I am pleased to introduce “Commercial Credit And Finance” – a comprehensive guide that explores the intricacies of commercial credit and finance. In this article, I will provide valuable insights and practical knowledge on the key aspects of this dynamic field. From understanding the importance of credit in the business world to delving into the various financing options available, this resource aims to equip individuals and businesses alike with the knowledge needed to navigate the realm of commercial credit and finance.

Definition of Commercial Credit and Finance

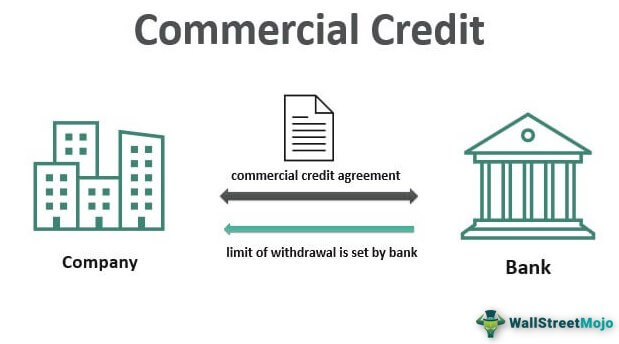

Commercial Credit

Commercial credit refers to the borrowing of funds by businesses in order to finance their operations and expansion. It involves the extension of credit by financial institutions, such as banks, to businesses for various purposes, including working capital management, business expansion, and risk mitigation. Commercial credit allows businesses to access the funds necessary to meet their financial needs and sustain their operations.

Commercial Finance

Commercial finance encompasses the broader range of financial services and products that support commercial credit activities. It involves the management of financial resources within a business, including financial planning, budgeting, and investment decisions. Commercial finance also includes the evaluation of financing options, such as short-term and long-term financing, equity financing, and debt financing. Ultimately, commercial finance ensures the efficient allocation and utilization of financial resources in a business to achieve its financial goals.

Importance of Commercial Credit and Finance

Facilitating Business Operations

Commercial credit and finance play a crucial role in facilitating the smooth functioning of business operations. By providing businesses with the necessary capital, commercial credit enables them to cover their day-to-day expenses, purchase inventory, and meet their financial obligations, such as paying suppliers and employees. It ensures that businesses have the financial resources to continue their operations without disruption, supporting their growth and success.

Working Capital Management

Effective working capital management is essential for businesses to maintain liquidity and meet their short-term financial obligations. Commercial credit allows businesses to manage their working capital by providing them with a source of funds to bridge any gaps between cash inflows and outflows. By utilizing commercial credit, businesses can manage their cash flow effectively, ensuring that they have sufficient liquidity to cover their operational needs and seize opportunities for growth.

Business Expansion

Commercial credit is also instrumental in supporting business expansion initiatives. Whether businesses are looking to enter new markets, invest in research and development, or acquire new assets, commercial credit provides them with the necessary financial resources to pursue growth opportunities. Without access to commercial credit, businesses may be limited in their ability to expand and seize new opportunities, potentially hindering their long-term growth prospects.

Risk Mitigation

Another important aspect of commercial credit is its role in mitigating various risks faced by businesses. For example, businesses can use commercial credit to hedge against fluctuations in interest rates, foreign exchange rates, or commodity prices. Commercial credit can also help businesses manage credit risks by allowing them to diversify their sources of financing and reduce their dependence on a single lender. By utilizing commercial credit strategically, businesses can protect themselves against a range of financial risks and strengthen their overall financial stability.

Types of Commercial Credit

Business Lines of Credit

A business line of credit is a flexible form of commercial credit that provides businesses with access to a predetermined amount of funds that they can draw upon as needed. It allows businesses to manage their cash flow effectively and address any short-term financing needs that may arise. With a business line of credit, businesses only pay interest on the amount they borrow, making it a cost-effective financing option.

