Throughout history, the intertwined concepts of finance and credit have played a critical role in shaping the economic landscape of nations. An integral part of our society, finance and credit enable individuals and businesses to meet their monetary needs, whether it be through lending, borrowing, or investment activities. In this article, we will explore the fundamental principles and mechanisms behind finance and credit, shedding light on how these intricate systems operate and impact our daily lives. From the intricacies of interest rates and risk assessment to the broader implications on economic growth and stability, we will embark on a journey to uncover the fascinating world of finance and credit.

Definition of Finance

Finance refers to the management of money and other financial resources. It involves various activities such as saving, investing, borrowing, and budgeting. Finance plays a crucial role in both personal and business aspects of life. It is the backbone of any economy and essential for the smooth functioning of individuals, organizations, and governments.

Meaning and Importance of Finance

Finance is a broad term that encompasses various aspects related to money and its management. It includes activities such as financial planning, budgeting, investing, and the study of financial markets. The significance of finance lies in its ability to allocate resources efficiently, enable economic growth, and ensure financial stability.

At the individual level, finance helps us manage our personal finances effectively. It allows us to make informed decisions about saving, spending, and investing our money. Finance provides us with the knowledge and tools to plan for our future, set financial goals, and maintain a stable financial situation.

In the business world, finance plays a vital role in the success and growth of companies. It involves managing cash flow, evaluating investment opportunities, and making financial decisions that maximize profitability. Without proper financial management, businesses would struggle to meet their obligations, fund expansions, and achieve long-term sustainability.

Types of Finance

There are various types of finance available to individuals and organizations, depending on their specific needs and circumstances. Some common types of finance include:

-

Personal Finance: This involves managing one’s own money, budgeting, saving, and investing for personal goals such as retirement, education, or buying a house.

-

Business Finance: Business finance focuses on managing financial resources within an organization. It includes options for funding, cash flow management, and financial planning.

-

Public Finance: Public finance deals with the financial management of governments and public institutions. It involves taxation, budgeting, and the allocation of public funds.

-

Corporate Finance: Corporate finance relates to the financial activities of corporations, including raising capital, investing, and managing financial risks.

-

International Finance: This branch of finance deals with financial transactions between countries and includes activities such as foreign exchange, international investments, and cross-border financing.

Personal Finance

Budgeting

Budgeting is a crucial aspect of personal finance. It involves creating a plan that outlines expected income and anticipated expenses. By budgeting, individuals can track their spending, prioritize expenses, and ensure they are living within their means.

To create a budget, one must gather information about their income from various sources, including salary, investments, and side businesses. It is essential to identify fixed expenses like rent or mortgage payments, utility bills, and loan repayments. Additionally, variable expenses such as groceries, entertainment, and transportation costs should be accounted for.

Once all income and expenses are identified, it is important to allocate funds appropriately. This may require making adjustments and trade-offs to ensure that essential needs are met and savings goals are prioritized.

Savings

Saving is a key component of personal finance. It involves setting aside a portion of income for future needs and emergencies. Savings can be used for various purposes, such as retirement, education, purchasing a home, or creating a financial safety net.

To save effectively, individuals should first determine their financial goals. This could include short-term goals like building an emergency fund or long-term goals such as saving for retirement. By setting specific goals, individuals can establish a savings plan and track their progress over time.

There are several strategies for saving money, such as automated savings plans, setting up separate savings accounts, or using budgeting tools to monitor expenses. It is crucial to develop the discipline to consistently contribute to savings and avoid unnecessary expenditures.

Investments

Investing is an important aspect of personal finance that allows individuals to grow their wealth over time. By investing, individuals can put their money to work and potentially earn returns that outpace inflation.

There are various investment options available, such as stocks, bonds, mutual funds, real estate, and more. Each option carries its own set of risks and potential rewards, and it is essential to understand these before investing.

Investing requires careful consideration of one’s risk tolerance, financial goals, and time horizon. It is recommended to diversify investments to spread risk and increase the likelihood of achieving desired returns. Regular monitoring of investments and occasional adjustments may be necessary to ensure the portfolio remains aligned with one’s goals.

