With the ever-increasing importance of credit scores in the financial world, it is crucial to understand the significant role they play when it comes to obtaining car finance. Your credit score, a numerical representation of your creditworthiness, can determine whether you are eligible for favorable loan terms and interest rates. In this article, I will explore the correlation between credit scores and car finance, shedding light on how this influential number can impact your ability to secure the ideal vehicle financing.

Understanding Credit Scores

What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness. It is a measure that lenders use to assess the risk of lending money to a borrower. Credit scores are generated by credit bureaus based on various factors, such as payment history, outstanding debt, length of credit history, types of credit used, and new credit inquiries.

Importance of credit scores

Credit scores play a crucial role in many financial decisions, including car financing. A good credit score can open doors to lower interest rates, higher loan amounts, and better financing options. It demonstrates responsible financial behavior and gives lenders confidence in a borrower’s ability to repay the loan. On the other hand, a poor credit score can limit financing options and result in higher interest rates, making it more challenging to afford a car.

Factors that affect credit scores

Several factors contribute to the calculation of a credit score. Payment history is the most significant factor, accounting for about 35% of the score. It reflects whether borrowers have made payments on time and if they have any delinquencies or defaults. The amount owed, which accounts for about 30% of the score, considers the total debt and utilization ratio. The length of credit history, comprising about 15% of the score, assesses the duration of borrowing and repayment activities. Types of credit used and new credit inquiries make up the remaining 10% each and analyze the variety of credit accounts and recent applications.

How Credit Scores Impact Car Financing

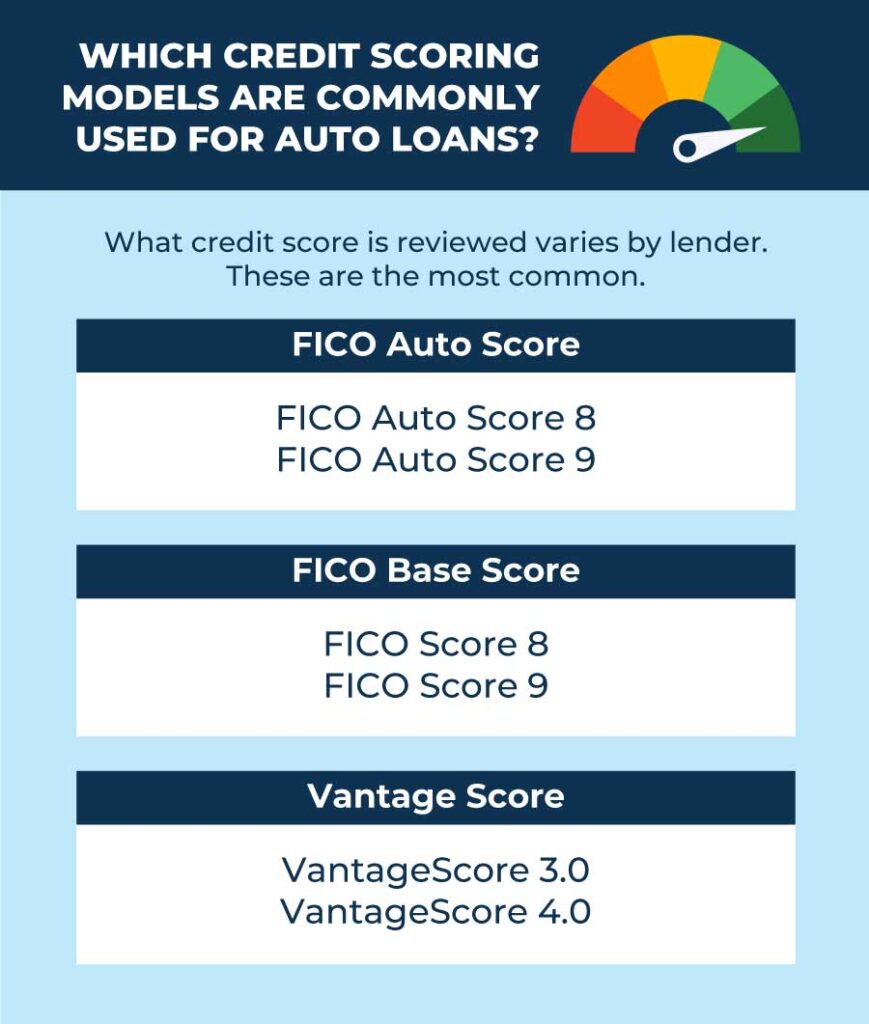

Relationship between credit scores and car financing

Credit scores have a significant impact on car financing as they determine the terms and conditions of the loan. Lenders use credit scores to assess the borrower’s risk and decide whether to approve the loan application. A higher credit score often leads to better loan terms, including lower interest rates, longer repayment terms, and higher loan amounts. Conversely, individuals with lower credit scores may face challenges in obtaining favorable financing options.