Trade Credit

Trade credit refers to the credit extended by suppliers to businesses, allowing them to purchase goods or services on credit terms. This type of commercial credit is commonly used in B2B transactions, where businesses can negotiate favorable payment terms with their suppliers. Trade credit provides businesses with a source of working capital without the need for immediate cash outflows, enabling them to manage their cash flow efficiently.

Credit Cards

Commercial credit cards offer businesses the convenience and flexibility of accessing credit for their day-to-day expenses. They allow businesses to make purchases and pay vendors, while also providing benefits such as rewards and expense tracking. Commercial credit cards are particularly popular among small businesses as they offer a quick and convenient financing option without the need for lengthy approval processes.

Small Business Administration (SBA) Loans

SBA loans are government-backed loans designed to support small businesses in the United States. These loans are provided by financial institutions but guaranteed by the Small Business Administration. SBA loans offer attractive terms and lower interest rates, making them a popular choice for small businesses looking for financing options to support their growth and expansion.

Bank Loans

Bank loans are a traditional form of commercial credit provided by banks to businesses. These loans can be secured or unsecured and may have fixed or variable interest rates. Bank loans are typically used for a variety of purposes, such as purchasing equipment, acquiring real estate, or funding working capital needs. They are commonly sought after by businesses due to their competitive terms and long-term financing options.

Invoice Factoring

Invoice factoring allows businesses to convert their accounts receivable into immediate cash. In this type of commercial credit, businesses sell their outstanding invoices to a factoring company at a discount, receiving a portion of the invoice value upfront. Factoring companies then assume responsibility for collecting the full invoice amount from customers. Invoice factoring provides businesses with quick access to cash flow and eliminates the need to wait for customer payments.

Asset-Based Lending

Asset-based lending involves using a company’s assets, such as inventory or accounts receivable, as collateral for a loan. This type of commercial credit provides businesses with access to funds based on the value of their assets. Asset-based lending is particularly useful for businesses with valuable assets and can be an effective way to secure financing when traditional loans may not be available.

Merchant Cash Advances

Merchant cash advances offer businesses an alternative financing option based on their credit card sales. In this type of commercial credit, a financial institution provides a lump sum payment to a business in exchange for a portion of its future credit card sales. This form of financing is commonly used by businesses that have a high volume of credit card transactions but may have difficulty accessing traditional loans.

Equipment Financing

Equipment financing allows businesses to acquire new equipment or machinery without incurring a large upfront cost. With equipment financing, businesses can obtain the necessary equipment by entering into a financing arrangement with a lender. The lender retains a security interest in the equipment until the loan is fully repaid. This type of commercial credit is particularly beneficial for businesses that rely on specialized equipment to operate.

Crowdfunding

Crowdfunding has emerged as a popular form of commercial credit for startups and small businesses. It involves raising funds from a large number of individuals, typically through online platforms. Businesses can offer products, rewards, or equity in exchange for financial contributions. Crowdfunding allows businesses to tap into a broad network of potential investors and raise the necessary funds to launch or expand their ventures.

Factors Considered for Commercial Credit Approval

Credit Score and History

Lenders consider an applicant’s credit score and credit history as an indicator of their creditworthiness. A strong credit score, usually above 700, demonstrates a history of responsible borrowing and timely repayment. Lenders prefer borrowers with good credit scores, as it reduces the risk of default.

Business Financial History

Lenders analyze a business’s financial history, including its profitability, revenue growth, and financial statements. A strong financial track record indicates a stable and successful business, increasing the likelihood of credit approval. Lenders often request several years’ worth of financial statements to evaluate a business’s financial health.

Debt-to-Income Ratio

The debt-to-income ratio compares a business’s total debt obligations to its income. Lenders assess this ratio to determine if the business can handle additional debt. A lower debt-to-income ratio indicates a lower risk for the lender, making credit approval more likely. Lenders typically prefer a debt-to-income ratio below 40%.