Business Finance

Financing Options

Businesses require financial resources to start, operate, and grow. There are several financing options available to businesses, depending on their size, industry, and funding needs.

Some common financing options include:

-

Equity Financing: This involves raising capital by selling shares of ownership in the business to investors. It can be through private investments, venture capital, or an initial public offering (IPO).

-

Debt Financing: Debt financing involves borrowing money from lenders and repaying it over time with interest. It can be in the form of bank loans, lines of credit, or corporate bonds.

-

Self-Funding: Some businesses choose to finance their operations through personal savings or profits generated from the business itself. This eliminates the need for external financing but may limit the business’s growth potential.

-

Government Grants and Subsidies: Governments often provide financial support to businesses through grants, subsidies, or tax incentives. These can help businesses fund specific projects or initiatives.

The choice of financing option depends on factors such as the business’s risk profile, growth potential, capital requirements, and the entrepreneur’s preferences.

Managing Cash Flow

Cash flow management is crucial for the success of any business. It involves monitoring the flow of cash into and out of the business to ensure there is enough liquidity to meet ongoing expenses and obligations.

To manage cash flow effectively, businesses must:

- Keep accurate records of all income and expenses

- Make accurate cash flow projections based on expected revenues and expenses

- Implement efficient invoicing and payment collection processes

- Control costs and manage inventory levels

- Negotiate favorable payment terms with suppliers

- Build a cash reserve for emergencies or unexpected expenses

By closely monitoring cash flow and implementing effective cash management strategies, businesses can avoid cash flow shortages, late payments, and potential financial distress.

Financial Planning

Financial planning is an important aspect of business finance that involves setting financial goals, developing strategies to achieve those goals, and creating a roadmap for the business’s financial future.

Financial planning typically includes the following steps:

-

Defining Financial Goals: Businesses must identify their short-term and long-term financial objectives, such as increasing revenue, profitability, market share, or expanding into new markets.

-

Assessing the Current Financial Situation: This involves analyzing the business’s current financial position, including assets, liabilities, cash flow, and profitability. It helps identify strengths, weaknesses, and areas for improvement.

-

Developing a Financial Strategy: Based on the goals and current situation, businesses develop a financial strategy that outlines specific actions and initiatives to achieve those goals. This may involve budgeting, investment decisions, cost-cutting measures, or targeting new customer segments.

-

Implementing the Financial Plan: Businesses execute the financial plan by allocating resources, monitoring progress, and making necessary adjustments along the way. Regular monitoring and reporting of financial performance are crucial to ensure the business stays on track.

Financial planning provides businesses with a structured approach to managing their finances and enables them to make informed decisions that support their overall strategic objectives.

Credit

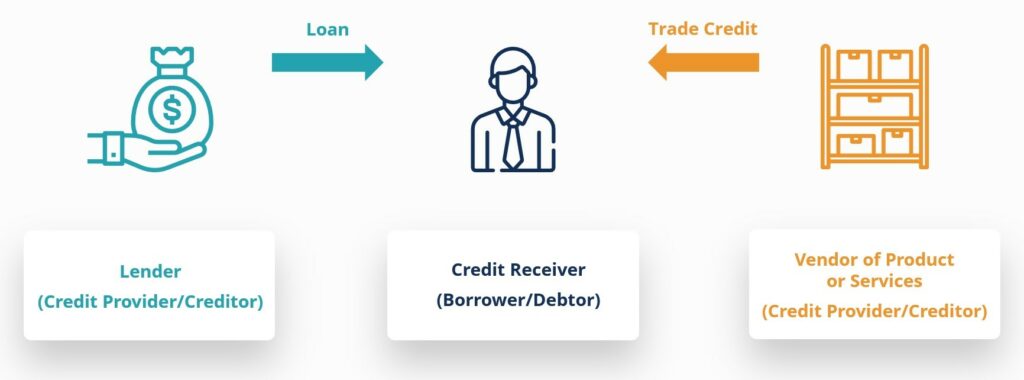

Introduction

Credit refers to the ability to borrow money or access goods and services with the promise of future payment. It plays a significant role in the economy by facilitating consumption, investment, and economic growth. However, responsible credit management is crucial to avoid excessive debt and financial difficulties.

