In the realm of personal finance, it is crucial to have a clear understanding of the distinction between credit and finance. While often used interchangeably, these two terms embody distinct concepts. Credit refers to the ability to borrow money or obtain goods or services with the promise of future repayment, often accompanied by interest or fees. On the other hand, finance encompasses the broader concept of managing one’s money, including budgeting, investing, and making financial decisions. By grasping the fundamental dissimilarities between credit and finance, individuals can make informed choices to navigate their financial journeys effectively.

Definition of credit

Explanation of credit

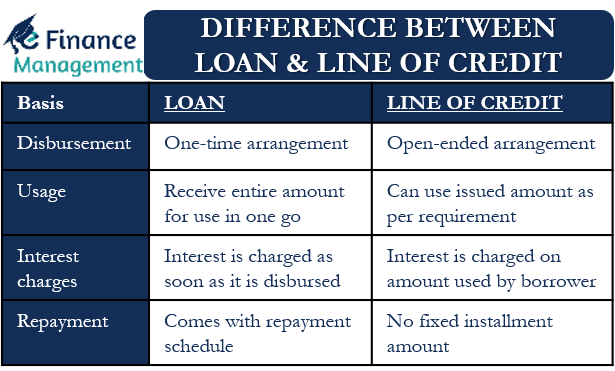

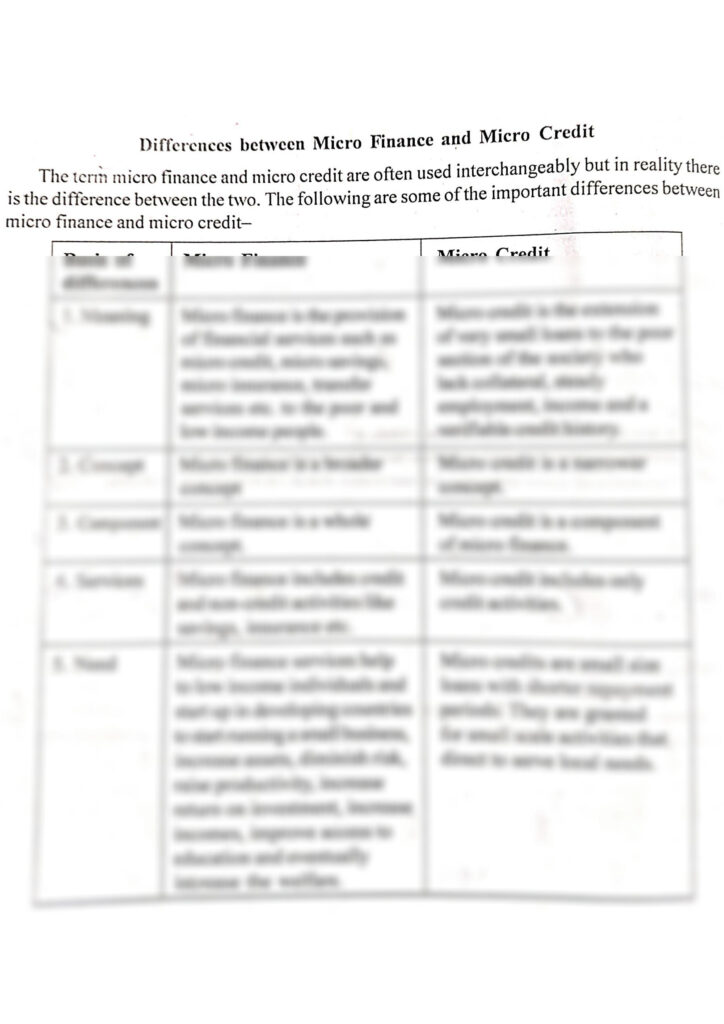

Credit refers to a financial arrangement where a borrower is provided with the opportunity to obtain goods, services, or funds based on the trust and confidence placed in their ability to repay the borrowed amount at a later date. It is a form of borrowed money that allows individuals or organizations to make purchases or investments without having to pay the entire amount upfront. Credit transactions are typically facilitated by lenders or financial institutions, who extend a line of credit to the borrower, allowing them to access the funds as needed.

