Bank Finance And Credit is a comprehensive article that delves into the intricate world of banking, exploring the various aspects of finance and credit. This informative piece provides an in-depth look at the fundamental principles and workings of the banking industry, shedding light on the critical role it plays in today’s economy. With a focus on the intricate interplay between finance and credit, this article offers valuable insights for both professionals in the field and those seeking a deeper understanding of the banking world.

Understanding Bank Finance

Definition of bank finance

Bank finance refers to the various financial services and products offered by banks to individuals, businesses, and governments. It involves the provision of funds through loans, overdrafts, and other credit facilities. Banks play a crucial role in facilitating economic activities by providing the necessary capital for investments, expansion, and day-to-day operations.

Types of bank finance

Banks offer a range of financial products to cater to the diverse needs of their customers. Some common types of bank finance include:

- Business loans: Banks provide loans to businesses to finance their operations, purchase equipment, or expand their facilities.

- Personal loans: Individuals can avail themselves of personal loans from banks for various purposes such as education, buying a car, or home improvements.

- Credit cards: Banks issue credit cards that allow individuals to make purchases and repay the amount over time.

- Mortgages: Banks provide home loans, also known as mortgages, to individuals to purchase or refinance their homes.

- Overdrafts: Bank overdrafts allow individuals and businesses to withdraw more money than they have in their accounts, providing short-term liquidity.

Importance of bank finance

Bank finance plays a vital role in the functioning of the economy. It provides individuals with access to funds for personal needs and businesses with capital for growth and expansion. By granting loans and credit facilities, banks enable individuals and businesses to make investments, stimulate consumption, and contribute to economic development. Moreover, bank finance promotes financial stability by mobilizing savings, allocating funds efficiently, and managing risks effectively.

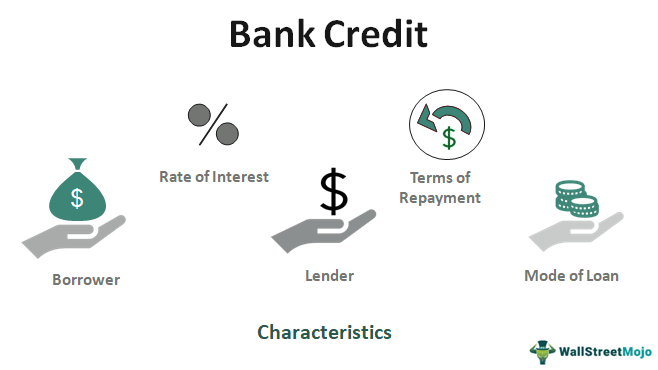

Bank Credit

Definition of bank credit

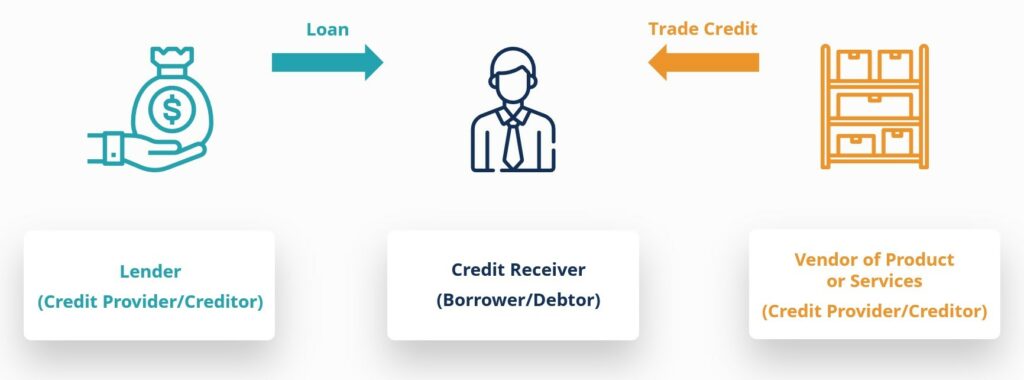

Bank credit refers to the borrowing capacity provided by banks to individuals and businesses based on their creditworthiness. It enables borrowers to access funds for various purposes, such as investments, working capital, or personal expenses. Bank credit is typically extended in the form of loans, credit cards, overdrafts, and other credit facilities.