Credit Score

A credit score is a numerical representation of an individual’s creditworthiness. It is based on an analysis of their credit history, including their payment history, amount of debt, length of credit history, and other relevant factors.

Lenders and financial institutions use credit scores to assess the likelihood of an individual repaying their debts. A higher credit score indicates a lower credit risk and increases the likelihood of being approved for credit at favorable terms.

To maintain a good credit score, individuals should:

- Pay bills and debts on time

- Keep credit card balances low

- Avoid excessive credit card applications

- Maintain a diverse credit mix

- Regularly review credit reports for errors

Understanding and managing one’s credit score is crucial for accessing credit at favorable terms and securing financial opportunities.

Types of Credit

There are various types of credit available to individuals and businesses, each with its own characteristics and suitability for different purposes.

Some common types of credit include:

-

Revolving Credit: This type of credit allows individuals to borrow up to a predetermined limit repeatedly. Credit cards and lines of credit are examples of revolving credit.

-

Installment Credit: Installment credit involves borrowing a fixed amount and repaying it over a specified period through regular, equal payments. Auto loans and mortgages are examples of installment credit.

-

Secured Credit: Secured credit is backed by collateral, such as a car or property, which serves as security for the loan. In the event of default, the lender may seize the collateral to recover the debt.

-

Unsecured Credit: Unsecured credit does not require collateral and is based on the borrower’s creditworthiness. Credit cards and personal loans are examples of unsecured credit.

-

Trade Credit: Trade credit is offered by suppliers to businesses, allowing them to purchase goods or services and pay for them at a later date.

The choice of credit type depends on factors such as the purpose of borrowing, repayment ability, credit history, and the terms and conditions offered by the lender.

Financial Institutions

Banks

Banks are financial institutions that provide a wide range of financial services to individuals, businesses, and governments. They play a crucial role in the economy by accepting deposits, making loans, facilitating transactions, and offering various financial products and services.

Banks offer services such as:

- Checking and savings accounts

- Loans and mortgages

- Credit cards

- Investment advisory services

- Foreign exchange transactions

- Insurance products

- Wealth management

Banks are regulated by government authorities to ensure stability, consumer protection, and adherence to industry standards. They play a significant role in the financial system by facilitating economic activities, managing risks, and providing critical financial infrastructure.

Credit Unions

Credit unions are member-owned financial cooperatives that operate for the benefit of their members. Unlike banks, which are typically for-profit entities, credit unions are not-for-profit organizations that prioritize the financial well-being of their members.

Credit unions offer services such as:

- Savings and checking accounts

- Loans and mortgages

- Credit cards

- Financial education and counseling

- Insurance products

- Small business services

As member-owned institutions, credit unions often offer competitive interest rates on loans and higher returns on savings compared to traditional banks. They are governed by a volunteer board of directors elected by the members, ensuring that decisions are made in the best interest of the members.

Online Financial Institutions

In recent years, the rise of technology has led to the emergence of online financial institutions. These digital-only institutions offer financial services entirely online, without brick-and-mortar branches.

Online financial institutions offer services such as:

- Online banking and mobile banking apps

- High-yield savings accounts

- Digital payments and money transfers

- Investment platforms

- Robo-advisory services

These institutions leverage technology to provide convenience, lower costs, and innovative financial solutions. They often offer competitive interest rates, fewer fees, and user-friendly interfaces, appealing to individuals looking for convenient and cost-effective financial services.

Insurance

Types of Insurance

Insurance is a risk management tool that provides financial protection against unforeseen events or losses. It involves transferring the financial risk to an insurance company in exchange for a premium. There are various types of insurance available to individuals and businesses.

Some common types of insurance include:

-

Life Insurance: Life insurance provides financial protection to beneficiaries in the event of the insured’s death. It helps ensure that loved ones are financially supported and can cover expenses such as funeral costs, outstanding debts, or income replacement.

-

Health Insurance: Health insurance covers medical expenses and provides financial protection against healthcare costs. It can include coverage for doctor visits, hospital stays, prescription medications, and preventive care.

-

Auto Insurance: Auto insurance protects against financial losses resulting from accidents, theft, or damage to a vehicle. It can cover repairs, medical expenses, and liability for injuries or property damage caused to others.