Types of credit

There are various types of credit available to individuals and businesses. Some common types include:

-

Revolving credit: This type of credit provides the borrower with a predetermined credit limit, which they can utilize and repay as per their convenience. Credit cards and lines of credit are examples of revolving credit.

-

Installment credit: With installment credit, borrowers receive a specific amount of money upfront and repay it in fixed installments over a predetermined period. Auto loans and mortgages are examples of installment credit.

-

Open credit: Open credit is typically extended to businesses and allows them to have ongoing accounts with suppliers to make purchases on credit. The amount owed is typically settled within a specific time frame, often within 30 days.

-

Charge cards: Charge cards function similarly to credit cards but require the full balance to be paid in full at the end of each billing cycle. While credit cards allow for minimum monthly payments, charge cards do not.

-

Secured credit: Secured credit is backed by collateral, such as a car or a house. If the borrower defaults on the payments, the lender has the right to seize the collateral to recover their losses.

-

Unsecured credit: Unlike secured credit, unsecured credit does not require collateral. Lenders evaluate the borrower’s creditworthiness and ability to repay based on their credit history and income.

Definition of finance

Explanation of finance

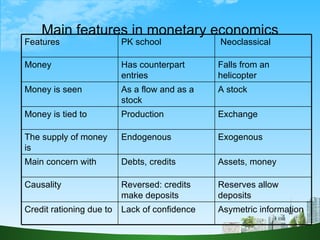

Finance refers to the management of money and financial transactions within an economy, organization, or individual’s personal life. It encompasses activities such as investing, borrowing, lending, budgeting, and the allocation of resources to achieve financial goals. Finance plays a critical role in decision-making processes, as it helps determine the viability, profitability, and sustainability of various projects or investments. It involves the analysis of financial data, assessment of risks, and the development of strategies to maximize the use of available financial resources.

Types of finance

Finance consists of different types, each serving distinct purposes and catering to varied financial needs. Some key types of finance include:

-

Personal finance: Personal finance refers to managing an individual’s or household’s financial resources to meet short-term and long-term financial goals. It involves budgeting, saving, investing, retirement planning, and managing debt effectively.

-

Corporate finance: Corporate finance involves the financial management of businesses and organizations. It includes activities such as raising capital, making investment decisions, managing financial risks, and optimizing the company’s financial structure to enhance shareholder value.

-

Public finance: Public finance focuses on the management of financial resources by governments and public entities. It deals with the allocation of funds for public services, taxation policies, and managing public debts and expenditures.

-

Project finance: Project finance involves the financing of specific projects or investments, typically large-scale infrastructure projects. It often utilizes a mix of debt and equity financing and considers the cash flow generated by the project as the primary source of repayment.

-

Behavioral finance: Behavioral finance combines principles of psychology with finance to understand and explain individuals’ financial decisions and behaviors. It aims to identify and rectify biases and irrationalities that influence financial decision-making.

Conceptual Difference

Nature of transactions

The primary difference between credit and finance lies in the nature of the transactions involved. Credit primarily focuses on providing individuals or businesses with access to borrowed funds or goods without immediate payment. It establishes a debtor-creditor relationship where the borrower is obligated to repay the borrowed amount along with any applicable interest and fees.

On the other hand, finance encompasses a broader range of financial activities beyond borrowing. It involves managing and leveraging financial resources to achieve specific goals, such as investing in projects, raising capital, or optimizing financial structures. Finance delves into the analysis, assessment, planning, and decision-making processes related to money management.

Purpose

Credit and finance also differ in terms of their purposes. The purpose of credit is to enable individuals or businesses to fulfill their immediate financial needs by providing them with access to funds or goods. It serves as a short-term solution for obtaining goods or services before having the necessary funds.

Finance, on the other hand, has a broader purpose of managing financial resources to achieve specific long-term goals. It involves strategic planning, risk assessment, and investment decision-making, aiming to maximize returns on investments or ensure the sustainability and profitability of projects or businesses.

Timeframe

Another distinguishing factor between credit and finance is the timeframe associated with each. Credit transactions are often short-term in nature, allowing individuals or businesses to access funds or goods immediately but requiring timely repayment. The repayment terms for credit are usually shorter and can range from a few days to a few years, depending on the type of credit.