Collateral

Collateral serves as security for the lender in case of default. It can be in the form of real estate, equipment, inventory, or accounts receivable. Lenders will evaluate the value of the collateral and its potential liquidity to determine the amount of credit they are willing to extend.

Financial Statements

Lenders review a business’s financial statements, including the balance sheet, income statement, and cash flow statement. These statements provide insights into the business’s financial stability, profitability, and cash flow. Lenders analyze these statements to assess the business’s ability to repay the loan and manage its financial obligations.

Cash Flow Analysis

Cash flow analysis is a critical factor in evaluating a business’s ability to repay debt. Lenders assess the cash flow statement to determine if the business generates enough cash to cover its operating expenses, debt payments, and other financial obligations. Positive cash flow indicates the business’s capacity to handle additional debt.

Business Plan Evaluation

Lenders often request a business plan to assess the viability and potential for growth. A comprehensive business plan demonstrates the business’s understanding of its industry, market, and competition. It should outline the business’s goals, strategies, and financial projections. A well-developed business plan can positively impact credit approval.

Commercial Credit Application Process

Gathering Required Documents

To apply for commercial credit, businesses need to gather various documents that lenders require for evaluation. These documents typically include financial statements, tax returns, bank statements, business licenses, and legal documents, such as articles of incorporation or partnership agreements. It is important to ensure that all required documents are complete and accurate.

Completing the Application

Businesses must complete the credit application accurately and thoroughly. The application typically requests information about the business, its owners or partners, financial information, and the purpose of the loan. It is essential to provide all the necessary information and ensure its accuracy to facilitate the review process.

Submission and Review

Once the credit application is completed, businesses submit it to the lender for review. Lenders evaluate the application and supporting documents to assess the creditworthiness of the business. This process may involve verifying the information provided, analyzing financial statements, and conducting credit checks. This review process can vary in duration depending on the complexity of the credit request and the lender’s internal processes.

Credit Decision and Approval

Based on the evaluation of the credit application and supporting documents, the lender makes a credit decision. If the application is approved, the lender will provide the business with the terms and conditions of the credit, such as the interest rate, repayment schedule, and any additional requirements. Businesses should carefully review these terms and conditions before accepting the credit offer.

Loan Disbursement

Once the credit offer is accepted, the lender disburses the approved funds to the business. The disbursement process depends on the type of credit; it may involve direct deposits, wire transfers, or checks. Some lenders may disburse the funds in a lump sum, while others may provide a line of credit for businesses to draw upon as needed.

Commercial Finance Options

Short-term Financing

Short-term financing refers to obtaining funds to cover immediate financing needs or to bridge temporary cash flow gaps. This type of financing is typically repaid within one year or less and can include options such as business lines of credit, trade credit, or invoice factoring. Short-term financing is useful for managing working capital, covering unexpected expenses, or taking advantage of time-bound opportunities.

Long-term Financing

Long-term financing involves obtaining funds for more extended periods, typically exceeding one year. This type of financing is often used for investments in fixed assets, business expansion, or acquisitions. Long-term financing options may include bank loans, SBA loans, or equipment financing. Long-term financing typically offers lower interest rates and structured repayment terms.

Equity Financing

Equity financing involves raising funds by selling ownership stakes in the business. It allows businesses to obtain capital without incurring debt that needs to be repaid. Equity financing can be obtained through various means, such as issuing shares to investors, attracting venture capital, or seeking investments from angel investors. Equity financing is often sought by startups or businesses with high growth potential.

Debt Financing

Debt financing involves borrowing funds from lenders or financial institutions with an agreement to repay the borrowed amount with interest. It is the most common form of commercial finance and includes options such as bank loans, SBA loans, and credit card debt. Debt financing allows businesses to access the required funds while retaining full ownership and control over their operations.

Mezzanine Financing

Mezzanine financing is a hybrid form of financing that combines debt and equity elements. It typically involves issuing debt that can be converted into equity in the future. Mezzanine financing is often used to bridge the funding gap between traditional bank loans and equity financing. Businesses that opt for mezzanine financing typically have a higher risk profile but also offer the potential for higher returns to investors.