-

Homeowners Insurance: Homeowners insurance provides financial protection against damage or loss to a home and its contents. It covers events such as fire, theft, vandalism, or natural disasters, providing compensation for repairs, replacement, or liability claims.

-

Business Insurance: Business insurance offers various types of coverage to protect businesses from financial losses. It can include property insurance, liability insurance, workers’ compensation, or professional liability insurance.

Importance of Insurance

Insurance is essential for managing and mitigating financial risks. It provides individuals and businesses with peace of mind, knowing that they are financially protected against unexpected events.

Insurance offers several benefits, including:

-

Financial Protection: Insurance helps individuals and businesses avoid significant financial losses that could otherwise be devastating. It provides a safety net and ensures that they can recover from unexpected events without suffering significant financial hardship.

-

Risk Transfer: Insurance allows individuals and businesses to transfer the financial risk to an insurance company. By paying a premium, policyholders shift the potential financial burden of a loss to the insurance provider.

-

Certainty and Stability: Insurance provides certainty and stability in an uncertain world. It enables individuals and businesses to plan for the future, knowing that they have protection and assistance in the event of a loss.

-

Legal and Regulatory Requirements: In many cases, insurance is required by law or regulation. For example, auto insurance is mandatory in most jurisdictions to protect against liability and ensure that victims of accidents are compensated.

Insurance Companies

Insurance companies are financial institutions that provide insurance policies and manage risk. They collect premiums from policyholders and use the funds to pay claims when necessary.

Insurance companies offer various types of insurance policies tailored to the needs of individuals, businesses, and organizations. They assess risk, calculate premiums, and manage investment activities to ensure they can meet their obligations to policyholders.

Insurance companies are regulated by government authorities to protect policyholders and ensure solvency. They are required to maintain sufficient reserves and adhere to stringent financial and ethical standards.

Financial Markets

Stock Market

The stock market is a financial market where individuals and institutions can buy and sell shares of publicly traded companies. It provides a platform for investors to participate in the ownership and growth of companies, as well as trade securities for potential financial gain.

The stock market enables companies to raise capital by issuing shares to the public. Investors can purchase these shares, becoming partial owners of the company and potentially benefiting from its profitability and growth. Shares can be bought and sold through stock exchanges, such as the New York Stock Exchange (NYSE) or Nasdaq.

Investing in the stock market carries risks, as share prices can fluctuate based on market conditions, economic factors, company performance, and investor sentiment. It is essential for investors to conduct thorough research and seek professional advice to make informed investment decisions.

Bond Market

The bond market, also known as the debt market or fixed-income market, is a financial market where investors buy and sell debt securities. Bonds represent loans made by investors to governments, municipalities, corporations, or other entities in exchange for periodic interest payments and the return of the principal at maturity.

Bonds are considered relatively lower-risk investments compared to stocks, as they provide a fixed income and are typically backed by the issuer’s ability to repay. They are often used by governments and companies to raise capital for projects or operations.

Investors can purchase bonds through brokers and financial institutions. The bond market offers a wide range of options, including government bonds, corporate bonds, municipal bonds, and international bonds. The prices and yields of bonds are influenced by factors such as interest rates, credit ratings, inflation expectations, and market conditions.

Foreign Exchange Market

The foreign exchange market, also known as the forex or FX market, is a decentralized global marketplace where currencies are bought and sold. It is the largest and most liquid financial market in the world, with trillions of dollars exchanged daily.

The forex market enables individuals, businesses, and institutions to convert one currency into another for various purposes, including international trade, investment, tourism, and speculation. Currency exchange rates fluctuate based on supply and demand factors, economic indicators, geopolitical events, and central bank policies.

Participants in the forex market include banks, central banks, multinational corporations, governments, and individual investors. Trading can occur electronically over-the-counter or through established exchanges.

Investing or trading in the foreign exchange market carries risks due to the volatility and complexities of currency markets. It requires a thorough understanding of market dynamics, economic factors, and risk management strategies.

Investment Options

Stocks

Stocks, also known as shares or equities, represent ownership in a company. By purchasing stocks, investors become partial owners of the company and have the potential to benefit from its financial performance and growth.

