Car Finance And Credit Score is a comprehensive article that explores the intricate relationship between car financing and an individual’s credit score. In this in-depth analysis, I will elucidate the key factors that lenders consider when assessing creditworthiness, the impact of credit scores on loan terms and interest rates, as well as provide valuable tips on how to improve your credit score to secure more favorable car financing options. By the end of this article, you will gain a profound understanding of how your credit score can significantly influence your car finance journey.

Understanding Car Finance

What is car finance?

Car finance refers to the process of obtaining funds to purchase a car. When individuals do not have enough money to buy a car outright, they often turn to car financing options offered by financial institutions. In car finance, the borrower will repay the loan amount in monthly installments over an agreed-upon period, including interest and other fees. This enables individuals to own a car and pay for it over time, making it more affordable and accessible for many people.

Types of car finance options

There are several car finance options available to suit different individuals’ needs and financial situations. The most common car finance options include:

-

Hire Purchase (HP): This type of financing allows the borrower to pay for the car in installments over a fixed period. Once all the payments have been made, ownership of the vehicle is transferred to the borrower.

-

Personal Contract Purchase (PCP): PCP is a popular option that provides lower monthly payments compared to HP. At the end of the agreement, the borrower has the choice to either return the vehicle, make a final “balloon” payment to own the car, or trade it in for a new one.

-

Personal Loans: This involves borrowing a lump sum from a financial institution or bank to purchase a car. The borrower then repays the loan in monthly installments over a fixed term. Personal loans can offer flexibility and may have lower interest rates compared to other car finance options.

-

Leasing: Rather than owning the vehicle, leasing allows individuals to rent a car for a set period. Monthly payments are made, and at the end of the lease term, the car is returned. Leasing can be advantageous for those who prefer driving a new car every few years and do not want the responsibility of ownership.

Advantages of car finance

Car finance offers several advantages to individuals looking to purchase a car. Some of the key advantages include:

-

Affordability: Car finance allows individuals to spread the cost of purchasing a car over time. This means that the upfront cost of buying a car is reduced, making it more affordable for many people.

-

Flexibility: Car finance options offer flexibility in terms of loan duration and repayment plans. This allows individuals to tailor the financing to their specific financial situation and budget.

-

Access to better vehicles: By opting for car finance, individuals can access better vehicles than they would be able to afford if they had to pay in cash. This opens up the opportunity to drive a higher-quality or newer car.

-

Building credit history: Regular and timely payments on car finance can help individuals build a positive credit history. This can be beneficial for future financial endeavors, such as obtaining a mortgage or other loans.

By understanding the different car finance options available and considering their own financial circumstances, individuals can make an informed decision on the best car finance option for them.

Importance of Credit Score

What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness. It is a reflection of their credit history and financial behavior. Credit scores are calculated based on various factors such as payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Lenders and financial institutions use credit scores to assess the risk involved in lending money to an individual and determine the terms and conditions of the loan, including interest rates.

Factors that affect credit score

Several factors can impact an individual’s credit score. These include:

-

Payment history: The payment history is one of the most critical factors in determining credit score. Making timely payments on credit cards, loans, and other debts contributes positively to the credit score. On the other hand, late or missed payments can have a negative impact.

-

Credit utilization: Credit utilization refers to the amount of available credit that an individual is currently using. High utilization rates can indicate a higher risk and negatively affect the credit score. It is generally recommended to keep credit utilization below 30% of the available credit limit.

-

Length of credit history: The length or age of one’s credit history also plays a role in determining credit scores. A longer credit history demonstrates a track record of responsible credit management.

-

Types of credit: A mix of credit types, such as credit cards, loans, and mortgages, can contribute positively to the credit score. Having a diverse credit portfolio indicates a responsible approach to credit management.

-

Recent credit inquiries: Multiple recent applications for credit, known as hard inquiries, can slightly lower the credit score. These inquiries occur when individuals apply for new credit cards, loans, or other forms of credit.

Why credit score matters in car finance

Credit score plays a crucial role in car finance as it directly impacts the terms and conditions of the loan. Lenders use credit scores to assess the risk involved in lending money for purchasing a car. A higher credit score typically results in more favorable loan terms, such as lower interest rates and longer repayment periods. On the other hand, individuals with lower credit scores may face higher interest rates and more restrictive loan terms.

A good credit score not only allows individuals to secure car finance more easily but also helps them save money in the long run by securing lower interest rates. It is therefore essential for individuals to understand their credit score and take steps to maintain or improve it.

How Credit Score Affects Car Finance

Credit score requirements for car finance

Credit score requirements for car finance vary depending on the financial institution and the specific car finance option chosen. Lenders generally have a minimum credit score requirement that borrowers must meet to qualify for car finance. The specific score required can vary, but a credit score of around 660 or higher is generally considered good enough to obtain favorable car finance terms.

However, it is important to note that meeting the minimum credit score requirement does not guarantee approval for car finance. Lenders also consider other factors such as income, employment history, and existing debt when assessing the overall creditworthiness of an individual.

