As an expert in the field of finance, I aim to shed light on the intricate world of debit and credit within the realm of personal and business finance. Understanding the fundamentals of finance debit and credit is essential for anyone seeking financial stability and success. In this article, I will explore the key concepts and strategies involved in navigating the intricacies of debit and credit in order to empower individuals and businesses to make informed financial decisions. Whether you are a seasoned investor or a novice just beginning your financial journey, this article will provide valuable insights into the world of finance debit and credit.

What is Debit and Credit?

Understanding Debit

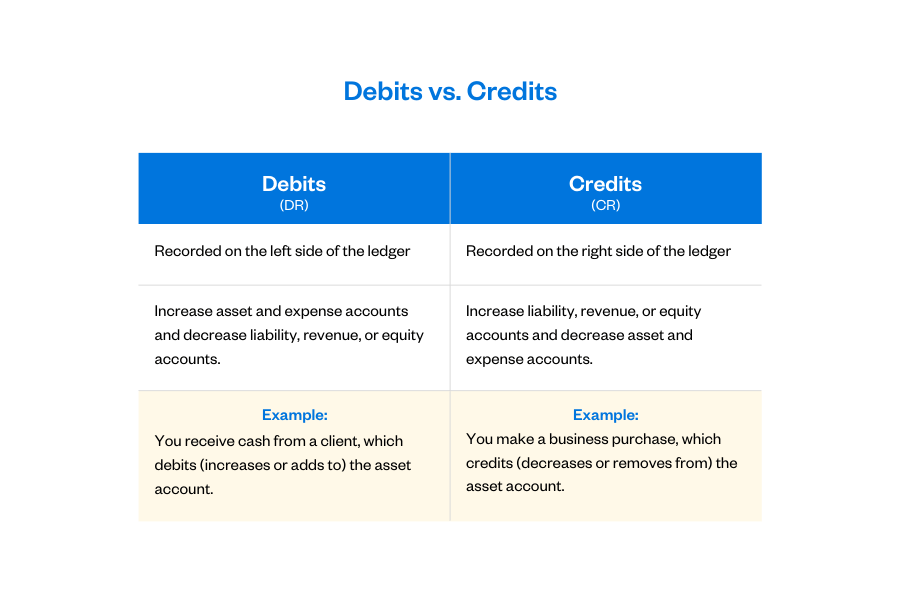

In the world of finance and accounting, debit is a term used to refer to various aspects related to financial transactions and bookkeeping. At its core, debit represents an entry made on the left side of an account in double-entry bookkeeping. This means that when a transaction occurs, a debit entry is made to one account, while a corresponding credit entry is made to another.

Understanding Credit

On the other hand, credit is the entry made on the right side of an account in double-entry bookkeeping. It is the opposite of debit and represents the other side of a transaction. Just like with debit, credit entries are made to different accounts depending on the nature of the transaction and the accounts involved.