Finance, on the other hand, typically deals with longer-term financial decisions and commitments. It takes into account the long-term financial implications and consequences of various investment decisions, capital allocation, or project funding. The timeframe associated with finance can span from several years to decades, depending on the nature and scope of the financial endeavor.

Sources of Credit

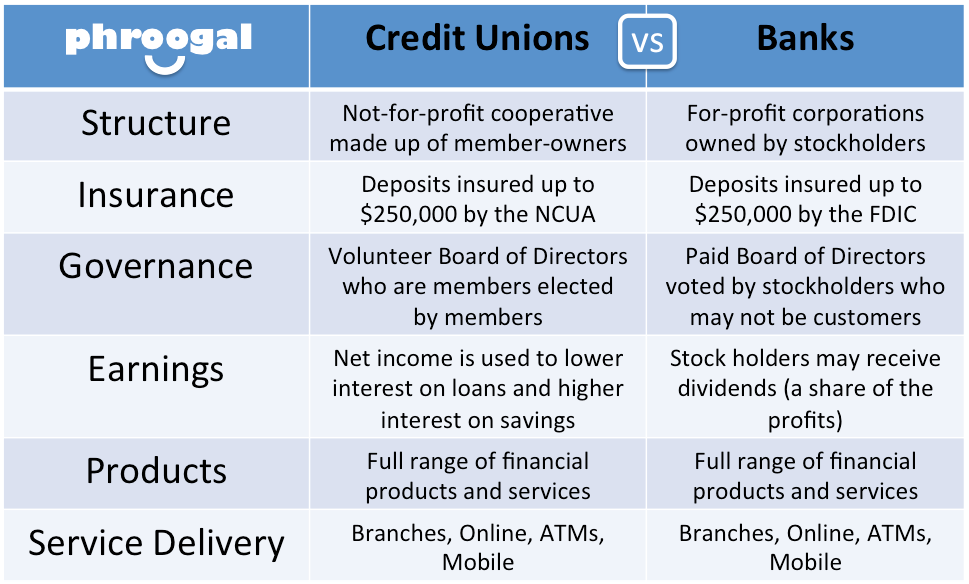

Banks and financial institutions

Banks and financial institutions are the primary sources of credit for individuals and businesses. They offer various types of credit, including personal loans, mortgages, business loans, and lines of credit. These institutions assess the creditworthiness and financial stability of borrowers before extending credit, considering factors such as credit history, income, assets, and liabilities. Banks and financial institutions play a crucial role in providing credit to foster economic growth and meet the financing needs of individuals and businesses.

Credit cards

Credit cards are a widely used source of credit, allowing individuals to make purchases on credit and repay the amount later. They provide a convenient and accessible form of credit, offering a pre-approved credit limit that the cardholders can utilize for purchases. Credit card companies charge interest on the outstanding balances, and borrowers have the option to repay the full amount or make minimum monthly payments.

Merchants

Merchants, such as retail stores or service providers, often offer in-store credit or financing options to attract customers. These credit arrangements allow individuals to make purchases and repay the amount directly to the merchant over a specified period. It provides flexibility for customers to obtain goods or services without having to pay the entire amount upfront.

Peer-to-peer lending

Peer-to-peer lending platforms have gained popularity as alternative sources of credit. These platforms connect borrowers directly with individual lenders, eliminating the need for intermediaries like banks. Peer-to-peer lending allows borrowers to obtain credit by showcasing their creditworthiness and financial needs to potential lenders. The loans are then funded by multiple individuals, each contributing a portion of the requested amount. Peer-to-peer lending often offers more competitive interest rates and flexible terms compared to traditional lending sources.

Government programs

Governments may also provide credit programs to support specific sectors or groups of individuals. These programs aim to stimulate economic development, support small businesses, or assist individuals with housing, education, or other needs. Government-backed loans or credit schemes often come with favorable terms, lower interest rates, or relaxed credit requirements to promote accessibility and affordability.