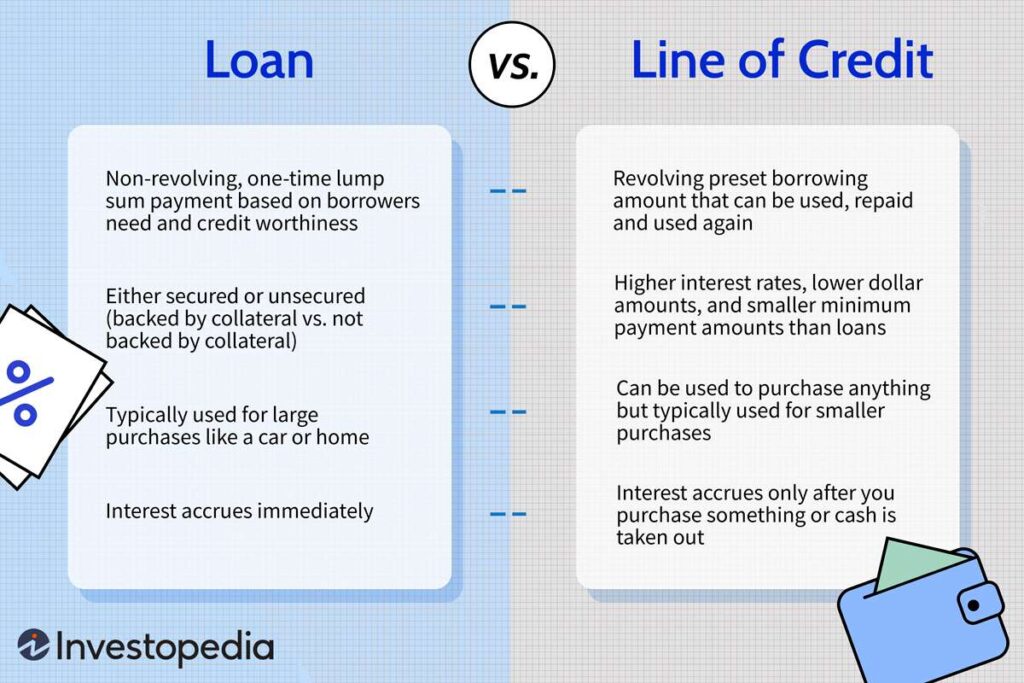

Types of bank credit

Banks offer different types of credit to cater to the specific needs of borrowers. Some common types of bank credit include:

- Secured loans: These loans are backed by collateral, such as real estate or vehicles, which reduces the risk for the bank.

- Unsecured loans: Unlike secured loans, unsecured loans do not require collateral but typically have higher interest rates to compensate for the increased risk.

- Revolving credit: This type of credit allows borrowers to repeatedly borrow and repay funds up to a predetermined credit limit. Credit cards are a common example of revolving credit.

- Lines of credit: Similar to revolving credit, lines of credit provide borrowers with access to funds up to a specified limit. However, they are often used by businesses for working capital purposes.

- Trade credit: Banks may offer trade credit to businesses, allowing them to purchase goods and services on credit from suppliers.

Factors affecting bank credit

Banks consider several factors when determining the amount of credit they are willing to extend to borrowers. These factors include the borrower’s credit history, income, debt-to-income ratio, employment stability, and collateral (if applicable). A good credit score, steady income, and a low debt burden increase the likelihood of obtaining higher credit limits and more favorable terms. However, creditworthiness assessments may vary among banks, and each institution has its own lending policies and risk appetite.

Bank Loans

Definition of bank loans

Bank loans refer to borrowed funds provided by banks to individuals, businesses, or governments for specific purposes. These loans are typically repaid in installments over a predetermined period, along with interest charges. Bank loans are a common form of financing used to fund various activities, such as purchasing assets, expanding operations, or meeting personal financial needs.

Types of bank loans

Banks offer different types of loans to meet the diverse financing requirements of borrowers. Some common types of bank loans include:

- Business loans: These loans are specifically designed for businesses to finance their operations, purchase equipment, expand facilities, or meet working capital requirements.

- Personal loans: Individuals can obtain personal loans from banks to fulfill various personal financial needs, such as funding education, consolidating debt, or covering unexpected expenses.

- Home loans: Banks provide home loans, also known as mortgages, to individuals to purchase or refinance their homes. These loans are usually of long-term duration and involve collateral in the form of the property being financed.

- Auto loans: Banks offer auto loans to individuals for purchasing vehicles. The vehicle itself serves as collateral to secure the loan.