Why lenders consider credit scores

Lenders consider credit scores because they provide valuable insight into an individual’s creditworthiness and repayment behavior. A higher credit score suggests responsible financial management and a lower likelihood of defaulting on loan payments. Lenders want to minimize their risk and ensure that borrowers can repay the loan in a timely manner. By evaluating credit scores, lenders can make informed decisions regarding loan approvals, interest rates, and loan amounts.

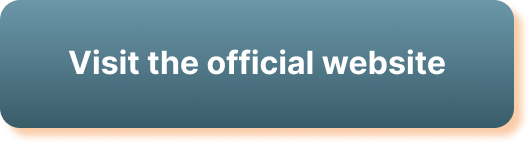

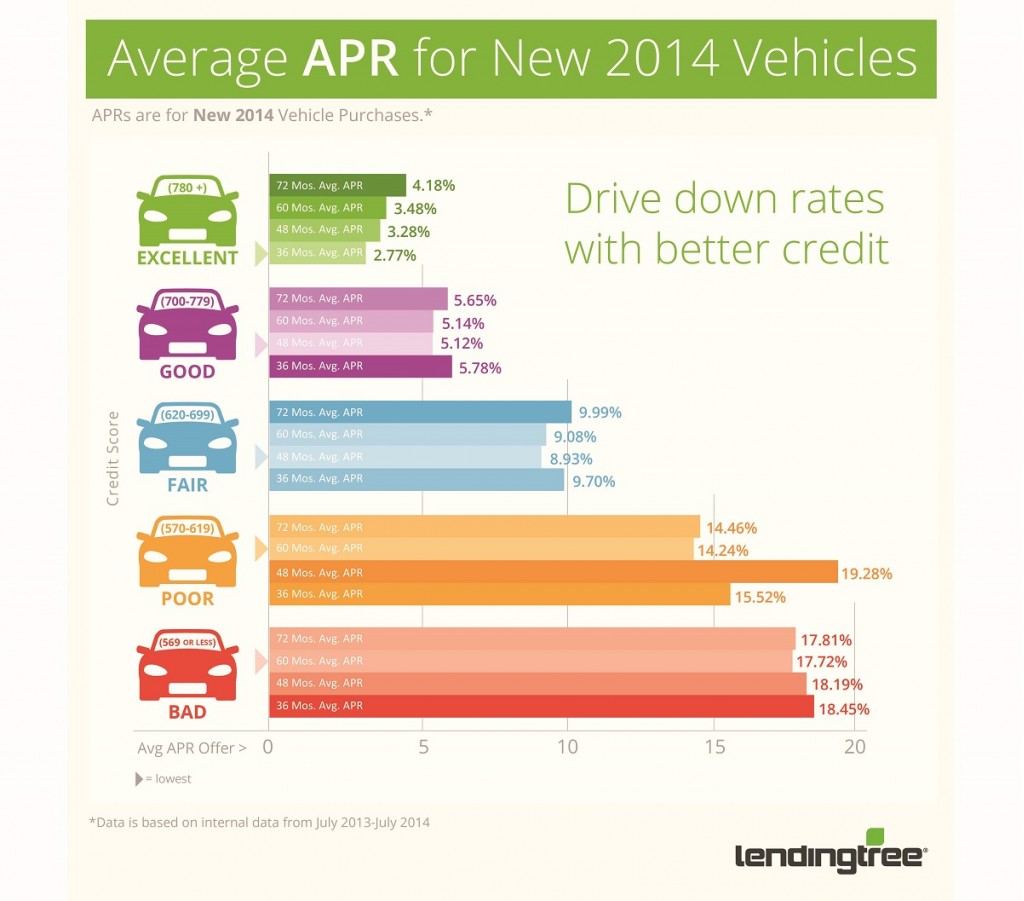

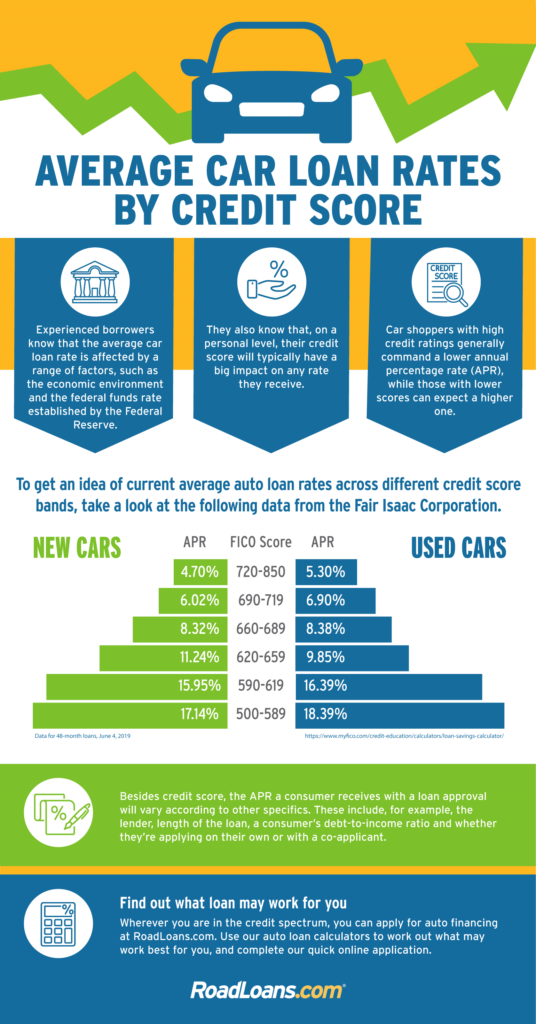

Interest rates based on credit scores

Interest rates on car loans are primarily determined by credit scores. Borrowers with excellent credit scores typically qualify for the lowest interest rates, which can significantly reduce the overall cost of financing a car. As credit scores decline, interest rates increase to compensate for the higher risk involved. This means that individuals with poor credit scores may face significantly higher interest rates, making the loan more expensive over time. It is important to note that even a slight difference in interest rates can result in substantial savings or additional costs throughout the loan term.

Types of Car Financing

Traditional auto loans

Traditional auto loans are the most common form of car financing. In this type of financing, the borrower takes out a loan from a lender to purchase a car, and the loan is then repaid over a fixed period with interest. Traditional auto loans offer flexibility in terms of choosing the car’s make, model, and ownership, providing the borrower with full ownership rights after the loan is fully repaid.

Leasing options

Leasing a car is another type of car financing that has gained popularity in recent years. It involves renting a car for a specific period, typically two to three years. During this time, the lessee pays monthly installments that cover the vehicle’s depreciation and fees. Unlike traditional auto loans, leasing does not result in ownership of the vehicle. At the end of the lease term, the lessee can either return the car or buy it at a predetermined price.

Special financing for low-credit individuals

For individuals with lower credit scores or limited credit histories, special financing options may be available. These options often come with higher interest rates and stricter terms but provide an opportunity for those with less-than-ideal credit to obtain car financing. Special financing may require a larger down payment or a co-signer to secure the loan.