Sources of Finance

Equity financing

Equity financing involves raising funds by selling ownership shares or equity in a business or project. It allows businesses to obtain capital without incurring debt or repayment obligations. Investors who contribute funds in exchange for equity become partial owners and may be entitled to share in the profits or voting rights of the entity. Equity financing is often utilized by startups, high-growth companies, or businesses with significant potential for future returns.

Debt financing

Debt financing, on the other hand, involves borrowing funds that must be repaid over a specified period, often with interest. It is one of the most common sources of finance for individuals and businesses alike, enabling them to access immediate funds for various purposes. Debt financing can be obtained through bank loans, bonds, or other debt instruments. Lenders or investors providing debt financing receive regular fixed payments, such as interest and principal, until the debt is fully repaid.

Personal savings

Personal savings are another significant source of finance, particularly for individual financial needs. Savings refer to the accumulation of funds set aside by individuals or households from their income or profits. By saving money over time, individuals can build a financial cushion or accumulate capital to finance future investments, cover emergencies, or fund personal goals.

Venture capital

Venture capital (VC) is a form of financing that involves external investors providing funds to startups or early-stage companies in exchange for equity. Venture capitalists typically invest in businesses with high growth potential and seek significant returns on their investments. These funds are often utilized by startups to finance research and development, expand operations, or scale the business. Venture capital firms provide expertise, mentorship, and connections beyond financial support, aiming to help the startups succeed.

Angel investors

Angel investors are individuals or groups who provide financing to startups or early-stage companies in exchange for equity. They are typically high-net-worth individuals with an interest in supporting innovative ideas or business ventures. Angel investors often invest their own personal funds and offer mentorship, guidance, and industry connections to the entrepreneurs they invest in. Their investments can range from seed capital for idea validation to larger amounts for scaling the business.

Application Process

Credit application process

The credit application process typically involves the following steps:

-

Application submission: The applicant fills out a credit application form provided by the lender or financial institution. This form requires the applicant to provide personal information, financial details, employment history, and other relevant information as requested.

-

Credit evaluation: The lender reviews the application and assesses the applicant’s creditworthiness. This evaluation may include checking the applicant’s credit score, income verification, employment history, and other factors that determine their ability to repay the credit.

-

Approval or rejection: Based on the credit evaluation, the lender decides whether to approve or reject the credit application. If approved, the lender may specify the approved credit limit, interest rate, and other terms and conditions.

-

Agreement and documentation: Upon approval, the borrower and the lender enter into a formal agreement outlining the terms and conditions of the credit arrangement. This agreement may include details such as the interest rate, repayment schedule, penalties for late payments, and any other relevant terms.

-

Utilization of credit: Once the credit is approved, the borrower can start using the approved funds or access the goods or services associated with the credit. The borrower is expected to adhere to the agreed-upon repayment terms and make scheduled payments as per the agreement.

Finance application process

The finance application process involves the following steps:

-

Investment or loan proposal: The applicant presents an investment or loan proposal to the potential investor or lender. This proposal outlines the purpose of the finance, the amount requested, the repayment terms, the potential returns or benefits, and any other relevant information.

-

Due diligence and assessment: The investor or lender evaluates the proposal and performs due diligence to assess the feasibility, viability, and risks associated with the finance. This evaluation may involve reviewing financial statements, business plans, market analysis, and other relevant documents.

-

Negotiation and agreement: If the investor or lender is satisfied with the proposal and assessment, they enter into negotiations with the applicant to determine the specific terms and conditions of the finance. This may include interest rates, repayment schedules, collateral requirements, equity shares, or any other relevant agreement.

-

Documentation and legal formalities: Once the terms are agreed upon, the applicant and the investor or lender document the agreed-upon terms in a legally binding agreement. This agreement specifies the rights, obligations, and responsibilities of both parties and forms the basis for the finance arrangement.

-

Disbursement and utilization of funds: Upon the completion of legal formalities, the investor or lender disburses the funds as per the agreed-upon terms. The applicant can then utilize the funds for the intended purpose, such as investment in projects, expansion of operations, or other approved uses.

Repayment Terms

Credit repayment

Credit repayment terms vary depending on the type of credit and the agreement between the borrower and the lender. The repayment terms may include:

-

Payment frequency: The borrower is expected to make regular payments, which can be monthly, bi-monthly, or as agreed upon with the lender.