- Student loans: Banks may provide loans to finance educational expenses, including tuition fees, books, and living costs.

Process of obtaining bank loans

The process of obtaining a bank loan typically involves several stages. Firstly, the borrower submits a loan application, which includes providing relevant details about their financial situation, purpose of the loan, and supporting documentation. Banks then assess the borrower’s creditworthiness, income stability, and repayment capacity. If approved, the bank will provide a loan offer outlining the loan amount, interest rate, repayment terms, and any applicable fees. Upon acceptance of the offer, the loan is disbursed to the borrower, who must then make regular repayments as per the agreed-upon terms.

Bank Overdrafts

Definition of bank overdrafts

A bank overdraft is a credit facility offered by banks that allows individuals or businesses to withdraw more money than is available in their bank accounts. It provides temporary liquidity to account holders and helps them meet their financial obligations when their account balances are insufficient.

Advantages and disadvantages of bank overdrafts

Bank overdrafts offer several advantages to individuals and businesses. First, they provide flexibility and convenience by allowing immediate access to additional funds without the need for a formal loan application. Overdrafts are particularly useful for managing short-term cash flow gaps and unforeseen expenses. Moreover, overdrafts are generally a cheaper form of borrowing compared to credit cards or personal loans.

However, there are certain disadvantages associated with bank overdrafts. They often attract higher interest rates compared to other forms of credit, making them more expensive in the long run. Additionally, banks can demand immediate repayment of the overdraft at any time and may charge penalty fees for unauthorized overdrafts or exceeding the approved limit.

Examples of bank overdrafts

Let’s consider a scenario where a small business experiences a temporary cash shortage. The business has an overdraft facility of $10,000 with their bank. With the overdraft, the business is able to meet its payroll obligations and continue its operations until it receives payments from customers. The overdraft is gradually repaid as the business receives its accounts receivable. Without the overdraft facility, the business may have faced difficulties in meeting its financial commitments and may have had to delay payments to employees or suppliers.

Bank Guarantees

Definition of bank guarantees

Bank guarantees are a financial tool offered by banks to support trade and business transactions. A bank guarantee is a written promise issued by a bank to pay a specified amount to a beneficiary if the customer fails to fulfill their contractual obligations. It provides assurance to the beneficiary that they will receive compensation if the customer is unable to fulfill their obligations.

Types of bank guarantees

Banks offer various types of guarantees to cater to different requirements. Some common types of bank guarantees include:

- Bid bond guarantee: This type of guarantee is used in the bidding process, assuring the buyer that the bidder will fulfill the contract if they win the bid.

- Performance bond guarantee: Performance bonds guarantee that the customer will fulfill their contractual obligations as per the agreed terms and conditions.

- Advance payment guarantee: When a buyer makes an advance payment to a supplier, an advance payment guarantee ensures that the seller uses the funds for the intended purpose and delivers the goods or services as agreed.

- Financial guarantee: Banks may issue financial guarantees to support loans, leases, or other financial obligations of their customers.

- Standby letter of credit: A standby letter of credit is a guarantee issued by a bank to ensure payment to the beneficiary if the customer fails to fulfill their obligations.

Role of bank guarantees in trade finance

Bank guarantees play a crucial role in facilitating international trade and business activities. They provide security and confidence to buyers and sellers by mitigating risks associated with non-performance or non-payment. By issuing guarantees, banks act as intermediaries, assuming the credit risk of their customers and providing assurance to the beneficiary. Bank guarantees are widely used in areas such as construction projects, import-export transactions, and government contracts.

Bank Mortgages

Definition of bank mortgages

Bank mortgages, also known as home loans or property loans, are long-term loans provided by banks to individuals for the purpose of purchasing or refinancing residential properties. The property being financed serves as collateral, providing security to the bank.

Types of bank mortgages

Banks offer various types of mortgages to suit the financial requirements of borrowers. Some common types of bank mortgages include:

- Fixed-rate mortgages: In a fixed-rate mortgage, the interest rate remains constant throughout the loan’s duration, providing borrowers with predictable monthly payments.

- Adjustable-rate mortgages: Adjustable-rate mortgages, also known as variable-rate mortgages, have interest rates that can change periodically based on market conditions.