Investing in stocks can provide capital appreciation through increases in share prices and dividend income from companies that distribute profits to shareholders. However, stock prices can be volatile and are influenced by various factors such as economic conditions, company performance, market sentiment, and geopolitical events.

Investors can purchase stocks through brokerage accounts or invest in mutual funds and exchange-traded funds (ETFs) that hold a diversified portfolio of stocks. It is important to conduct thorough research, diversify investments, and consider risk tolerance and investment goals when investing in stocks.

Bonds

Bonds are debt securities issued by governments, municipalities, corporations, or other entities to raise capital. By purchasing bonds, investors become lenders, as they provide loans to the issuers in exchange for regular interest payments and the return of the principal at maturity.

Bonds are generally considered lower-risk investments compared to stocks, as they provide a fixed income and are typically backed by the issuer’s ability to repay. They offer various features, such as different durations, interest rates, credit ratings, and repayment terms.

Investors can purchase individual bonds or invest in bond funds that hold a portfolio of bonds. It is important to assess the creditworthiness of bond issuers, understand the risks associated with bonds, and consider investment objectives and time horizons when investing in bonds.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or other assets. They are managed by professional fund managers who make investment decisions on behalf of the investors.

Mutual funds offer various benefits, including diversification, professional management, liquidity, and accessibility. They enable individuals to invest in a wide range of assets with relatively smaller investment amounts compared to purchasing individual securities.

Investors can choose from different types of mutual funds based on their investment objectives, risk tolerance, and time horizons. These can include equity funds, bond funds, money market funds, index funds, sector funds, and more. It is important to review fund prospectuses, assess fees and expenses, and consider historical performance before investing in mutual funds.

Financial Planning

Setting Financial Goals

Financial planning begins with setting clear and measurable financial goals. These goals can be short-term, such as saving for a vacation, or long-term, such as planning for retirement or purchasing a home.

Setting financial goals helps individuals establish a roadmap for their financial future and prioritize their financial decisions. Goals should be specific, realistic, and time-bound. They may include aspects such as savings targets, debt reduction, investment objectives, or income growth.

By setting financial goals, individuals can align their financial decisions and actions with their desired outcomes. It provides motivation, focuses attention, and helps monitor progress toward achieving those goals.

Creating a Budget

Creating a budget is a fundamental aspect of financial planning. It involves tracking income and expenses to ensure that spending aligns with financial goals and priorities.

To create a budget, individuals should:

-

Track Income: Identify all sources of income, including salary, investments, rental income, or side business earnings. Calculate the total monthly income.

-

Identify Expenses: Categorize expenses into fixed (e.g., rent, loan payments, utilities) and variable (e.g., groceries, entertainment) expenses. Review bank statements, bills, and receipts to determine monthly expenses.

-

Set Priorities: Allocate funds to essential expenses first, such as housing, utilities, and debt repayment. Then, allocate funds to discretionary expenses based on personal preferences and financial goals.

-

Monitor and Adjust: Regularly review the budget and track actual income and expenses. Identify areas where spending can be reduced or reallocated to meet financial goals. Adjust the budget as necessary.

A budget helps individuals manage their cash flow, control spending, and ensure that they are living within their means. It provides a clear picture of financial priorities and allows for better decision-making.

Retirement Planning

Retirement planning is a critical aspect of financial planning. It involves setting aside funds and making investment decisions to ensure a comfortable retirement in the future.

To plan for retirement effectively, individuals should consider the following:

-

Determine Retirement Needs: Estimate future expenses, including housing, healthcare, daily living expenses, and leisure activities. Consider potential sources of income, such as Social Security or pensions.

-

Calculate Retirement Savings Goal: Based on estimated retirement needs, calculate the amount of savings required to achieve those goals. Consider factors such as time horizon, inflation, investment returns, and risk tolerance.

-

Save and Invest: Develop a savings strategy to accumulate the required retirement funds. Invest in appropriate retirement accounts, such as employer-sponsored plans (e.g., 401(k), 403(b)) or individual retirement accounts (IRAs). Consider diversifying investments and consult with a financial advisor if needed.