-

Interest rate: The lender charges interest on the outstanding balance or credit utilized. The interest rate can be fixed or variable, depending on the type of credit and the prevailing market conditions.

-

Minimum payments: Credit arrangements such as credit cards often require minimum monthly payments. These minimum payments are typically a percentage of the outstanding balance or a fixed dollar amount.

-

Repayment period: The repayment period or term varies depending on the credit type. It can range from a few days, in the case of short-term credit, to several years for long-term loans or mortgages.

-

Penalties for late payments: Lenders may impose penalties, such as late payment fees or increased interest rates, if borrowers fail to make payments on time. These penalties encourage timely repayment and deter delinquency.

Finance repayment

Finance repayment terms also vary based on the nature of the finance and the agreement between the borrower and the lender or investor. The repayment terms for finance may include:

-

Repayment schedule: The repayment schedule specifies the frequency and timing of the payments. It can be monthly, quarterly, annually, or based on specific milestones or cash flow projections.

-

Interest rate: Borrowers are often required to pay interest on the finance provided. The interest rate can be fixed or variable, depending on the agreement and prevailing market conditions.

-

Principal repayment: Borrowers are obliged to repay the initial amount of finance provided, either in installments or as a lump-sum payment at the end of the finance term.

-

Collateral or security: In some cases, lenders or investors may require borrowers to provide collateral or security to secure the finance. This collateral serves as a form of guarantee and can be seized by the lender in the event of defaults.

-

Grace periods or moratoriums: Some finance arrangements may offer grace periods or moratoriums where borrowers are granted a specific period without making repayments. This can be beneficial for startups or businesses during the initial stages or for projects with extended gestation periods.

Interest Rates

Credit interest rates

Credit interest rates vary depending on various factors, including the type of credit, the borrower’s creditworthiness, prevailing market conditions, and the lender’s policies. Factors that can influence credit interest rates include:

-

Credit score: Borrowers with higher credit scores often qualify for lower interest rates due to their demonstrated creditworthiness and lower perceived risk.

-

Collateral or security: Secured credit, backed by collateral, may have lower interest rates compared to unsecured credit, as it provides added security for the lender.

-

Type of credit: Different types of credit have varying interest rate structures. For example, credit card interest rates are often higher due to the convenience and flexibility they offer.

-

Market conditions: Interest rates can fluctuate based on the overall economic conditions, inflation rates, and monetary policies of the government or central banks. Changes in these factors can impact credit interest rates.

-

Credit history: Individuals or businesses with a reliable credit history, without a record of defaults or delinquencies, may be offered more favorable interest rates.

Finance interest rates

Finance interest rates can also vary depending on several factors:

-

Risk assessment: Lenders or investors assess the risk associated with the finance arrangement, considering factors such as the borrower’s creditworthiness, market conditions, project viability, or potential returns. Higher-risk investments generally attract higher interest rates.

-

Market rates: The prevailing market rates and interest rate trends in the financial market significantly influence finance interest rates. These rates are influenced by factors like inflation, economic outlook, and demand and supply dynamics.

-

Collateral or security: Collateralized finance, where borrowers provide a form of security or collateral, often attracts lower interest rates as it reduces the risk for lenders or investors.

-

Finance term: The length of the finance term can impact the interest rate. Longer-term finances may have higher rates to account for the increased risk and uncertainty associated with prolonged financing.

-

Negotiation and competition: Borrowers can negotiate interest rates with lenders or investors, especially in competitive markets. The borrower’s bargaining power, their financial stability, and the attractiveness of the investment opportunity can influence the interest rates offered.

Risk Factors

Credit risk factors

Credit transactions carry certain risks for both the borrower and the lender. Some key credit risk factors include:

-

Creditworthiness of the borrower: The borrower’s creditworthiness, as assessed by factors such as credit history, income stability, and debt burden, determines their ability to repay the credit. Low creditworthiness indicates a higher risk of default.

-

Market or economic conditions: Adverse market or economic conditions can impact a borrower’s ability to repay credit, especially in cases of sudden job losses, economic downturns, or industry-specific challenges.