Asset-Based Financing

Asset-based financing involves using a company’s assets as collateral to secure a loan or line of credit. The value of the assets, such as accounts receivable, inventory, or equipment, determines the amount of credit that can be obtained. Asset-based financing is popular among businesses that have valuable assets but may not qualify for traditional loans due to credit or cash flow issues.

Public and Private Debt Issuances

Public and private debt issuances involve raising funds by issuing debt instruments to investors. Public debt issuances are conducted through securities offerings in the public markets, such as bonds or commercial paper. Private debt issuances, on the other hand, involve raising funds from select investors or institutions. Debt issuances provide businesses with access to larger amounts of capital, but they are subject to stringent regulatory requirements.

Venture Capital

Venture capital involves providing capital to startups and early-stage businesses in exchange for an ownership stake. Venture capitalists typically invest in businesses with high growth potential and innovative ideas. Venture capital funding is often sought by businesses in technology, healthcare, or other industries that require substantial financial resources for research and development, product development, or scaling operations.

Angel Investors

Angel investors are individual investors who provide capital to startups or small businesses in exchange for equity or convertible debt. Angel investors often invest their own money and can provide not only financial resources but also industry expertise and networks. Angel investments play a crucial role in supporting early-stage businesses, fostering innovation, and fueling entrepreneurial growth.

Alternative Financing

Alternative financing options have emerged in recent years, offering businesses additional sources of capital outside traditional banking channels. These options include peer-to-peer lending platforms, invoice trading, crowdfunding, and revenue-based financing. Alternative financing options provide businesses with innovative ways to access capital, typically with simplified application processes and faster funding turnaround times.

Challenges and Risks in Commercial Credit and Finance

Interest Rates

One of the primary challenges in commercial credit and finance is the impact of interest rates. Interest rates can significantly affect the cost of borrowing for businesses and impact their profitability. Businesses must consider interest rate fluctuations and plan their borrowing strategies accordingly to minimize the cost of credit and optimize their financial performance.

Creditworthiness

Maintaining good creditworthiness is crucial for businesses seeking commercial credit. A poor credit history or low credit score can limit the availability of credit options and lead to higher interest rates or stricter borrowing terms. Businesses must actively manage their credit profiles by ensuring timely repayment, maintaining low levels of debt, and monitoring their credit reports regularly.

Economic Conditions

The overall state of the economy can impact the availability and terms of commercial credit. During economic downturns or recessions, lenders may tighten their lending criteria, making it more challenging for businesses to access credit. Conversely, during economic expansion, lenders may be more willing to extend credit, offering favorable terms and conditions. Businesses must be prepared to adapt their financing strategies based on prevailing economic conditions.

Compliance and Regulatory Risks

Commercial credit and finance are subject to various regulatory requirements and compliance obligations. Businesses must ensure that they adhere to applicable laws and regulations to avoid penalties or legal complications. These regulations may pertain to financial reporting, lending practices, consumer protection, or anti-money laundering measures. Non-compliance can jeopardize a business’s reputation and result in legal and financial consequences.

Default and Bankruptcy

Default and bankruptcy represent significant risks for lenders and businesses involved in commercial credit transactions. Unexpected events, such as economic crises, market disruptions, or unforeseen business challenges, can lead to financial distress for businesses, making it difficult to meet their debt obligations. Lenders face the risk of loan defaults, while businesses may suffer reputational damage and potential insolvency.

Fraudulent Activities

Commercial credit and finance are vulnerable to fraudulent activities, including identity theft, loan fraud, or fraudulent financial reporting. This can result in significant financial losses for lenders and businesses. To mitigate this risk, lenders employ various risk management and anti-fraud measures, such as credit checks, identity verification, and thorough due diligence processes.