- Government-backed mortgages: Governments may offer mortgage programs, such as FHA loans in the United States, which are insured by government agencies to facilitate homeownership for individuals who may not qualify for traditional bank mortgages.

- Interest-only mortgages: Interest-only mortgages allow borrowers to pay only the interest portion of the loan for a specified period, typically followed by higher monthly payments that include both principal and interest.

- Balloon mortgages: Balloon mortgages involve lower monthly payments during an initial period, after which the remaining balance becomes due as a lump sum payment.

Home loan application process

Obtaining a bank mortgage involves a comprehensive application process. Borrowers typically start by submitting an application form, along with supporting documentation such as proof of income, identification, and property details. Banks conduct thorough assessments of the borrower’s creditworthiness, employment stability, and debt-to-income ratio to determine their eligibility for the loan. Appraisals and property valuations are also conducted to assess the value and condition of the property being financed. Once approved, the borrower and bank agree upon the terms and conditions of the mortgage, and the loan is disbursed.

Credit Scoring

Definition of credit scoring

Credit scoring is a statistical technique used by banks to evaluate the creditworthiness of individuals or businesses. It involves assessing various factors to determine the likelihood of a borrower repaying their debts on time. Credit scores help banks make informed lending decisions and manage their credit risk.

Importance of credit scoring in bank finance

Credit scoring plays a pivotal role in bank finance as it enables banks to assess the creditworthiness of borrowers objectively and consistently. By analyzing factors such as a borrower’s payment history, outstanding debts, length of credit history, and types of credit used, banks can predict the probability of default and determine suitable loan terms. Credit scores help streamline the lending process, minimize human bias, and ensure fair and consistent evaluations for all borrowers.

Factors involved in credit scoring

Credit scoring models consider various factors that impact an individual’s creditworthiness. These factors commonly include:

- Payment history: The borrower’s track record of making timely payments on existing and previous credit obligations.

- Credit utilization: The proportion of available credit the borrower has used. Lower credit utilization ratios are generally considered favorable.

- Credit history length: The length of time the borrower has had credit accounts open. Longer credit histories generally indicate more stability and responsible credit management.

- Types of credit used: The different types of credit accounts the borrower has, such as mortgages, credit cards, and loans. A diverse credit mix can positively impact credit scores.

- Public records: Any bankruptcies, liens, or judgments against the borrower may negatively affect credit scores.

- Inquiries: The number of times a borrower’s credit report has been accessed. Multiple inquiries within a short period may indicate higher credit risk.

Credit Cards

Definition of credit cards

Credit cards are financial tools issued by banks that allow individuals to make purchases on credit. Cardholders receive a revolving line of credit, enabling them to borrow money from the issuing bank to pay for goods and services, with the obligation to repay the borrowed amount on or before the due date.

Types of credit cards

There are various types of credit cards available to cater to different needs and financial profiles of individuals. Some common types of credit cards include:

- Rewards cards: These credit cards offer rewards such as cashback, travel points, or discounts on specific purchases. Rewards are earned based on the cardholder’s spending patterns.

- Secured cards: Secured credit cards are typically offered to individuals with limited or poor credit histories. They require a security deposit, which serves as collateral for the credit line.

- Balance transfer cards: Balance transfer cards allow individuals to transfer balances from existing credit cards to benefit from lower interest rates or promotional periods.

- Business cards: Designed specifically for business owners, these credit cards offer features tailored to business expenses, such as expense tracking, employee cards, and business rewards programs.

- Student cards: Student credit cards are specifically designed for students who may have limited credit histories. These cards often have lower credit limits and may offer incentives for good academic performance.

Benefits and risks of using credit cards

Credit cards offer several benefits to cardholders. Firstly, they provide convenience, allowing individuals to make purchases without carrying cash. Credit cards also offer an interest-free grace period if the cardholder pays the balance in full by the due date. Additionally, credit cards provide added security for online purchases and offer various rewards and benefits, such as cashback or travel perks, depending on the card issuer.

However, there are risks associated with credit card usage. If cardholders do not pay their balance in full by the due date, interest charges are applied, which can be significantly higher than other forms of credit. Moreover, credit cards can lead to excessive debt if not used responsibly. Cardholders must be mindful of their spending habits and budgeting to avoid accumulating high levels of debt and damaging their credit scores.

Bankruptcy and Foreclosure

Definition of bankruptcy and foreclosure

Bankruptcy and foreclosure are legal processes associated with the inability to repay debts and satisfy financial obligations.