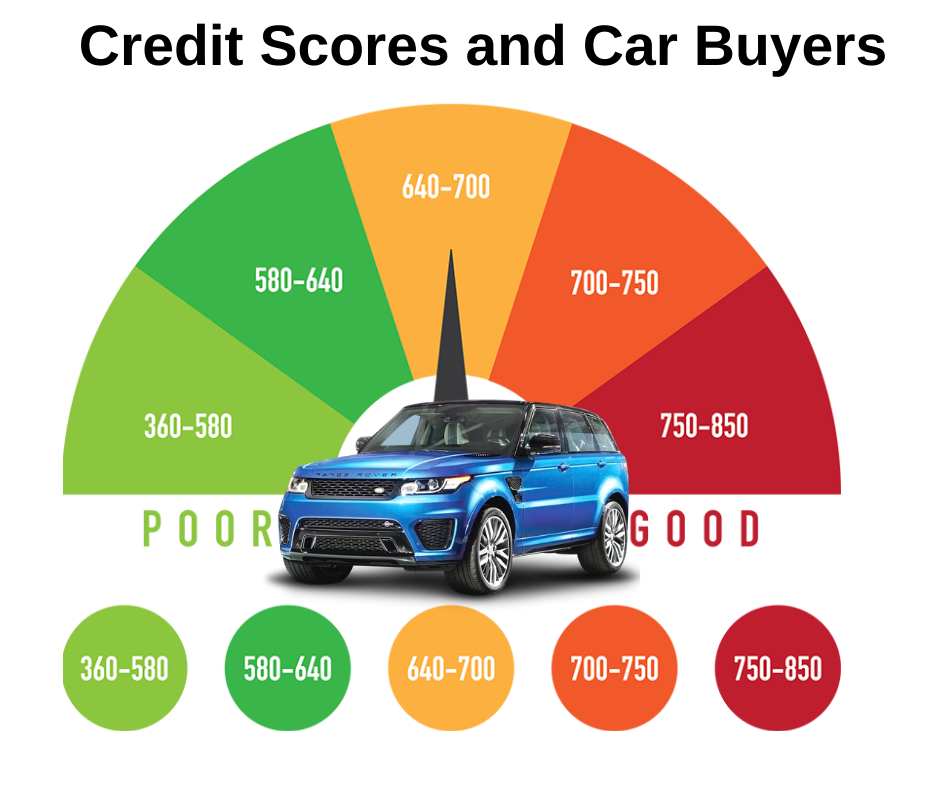

Minimum Credit Score Requirements

General credit score requirements

The minimum credit score requirements for car financing vary depending on the lender and the type of loan. In general, a credit score above 700 is considered excellent, and borrowers with such scores are likely to qualify for the best loan terms and interest rates. A credit score between 650 and 699 is considered good, while a score between 600 and 649 is considered fair. Credit scores below 600 may be categorized as poor, making it more challenging to secure favorable financing options.

Specific credit score requirements for different lenders

Different lenders may have specific credit score requirements based on their risk tolerance and lending policies. While some lenders may have strict minimum credit score requirements, others may be more flexible and consider other factors, such as income and employment history. It is essential for borrowers to research and compare lenders to find those that are more likely to approve loans based on their credit score range.

Options for individuals with lower credit scores

Individuals with lower credit scores still have options for car financing. They can pursue special financing programs, seek loans from credit unions or online lenders specializing in low-credit borrowers, or consider a co-signer to strengthen their loan application. Taking steps to improve credit scores before applying for a loan can also increase the chances of getting approved for better financing options.

Improving Credit Scores for Better Car Financing

Understanding credit utilization

Credit utilization refers to the percentage of a borrower’s available credit that they are currently using. It is an essential factor in calculating credit scores. To improve credit scores, individuals should aim to keep their credit utilization below 30%. This can be achieved by paying down outstanding balances and avoiding maxing out credit cards. Lower credit utilization indicates responsible credit management and can positively impact credit scores over time.

Making timely bill payments

Consistent and timely bill payments are critical for maintaining good credit scores. Payment history is a significant factor in credit score calculations. Late or missed payments can have a significant negative impact on credit scores, making it harder to secure favorable financing options. Setting up automatic payments or reminders can help ensure bills are paid on time and prevent any derogatory marks on credit reports.

Minimizing credit inquiries

Applying for multiple credit cards or loans within a short period can result in multiple hard inquiries on credit reports. Each hard inquiry can potentially lower credit scores by a few points. Minimizing credit inquiries can help maintain or improve credit scores. It is important to carefully consider the need for new credit and only apply for credit when necessary.

Applying for Car Financing

Preparing necessary documents

Before applying for car financing, borrowers should gather the necessary documents to streamline the application process. These commonly include proof of income, such as pay stubs or tax returns, proof of residence, identification documents, and banking statements. Having these documents readily available can speed up the loan application and approval process.

Choosing the right lender

Selecting the right lender is crucial when seeking car financing. Different lenders offer varying loan terms, interest rates, and repayment options. It is essential to research and compare multiple lenders, considering factors such as credit score requirements, customer reviews, and available financing options. Working with a reputable lender who understands individual needs and provides personalized services can enhance the car financing experience.

Submitting the application

Once all necessary documents have been prepared and the lender has been chosen, the borrower can submit the loan application. It is important to provide accurate and complete information to avoid delays or potential denial of the loan. The lender will review the application, assess the creditworthiness of the borrower, and decide whether to approve the loan based on their lending criteria.

Effect of Credit Score on Loan Amount

How credit scores impact the loan amount

Credit scores play a significant role in determining the loan amount that borrowers can qualify for. Lenders often offer larger loan amounts to individuals with higher credit scores. A higher credit score demonstrates financial responsibility and a reduced risk of defaulting on loan payments, allowing lenders to extend more credit. Conversely, individuals with lower credit scores may qualify for smaller loan amounts due to the higher risk associated with their credit history.

Lenders’ considerations in determining loan amount

In addition to credit scores, lenders consider various factors when determining the loan amount. These factors may include the borrower’s income, employment history, debt-to-income ratio, and the value of the car being financed. Lenders want to ensure that the borrower can afford the loan and that the loan amount does not exceed the value of the car. By assessing these factors, lenders can make informed decisions about the appropriate loan amount for each borrower.