Market Volatility

Market volatility can impact the availability and cost of commercial credit. Financial market fluctuations, changes in interest rates, or disruptions in capital markets can affect lenders’ willingness to extend credit or impose stricter borrowing terms. Businesses must monitor market conditions and be prepared for potential shifts that may impact their access to financing.

Liquidity Risk

Liquidity risk refers to the risk of not being able to meet short-term financial obligations. Businesses heavily reliant on commercial credit may face liquidity challenges if lenders suddenly tighten credit availability. To mitigate liquidity risk, businesses should maintain sufficient cash reserves, diversify their sources of funding, and carefully manage their cash flow.

Currency Fluctuations

For businesses engaged in international trade or with foreign operations, currency fluctuations can pose risks in commercial credit and finance. Exchange rate volatility can impact the cost of imported goods, export revenue, and foreign currency-denominated debt. Businesses exposed to currency fluctuations should consider hedging strategies or negotiate favorable terms to manage these risks.

Security and Cybersecurity Risks

As commercial credit and finance increasingly rely on digital platforms and technologies, security and cybersecurity risks become prominent concerns. Businesses must protect sensitive financial information and guard against data breaches, identity theft, or financial fraud. Establishing robust cybersecurity measures and regularly updating security protocols are essential to safeguarding against these risks.

Commercial Credit and Finance vs. Consumer Credit and Finance

Nature of Borrower

Commercial credit and finance are primarily extended to businesses, while consumer credit and finance are targeted at individual consumers. Commercial credit considers the financial health and creditworthiness of a business, its assets, and revenue-generating capabilities. In contrast, consumer credit evaluates an individual’s credit history, income, and personal financial circumstances.

Purpose of Funding

Commercial credit is typically utilized by businesses to support their operations, manage working capital, expand their operations, or mitigate risks. Consumer credit, on the other hand, is generally utilized by individuals for personal expenses, such as purchasing a home, financing education, or making large purchases.

Legal Regulations

Commercial credit and finance are subject to specific legal regulations and compliance requirements. These regulations aim to ensure fair lending practices, protect consumers, and promote transparency in commercial financial transactions. Consumer credit and finance also have regulatory frameworks in place to safeguard consumers’ rights and prevent predatory lending practices.

Loan Amounts

Commercial credit often involves larger loan amounts compared to consumer credit. Businesses may require substantial funding for investments in equipment, real estate, or other capital-intensive projects. Consumer credit, on the other hand, typically involves smaller loan amounts to support personal expenses or finance smaller purchases.

Risk Assessment

Commercial credit and consumer credit differ in terms of risk assessment. Commercial credit is primarily assessed based on the financial health, creditworthiness, and revenue-generating capabilities of a business. Consumer credit, on the other hand, is assessed based on an individual’s credit score, income, and personal credit history. The risk factors considered in each type of credit differ due to the nature of the borrower and the purpose of funding.

Credit Monitoring and Management

Credit Reporting Agencies

Credit reporting agencies play a vital role in commercial credit and finance by providing credit information about businesses. These agencies collect and store data on businesses’ credit history, financial health, and payment behaviors. Lenders use this information to assess the creditworthiness of businesses and make informed credit decisions.

Credit Scores

Credit scores are numerical ratings that assess a business’s or individual’s creditworthiness. These scores are based on an analysis of credit reports, financial information, and repayment history. Lenders use credit scores as a key factor in determining credit eligibility and interest rates. Higher credit scores indicate a lower risk of default and can lead to more favorable credit terms.

Credit Monitoring Services

Credit monitoring services allow businesses to stay informed about changes to their credit profiles and detect any potential signs of identity theft or fraudulent activities. These services provide alerts and notifications about new accounts, credit inquiries, or negative information on a business’s credit report. Credit monitoring services help businesses proactively manage their credit and protect themselves from unauthorized activities.

Credit Limits

Credit limits determine the maximum amount of credit that businesses can access from a specific credit facility, such as a business line of credit or credit card. Credit limits are set by lenders based on the borrower’s creditworthiness, financial capacity, and risk factors. Businesses must manage their credit limits effectively to avoid excessive debt and ensure responsible borrowing.