Bankruptcy: Bankruptcy is a legal status where an individual or business is unable to pay their debts. It provides individuals and businesses with an opportunity to resolve their financial difficulties and obtain a fresh start by either liquidating assets or creating a repayment plan approved by the court.

Foreclosure: Foreclosure is a legal process initiated by a bank or lender when a borrower fails to make mortgage payments as per the agreed-upon terms. It allows the lender to seize and sell the property to recover the outstanding mortgage balance.

Effects of bankruptcy and foreclosure on bank finance

Bankruptcy and foreclosure can have significant implications on bank finance. When borrowers go bankrupt, it often results in a loss for lenders, as they may not recover the full amount owed. Lenders also incur administrative and legal costs associated with bankruptcy proceedings. Foreclosures can lead to losses for banks if the proceeds from selling the property are insufficient to cover the outstanding mortgage balance.

Additionally, bankruptcy and foreclosure negatively impact the creditworthiness of individuals and businesses. Bankruptcy information remains on the credit report for several years, making it difficult for individuals to obtain credit in the future. This can limit their ability to access loans, credit cards, and other forms of bank finance. Similarly, foreclosure records on credit reports can hinder individuals from qualifying for future mortgages and other types of financing.

Preventing bankruptcy and foreclosure

To prevent bankruptcy and foreclosure, it is crucial to maintain good financial health and practice responsible financial management. Some measures individuals and businesses can take include:

- Budgeting and financial planning: Creating and adhering to a budget can help manage expenses, ensure timely payments, and avoid excessive debt.

- Building an emergency fund: Setting aside funds for unexpected expenses can provide a financial safety net during challenging times, reducing the risk of default.

- Seeking professional advice: Consulting financial advisors, credit counselors, or bankruptcy attorneys can help individuals and businesses navigate through challenging financial situations and explore potential solutions.

- Open communication with lenders: In case of financial difficulties, it is important to maintain open lines of communication with lenders to explore alternative repayment arrangements or loan modifications.

Taking proactive measures to address financial challenges can help individuals and businesses avoid the severe consequences of bankruptcy and foreclosure and maintain a healthy financial standing.

Credit Report

Definition of credit report

A credit report is a record of an individual’s or business’s credit history and financial behavior. It provides a comprehensive overview of credit accounts, payment history, outstanding debts, and public records related to creditworthiness.

How to obtain a credit report

Credit reports can be obtained from credit reporting agencies, also known as credit bureaus. In most countries, individuals are entitled to receive one free credit report annually from each major credit bureau. The process typically involves requesting the reports online, by mail, or through designated channels set by the credit reporting agencies. To obtain a credit report, individuals generally need to provide identifying information such as their name, address, and social security number.

Interpreting a credit report

Interpreting a credit report can help individuals and businesses gain insights into their financial standing and creditworthiness. Key components to consider when reviewing a credit report include:

- Personal information: This section provides details about the individual’s or business’s identity, including name, address, date of birth, and social security number.

- Credit accounts: The credit account section lists various accounts held by the individual or business, providing information on the creditor, account type, credit limit, balance, and payment history. Reviewing this section helps identify any accounts in good standing or those that require attention.

- Payment history: This section displays the payment track record for each credit account, indicating whether payments have been made on time, late, or if any defaults have occurred.

- Public records: If applicable, public records such as bankruptcies, liens, or judgments are reflected in this section, which highlights potential areas of concern that may affect creditworthiness.

- Inquiries: The inquiries section lists entities that have accessed the credit report. This can include lenders, landlords, or other authorized parties. Multiple inquiries within a short period may impact credit scores.

It is important to review credit reports regularly, identify any errors or discrepancies, and take necessary steps to rectify them. Monitoring credit reports allows individuals and businesses to understand their credit standing, address any issues promptly, and maintain a favorable credit profile.

In conclusion, bank finance plays a crucial role in the economy by providing various financial products and services to individuals, businesses, and governments. Understanding the different types of bank finance, such as bank credit, loans, overdrafts, guarantees, mortgages, and credit cards, is essential for making informed financial decisions. Credit scoring, bankruptcy, foreclosure, and credit reports are vital components that impact bank finance and creditworthiness. By comprehending these concepts and effectively managing finances, individuals and businesses can navigate the world of bank finance with confidence and ensure a solid financial foundation.