-

Monitor and Adjust: Regularly review retirement savings progress and adjust contributions and investments as necessary. Consider additional retirement income sources, such as part-time work or rental income.

Retirement planning should start early to take advantage of compounding returns and allow for long-term savings growth. It is important to regularly reassess retirement goals and update the plan as life circumstances change.

Taxation

Tax Planning

Tax planning is a crucial aspect of financial planning that involves managing tax obligations efficiently. It seeks to minimize tax liabilities while complying with applicable tax laws and regulations.

To engage in effective tax planning, individuals and businesses should consider the following strategies:

-

Understand Tax Laws: Stay abreast of tax laws and regulations to take advantage of available deductions, credits, and exemptions. Consider consulting a tax professional for guidance.

-

Optimize Asset Allocation: Consider the tax implications of different investment strategies. Evaluate tax-efficient investments such as tax-advantaged retirement accounts or tax-exempt municipal bonds.

-

Timing of Income and Expenses: Strategically time the recognition of income and the payment of deductible expenses to manage taxable income. This may involve deferring income to a subsequent year or accelerating expenses to the current year.

-

Charitable Giving: Utilize tax incentives for charitable giving, such as deducting donations to qualified charities or establishing charitable trusts.

Tax planning should be an ongoing process that considers changing tax laws, personal or business circumstances, and financial goals. By optimizing tax strategies, individuals and businesses can maximize savings and ensure compliance with tax obligations.

Types of Taxes

Taxes are financial obligations imposed by governments to fund public expenditures and provide essential services. There are various types of taxes levied on individuals, businesses, and transactions.

Some common types of taxes include:

-

Income Tax: This tax is levied on individuals and businesses based on their taxable income. Income tax rates can be progressive, meaning that higher income levels are subject to higher tax rates.

-

Sales Tax: Sales tax is levied on the sale of goods and services at the point of purchase. The tax rate and the items subject to sales tax vary by jurisdiction.

-

Property Tax: Property tax is imposed on the value of real estate properties. It is often used to fund local government services such as schools, infrastructure, and emergency services.

-

Corporate Tax: Corporate tax is levied on the profits of corporations. The tax rate may vary depending on the jurisdiction and the structure of the company.

-

Social Security and Medicare Taxes: These taxes fund social security and healthcare programs. They are typically withheld from employees’ wages and matched by employers.

-

Excise Taxes: Excise taxes are levied on specific goods or services, such as tobacco, alcohol, gasoline, or luxury items. They are often used to discourage consumption or fund specific programs.

The type and amount of taxes paid depend on factors such as income levels, assets owned, jurisdictions, and tax incentives or deductions available.

Tax Benefits

Tax benefits are provisions in the tax code that allow individuals and businesses to reduce their tax liabilities. These benefits provide incentives for specific activities, investments, or behaviors.

Some common tax benefits include:

-

Deductions: Deductions reduce taxable income by subtracting eligible expenses from total income. Examples include deductions for mortgage interest, student loan interest, or medical expenses.

-

Credits: Tax credits directly reduce the amount of tax owed. They are more beneficial than deductions, as they provide a dollar-for-dollar reduction in tax liability. Common credits include the child tax credit, earned income tax credit, or energy efficiency credits.

-

Tax-Advantaged Accounts: Certain accounts offer tax advantages, such as tax-deferred growth, tax-free withdrawals, or deductible contributions. Examples include individual retirement accounts (IRAs), 401(k) plans, or health savings accounts (HSAs).

-

Exemptions: Exemptions allow individuals to exclude a certain amount of income from taxation. Personal exemptions and exemptions for dependents were commonly available in the past but have been replaced by other provisions in recent tax reforms.

Tax benefits are subject to specific eligibility criteria, annual changes in tax laws, and limitations. It is important to consult with a tax professional or review relevant tax publications to understand and take advantage of available tax benefits.

In conclusion, finance encompasses a wide range of activities related to managing money and financial resources. It is essential for individuals, businesses, and governments to effectively manage their finances to meet their goals, ensure financial stability, and foster economic growth. Whether it is personal finance, business finance, credit management, investments, or tax planning, understanding the various aspects of finance is crucial for making informed decisions and achieving financial success.