Difference Between Debit and Credit

Definition

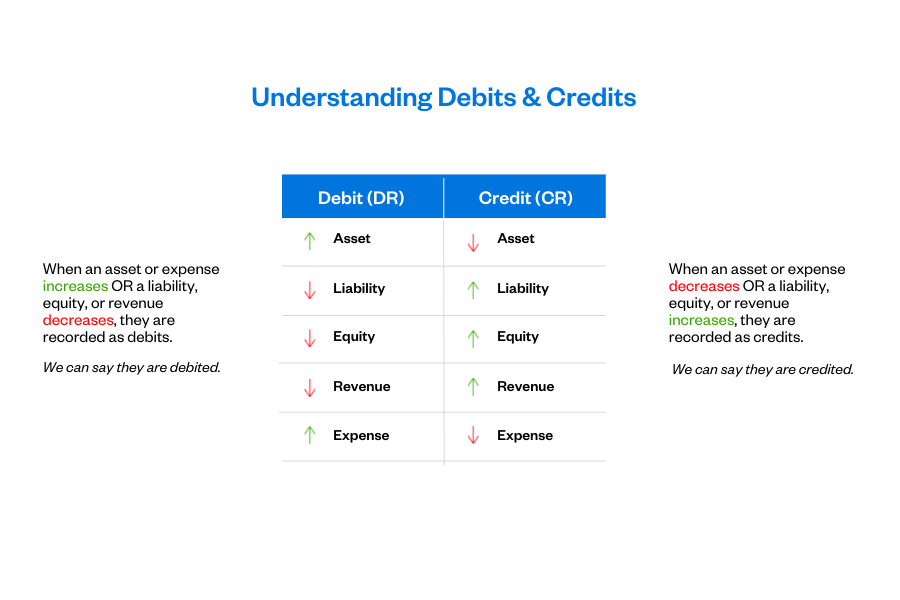

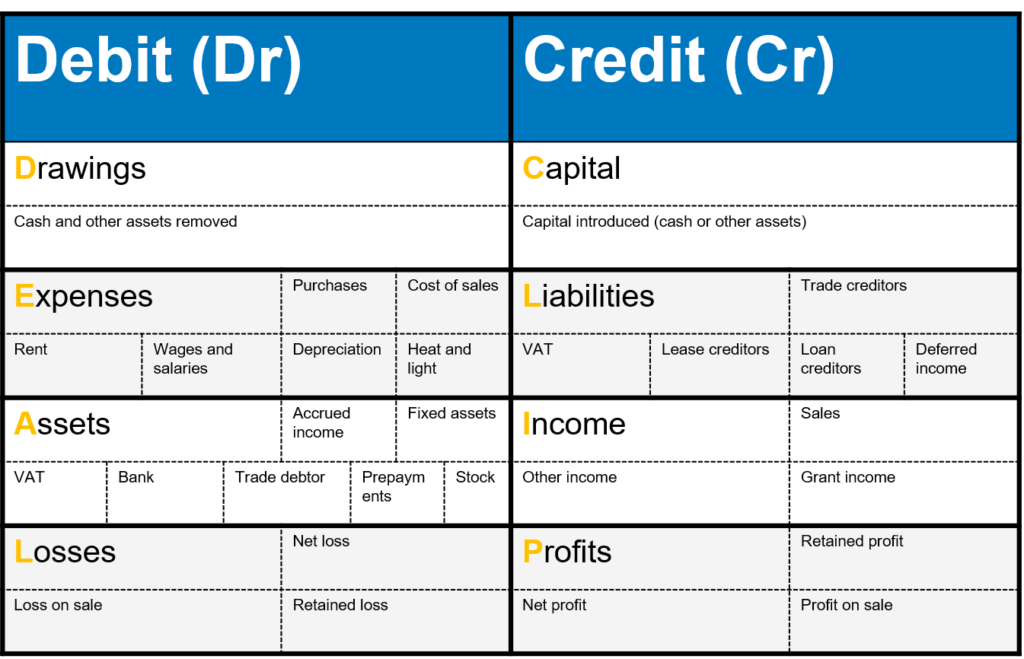

In simple terms, debit and credit are two sides of the same coin. Debit refers to the left side of an account, while credit refers to the right side. However, their specific definitions go beyond these physical positions. Debits are used to record increases in assets and expenses, as well as decreases in liabilities and revenues. On the other hand, credits are used to record decreases in assets and expenses, as well as increases in liabilities and revenues.

Accounting Entries

When a financial transaction occurs, both debit and credit entries must be made to ensure the accounting equation remains balanced. This double-entry bookkeeping system ensures that for every debit entry made, a corresponding credit entry is recorded. This practice allows for a transparent and comprehensive record of all financial transactions, as well as provides a method for accurate financial statements and reporting.

Effect on Financial Statements

Debit and credit entries have a significant impact on financial statements. The balances of specific accounts, whether they are assets, liabilities, equity, revenue, or expense accounts, are affected by whether there is a debit or credit transaction. The net effect of all these individual debits and credits results in the financial position and performance of an individual or business being accurately reflected in the financial statements

Debit in Finance

Debit Cards

One common form of debit in personal finance is the use of debit cards. Debit cards are linked to a bank account and allow individuals to make purchases using funds directly from their accounts. When a transaction is made using a debit card, the corresponding amount is debited from the individual’s bank account and is immediately reflected in the account balance.

Debit Transactions

Debit transactions represent the movement of funds out of an account. This could include payments for goods or services, withdrawals from an ATM, or transfers to other accounts. Debit transactions provide individuals and businesses with a convenient way to handle their financial transactions without the need for carrying large amounts of cash.

Debit Balances

In finance, a debit balance refers to a situation where the total debits in an account exceed the total credits. This indicates that there is a positive balance in that account. For example, if an individual has $1,000 in their bank account and makes a debit transaction of $500, the resulting balance would be $500.