-

Interest rate risk: Fluctuations in interest rates can affect the cost of borrowing and the borrower’s ability to repay the credit. Rising interest rates can increase the burden of interest payments, making it challenging to meet repayment obligations.

-

Collateral valuation: In cases of secured credit, fluctuations in the value of the collateral can impact the lender’s ability to recover their funds in the event of defaults. Declining collateral value can increase the risk for the lender.

-

Delinquency and default: There is a risk of borrowers becoming delinquent or defaulting on their payments, leading to financial losses for the lender. This risk is influenced by factors such as the borrower’s financial stability, personal circumstances, and unforeseen events.

Finance risk factors

Finance arrangements also involve specific risks that both the borrower and the lender or investor need to consider. Some notable finance risk factors include:

-

Project viability and market risks: In cases of project finance or business investments, the viability and success of the venture are critical factors. Market risks, competition, regulatory changes, or unforeseen events may pose challenges and impact the projected returns or revenues.

-

Credit risk: In finance arrangements involving debt financing, there is a credit risk associated with the borrower’s ability to repay the finance. Lenders or investors evaluate the creditworthiness, financial stability, and repayment capacity of the borrower to mitigate this risk.

-

Interest rate risk: Fluctuations in interest rates can impact the cost of capital and the profitability of the investment or business. Rising interest rates can increase finance costs, affecting cash flows and returns.

-

Market risks and volatility: Investments are subject to market risks, such as stock market fluctuations, commodity price variations, or changes in currency exchange rates. These market risks can impact the value of investments and the returns generated.

-

Operational and execution risks: Execution risks refer to challenges in implementing or executing the planned projects or business strategies. Operational risks relate to the day-to-day management, efficiency, and profitability of the business or investment. Mitigating these risks requires effective planning, risk management strategies, and contingency plans.

Common Uses

Credit usage

Credit is widely used in various contexts to fulfill a range of financial needs. Some common uses of credit include:

-

Personal expenses: Credit cards and personal loans are often utilized for personal expenses such as groceries, travel, leisure activities, or home improvements.

-

Education expenses: Many individuals rely on credit to finance their education, covering tuition fees, books, accommodation, or other educational expenses.

-

Home purchases: Mortgage loans enable individuals to purchase homes by providing the necessary funding upfront. The borrower then repays the mortgage over a specific period.

-

Business operations: Credit plays a vital role in financing business operations, such as purchasing inventory, equipment, or machinery. Businesses often rely on lines of credit or business loans to manage their cash flow needs.

-

Emergency situations: Credit can be used in emergencies to cover unexpected expenses or financial setbacks, such as medical bills, car repairs, or job losses.

Finance usage

Finance is commonly utilized for various long-term financial needs and investments. Some key uses of finance include:

-

Business expansion or start-ups: Businesses often require finance to expand their operations, launch new products, or enter new markets. Finance enables businesses to invest in marketing, research and development, infrastructure, or acquisitions.

-

Real estate development: Real estate developers require finance for acquiring land, constructing properties, or funding large-scale development projects. Finance plays a crucial role in the real estate sector, enabling the growth of infrastructure and housing projects.

-

Research and development: Companies involved in research-driven industries often require finance to support ongoing research and development efforts, innovation, or the commercialization of new technologies.

-

Infrastructure projects: Finance is integral to financing large-scale infrastructure projects such as airports, bridges, railways, or power plants. These projects often require substantial investments, which can be sourced through finance.

-

Venture capital investments: Startups and high-growth companies rely on venture capital financing to scale their businesses, develop innovative solutions, or penetrate new markets. Venture capital funds are typically utilized for research, product development, marketing, and expansion plans.

In summary, credit and finance represent different aspects of the financial landscape. Credit primarily focuses on providing individuals and businesses with access to borrowed funds or goods, while finance encompasses a broader range of financial activities such as investing, budgeting, and resource allocation. The sources, application processes, repayment terms, interest rates, and risk factors associated with credit and finance differ significantly, catering to diverse financial needs and objectives. Understanding the distinctions between credit and finance is essential for making informed financial decisions and managing financial resources effectively.