Alternative options for individuals with lower credit scores

Individuals with lower credit scores may face limitations on the loan amount they can qualify for. However, alternative options can still be available. For example, a larger down payment can reduce the loan amount required, making it more likely to secure financing. Additionally, exploring special financing programs specifically designed for low-credit individuals can provide alternative solutions. By working with a knowledgeable lender, borrowers can explore these options and find the most suitable car financing solution for their needs.

Car Financing Options for Different Credit Scores

Excellent credit scores

Borrowers with excellent credit scores have access to the best car financing options. Lenders are more willing to offer favorable terms, including lower interest rates, longer repayment terms, and higher loan amounts. Individuals with excellent credit scores can negotiate with lenders and choose from a wide range of financing options. They may also qualify for manufacturer incentives or special financing offers from car dealerships.

Good credit scores

Those with good credit scores still have a favorable position when it comes to car financing. They may not have access to the absolute best terms, but they can still obtain competitive interest rates and loan amounts. Good credit scores demonstrate responsible credit management, and lenders are more inclined to offer suitable financing options to these borrowers.

Fair credit scores

Fair credit scores may result in slight limitations when it comes to car financing. Borrowers with fair credit scores may face slightly higher interest rates and may need to provide additional documentation or collateral to secure the loan. However, lenders still consider them as acceptable risks and provide reasonable financing options to help individuals obtain the car they need.

Poor credit scores

Individuals with poor credit scores often face more significant challenges in obtaining car financing. They may be subject to higher interest rates, stricter loan terms, or require a co-signer to secure the loan. In some cases, specialized lenders may be the only option for car financing. While the terms may not be as favorable, poor credit scores should not discourage individuals from seeking car financing. It is important to explore various lenders and options to find the most suitable solution for their situation.

Rebuilding Credit After Car Financing Challenges

Effects of car financing on credit scores

Car financing, when managed responsibly, can have positive effects on credit scores. Making timely payments and staying within the agreed terms can demonstrate improved creditworthiness, resulting in an increase in credit scores. However, missed or late payments can have the opposite effect, exacerbating credit score issues. Timely repayment is crucial when rebuilding credit after car financing challenges.

Strategies for rebuilding credit

To rebuild credit after car financing challenges, individuals can take several steps. Firstly, ensuring that all bills, including the car loan, are paid on time. Secondly, paying off any outstanding debts or credit card balances can help lower credit utilization and positively affect credit scores. It is also advisable to review and dispute any erroneous information on credit reports. Finally, individuals may consider seeking professional advice from credit counseling agencies or financial advisors specializing in credit repair.

Seeking professional advice

For individuals struggling with credit issues, seeking professional advice can be valuable. Credit counseling agencies can provide guidance on managing debts, creating budgets, and improving credit scores. They can assist in negotiating with creditors and setting up manageable repayment plans. Financial advisors specializing in credit repair can provide personalized strategies and tactics to rebuild credit and navigate the car financing process more effectively.

Monitoring and Maintaining a Healthy Credit Score

Regularly checking credit reports

Monitoring credit reports regularly is essential for maintaining a healthy credit score. Checking credit reports allows individuals to identify any errors or fraudulent activity and take corrective measures promptly. It also provides the opportunity to assess credit utilization and ensure that all accounts are reported accurately. Free annual credit reports are available from each of the three major credit bureaus, and additional credit monitoring services offer real-time updates and alerts.

Managing credit card utilization

Credit card utilization, or the ratio of outstanding credit card balances to credit limits, is an influential factor in credit scores. Maintaining a low credit card utilization ratio, ideally below 30%, demonstrates responsible credit management. Individuals can manage credit card utilization by paying balances in full each month and avoiding unnecessary or excessive spending. It is also beneficial to keep older credit card accounts active, as they contribute to the overall length of credit history.

Strategies for maintaining a good credit score

To maintain a good credit score, individuals should continue practicing responsible credit habits. This includes making timely payments on all bills, not just credit card balances or loans. Avoiding excessive debt and keeping credit card balances low can also contribute to a healthy credit score. It is important to manage credit responsibly and to avoid applying for new credit unless necessary. Regularly reviewing credit reports and seeking professional advice when needed can also help individuals maintain a good credit score in the long run.

In conclusion, understanding and managing credit scores are crucial when seeking car financing. A good credit score opens doors to better loan terms, while a poor credit score can result in limited options and higher interest rates. By improving credit scores, individuals can enhance their chances of securing favorable car financing. Exploring different lenders and financing options allows borrowers to find the most suitable solution based on their credit score range. Timely repayment, responsible credit utilization, and ongoing monitoring of credit scores are essential for maintaining a healthy credit profile.