforms, are transforming the credit bond market. These innovations can enhance efficiency, transparency, and liquidity in trading and settlement processes, reducing costs and improving overall market access.

10.2 Regulatory Developments

Regulatory developments play a crucial role in shaping the credit bond market. Changes in regulations, such as increased disclosure requirements or shifts in capital requirements, can impact the issuance process, trading dynamics, and investor protection. Staying abreast of regulatory developments is essential for market participants to navigate the evolving landscape effectively.

In conclusion, credit bonds play a fundamental role in financing operations, projects, and investments for various entities. They provide a reliable investment option for investors seeking fixed income returns while contributing to economic growth. Understanding the nuances of credit bond finance, security measures, trading strategies, and market dynamics is crucial for both issuers and investors in making informed decisions and managing risks effectively.