Credit in Finance

Credit Cards

Unlike debit cards, credit cards allow individuals to make purchases on credit. When an individual makes a purchase using a credit card, they are essentially borrowing money from the credit card issuer. The amount spent is not immediately deducted from the individual’s bank account but is added to their credit card balance. The credit card statement is then issued at the end of a billing cycle, with the individual having the option to pay off the full balance or make minimum payments over time.

Credit Transactions

Credit transactions are associated with the movement of funds into an account. This could include receiving payments, loans, or any other form of funds transfer that increases the account balance. Credit transactions provide individuals and businesses with financial flexibility and the ability to make purchases or investments without requiring immediate cash on hand.

Credit Balances

A credit balance refers to a situation where the total credits in an account exceed the total debits. This indicates that there is a positive balance in that account. For example, if an individual receives a payment of $1,000 and there are no debit transactions, the resulting balance would be $1,000.

Debit and Credit in Accounting

Double-Entry Bookkeeping

In accounting, the double-entry bookkeeping system is widely used to record and track financial transactions. This system ensures that every transaction is recorded with a debit entry to one account and a corresponding credit entry to another account. By utilizing this system, businesses can maintain accurate and comprehensive financial records, which are essential for decision-making, tax compliance, and financial analysis.

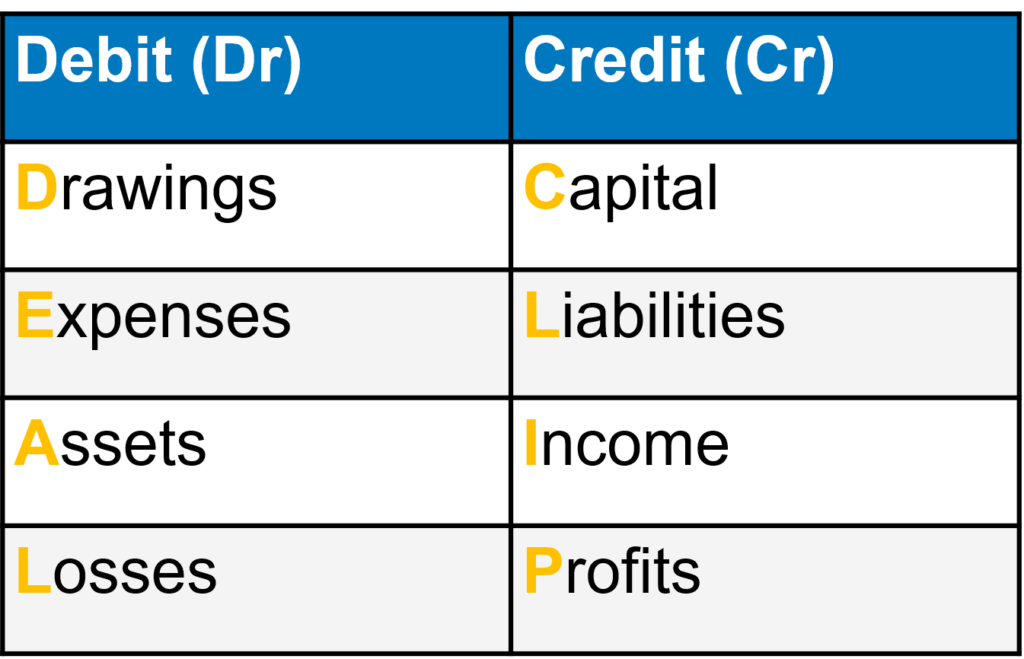

Debit and Credit Rules

Debit and credit rules guide accountants in determining which accounts are debited and credited for a particular transaction. These rules are based on the nature of the accounts involved and the type of transaction being recorded. For example, an increase in an asset account would require a debit entry, while an increase in a liability account would require a credit entry. Understanding and following these rules is crucial in maintaining accurate and balanced financial records.

Types of Debit and Credit Accounts

Asset Accounts

Asset accounts include cash, inventory, property, and equipment, among others. When these accounts increase, they are debited, and when they decrease, they are credited. The purpose of recording these transactions is to accurately reflect the value of assets owned by an individual or business.

Liability Accounts

Liability accounts represent debts or obligations owed by an individual or business. When these accounts increase, they are credited, and when they decrease, they are debited. Recording these transactions is essential in accurately reflecting the financial obligations and debts owed to various parties.