Risk Assessment

Credit monitoring and risk assessment involve ongoing evaluation of a business’s credit profile, financial health, and repayment behaviors. Businesses need to continually assess their financial position, review credit reports and statements, and monitor their credit scores. Regular risk assessments help businesses identify potential issues, take corrective actions, and maintain a strong credit profile.

Repayment and Debt Management

Effective credit management involves responsible repayment and debt management practices. Businesses must prioritize timely repayment of credit obligations, monitor their debt levels, and ensure that they have sufficient cash flow to meet their financial commitments. Implementing sound debt management strategies allows businesses to maintain their creditworthiness, avoid excessive debt, and protect their financial stability.

Key Players in Commercial Credit and Finance

Banks and Financial Institutions

Banks and financial institutions are significant players in commercial credit and finance. They provide a range of financing options, such as loans, lines of credit, and other financial services tailored to the specific needs of businesses. Banks play a crucial role in supporting businesses’ financial needs and driving economic growth.

Credit Rating Agencies

Credit rating agencies assess the creditworthiness and financial stability of businesses and assign credit ratings based on their evaluations. These ratings provide insights into the credit risk associated with investing in or lending to a particular business. Credit rating agencies play a critical role in providing independent assessments of credit quality, which are used by investors, lenders, and businesses.

Non-Banking Financial Companies (NBFCs)

Non-Banking Financial Companies, or NBFCs, are financial institutions that provide a range of credit and financial services similar to banks but are not licensed as traditional banks. NBFCs offer commercial credit, loans, leasing, and other specialized financing options to businesses. They play a significant role in expanding access to finance for businesses, particularly in emerging markets.

Credit Unions

Credit unions are cooperative financial institutions that are owned and operated by their members. They offer a range of financial services, including commercial credit and loans, to their members who often belong to a particular community or industry. Credit unions provide an alternative source of commercial credit for businesses, typically with more personalized service and competitive terms.

Government Agencies

Government agencies, such as the Small Business Administration (SBA) in the United States, play a crucial role in supporting commercial credit and finance for businesses. These agencies offer loan guarantee programs, financial assistance, and other resources to promote small business growth and provide access to credit for businesses that may not qualify for traditional financing.

Private Investors

Private investors, including institutional investors, venture capital firms, and private equity firms, are important sources of capital for businesses seeking commercial credit. These investors provide funding in exchange for equity or debt, depending on the investment structure. Private investors often play a vital role in supporting businesses with high growth potential or innovative business models.

Insurance Companies

Insurance companies are involved in commercial credit and finance through various means. They provide insurance products to protect businesses against specific risks, such as credit insurance to cover potential losses from non-payment by customers. Insurance companies may also invest in debt securities issued by businesses, providing them with capital for their operations or expansion.

Investment Banks

Investment banks primarily act as intermediaries in capital markets, offering advisory services and facilitating the issuance of debt or equity securities. They provide businesses with access to funding through debt issuances, initial public offerings (IPOs), or private placements. Investment banks play a critical role in capital raising activities and enable businesses to access larger amounts of capital.

Crowdfunding Platforms

Crowdfunding platforms have emerged as an alternative source of commercial credit and finance for businesses. These online platforms connect businesses with a large number of individual investors who contribute funds to support a business’s projects or ventures. Crowdfunding platforms offer businesses an opportunity to access capital quickly, raise awareness about their products or services, and build a community of supporters.

Peer-to-Peer Lenders

Peer-to-peer (P2P) lending platforms connect individual lenders with borrowers, bypassing traditional financial institutions. P2P lending platforms offer an alternative source of commercial credit for businesses and individuals. Borrowers can access funds quickly, and lenders have the opportunity to earn interest on their invested capital. P2P lending platforms provide increased efficiency and flexibility in accessing credit for businesses.