Equity Accounts

Equity accounts reflect the ownership interest in a business. They include accounts such as owner’s equity or shareholder’s equity. When equity accounts increase, they are credited, and when they decrease, they are debited. These accounts allow for the tracking of the investments made and the profits or losses generated within a business.

Revenue Accounts

Revenue accounts encompass the income generated by the sale of goods or services provided by a business. When revenue accounts increase, they are credited, and when they decrease, they are debited. Properly recording revenue transactions is vital for calculating profitability and assessing the financial performance of a business.

Expense Accounts

Expense accounts represent the costs incurred by a business in its day-to-day operations. These can include salaries, rent, utilities, and other expenses. When expense accounts increase, they are debited, and when they decrease, they are credited. Tracking and categorizing these expenses is crucial for budgeting, cost control, and financial analysis.

Benefits and Risks of Debit and Credit

Benefits of Debit

Debit offers the advantage of allowing individuals to make purchases directly from their available funds, eliminating the need to carry large amounts of cash. It also assists in budgeting by providing real-time transaction records and allowing for better expense tracking. Debit cards are widely accepted and can be used for online transactions, making them highly convenient in today’s digital age.

Benefits of Credit

Credit provides individuals with the opportunity to make purchases without immediately depleting their bank account balance. It allows for larger purchases and provides a safety net in case of emergencies. Credit cards often come with additional benefits such as rewards points, cashback offers, and extended warranties, which can further enhance the financial benefits of using credit.

Risks of Debit

While debit offers many benefits, it also carries certain risks. In cases of fraud or unauthorized transactions, it can be more challenging to recover funds that have been debited from a bank account. Additionally, strict budgeting is required when using debit to ensure that available funds are not overspent. Overdraft fees and potential denial of transactions can also occur if funds are insufficient.

Risks of Credit

The primary risk associated with credit is excessive debt and the potential for high-interest charges when balances are not paid in full. Late payments can negatively impact credit scores and result in additional fees or interest rate hikes. Issuing credit to individuals without proper assessment can also lead to a higher risk of defaults and loan delinquencies for lenders.

Managing Personal Finances with Debit and Credit

Budgeting

Both debit and credit transactions should be integrated into an individual’s budgeting process to ensure proper financial management. By tracking income and expenses, individuals can allocate funds appropriately and avoid overspending. Budgeting helps prioritize essential expenses and long-term financial goals.

Tracking Expenses

Utilizing debit and credit transactions allows for a more accurate and detailed tracking of expenses. Online banking portals and credit card statements provide individuals with access to transaction history, which can be instrumental when categorizing expenses and reviewing spending habits. This information promotes financial awareness and enables individuals to identify areas for potential cost-saving.

Building Credit

Credit cards offer individuals the opportunity to build and establish a credit history. By making consistent, on-time payments, individuals demonstrate their creditworthiness to lenders and increase their credit scores. A good credit history is essential for securing loans, mortgages, and favorable interest rates in the future.

Using Debit and Credit for Business Finances

Cash Flow Management

Debits and credits play a crucial role in managing the cash flow of a business. Monitoring cash inflows and outflows through proper bookkeeping allows businesses to project future revenue, track expenses, and make informed financial decisions. By accurately recording debits and credits, businesses can maintain a healthy cash flow position.

Managing Accounts Payable and Receivable

In business, debit and credit transactions are vital for managing accounts payable and receivable. When a business receives goods or services on credit from suppliers, an accounts payable is created. On the other hand, when a business extends credit to customers, an accounts receivable is established. Properly tracking and managing these accounts is essential to maintain healthy vendor and customer relationships.

Financial Reporting

Accurate debits and credits are the foundation of financial reporting for businesses. Financial statements, such as the balance sheet, income statement, and cash flow statement, rely on the information provided by the double-entry bookkeeping system. By properly recording debit and credit entries, businesses can generate reliable financial reports for internal management purposes and external stakeholders.

Conclusion

Understanding the concept of debit and credit is essential for anyone involved in finance and accounting. Debits and credits form the basis of the double-entry bookkeeping system, enabling accurate recording of financial transactions. Whether in personal or business finance, debit and credit play significant roles in managing finances and making informed financial decisions. By grasping the benefits, risks, and applications of debit and credit, individuals and businesses can ensure proper management of their funds and establish a strong financial foundation.