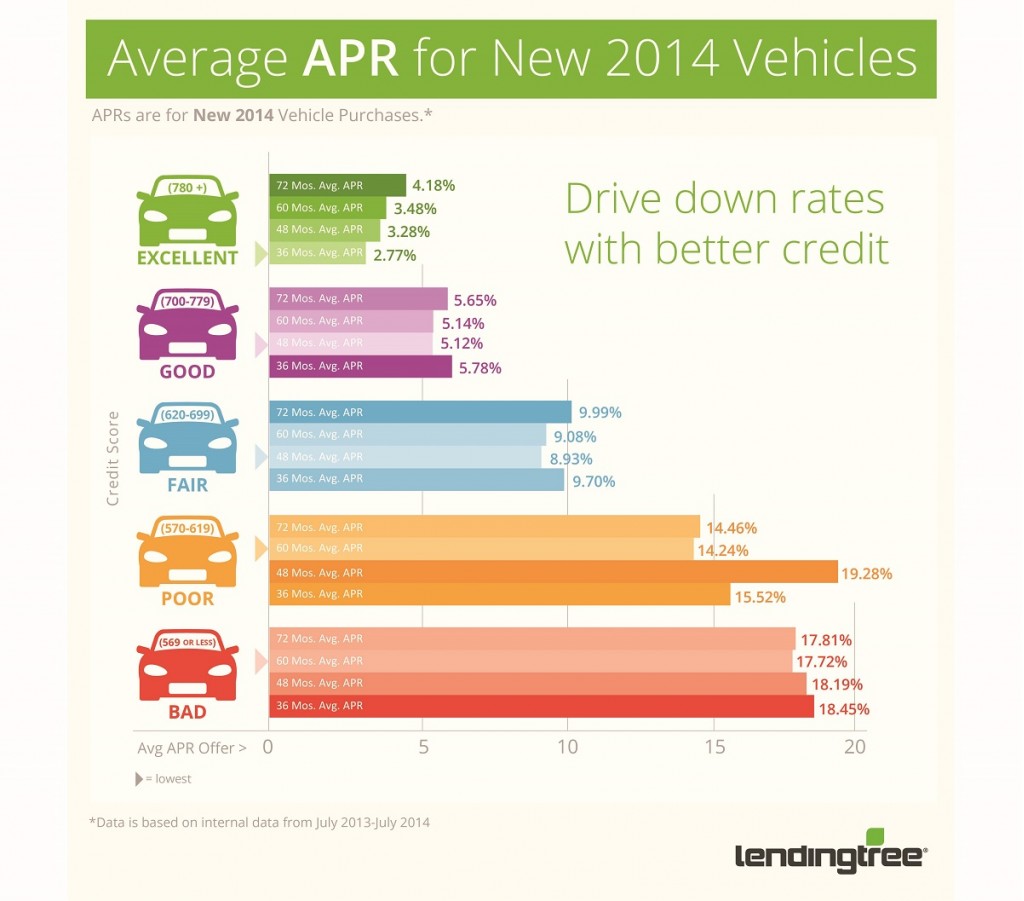

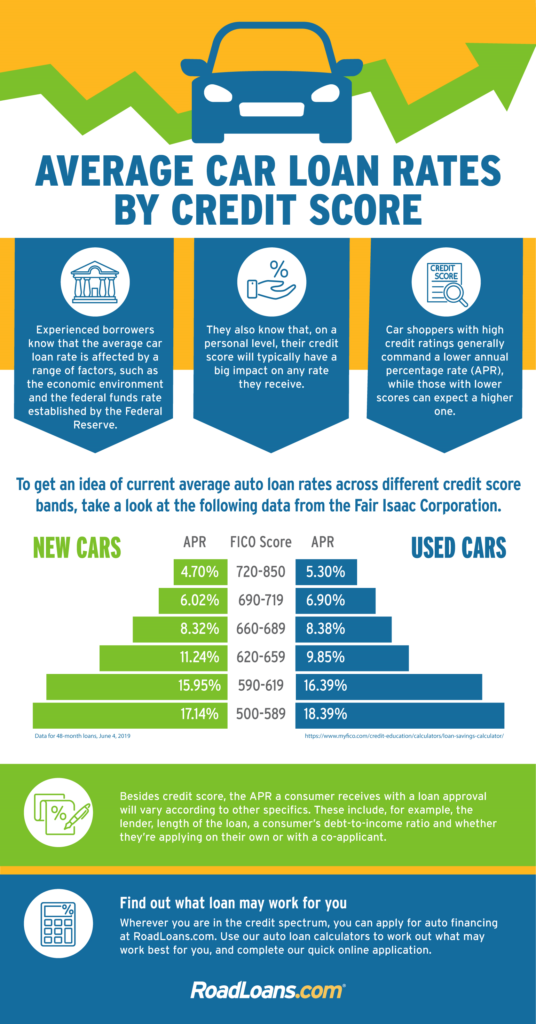

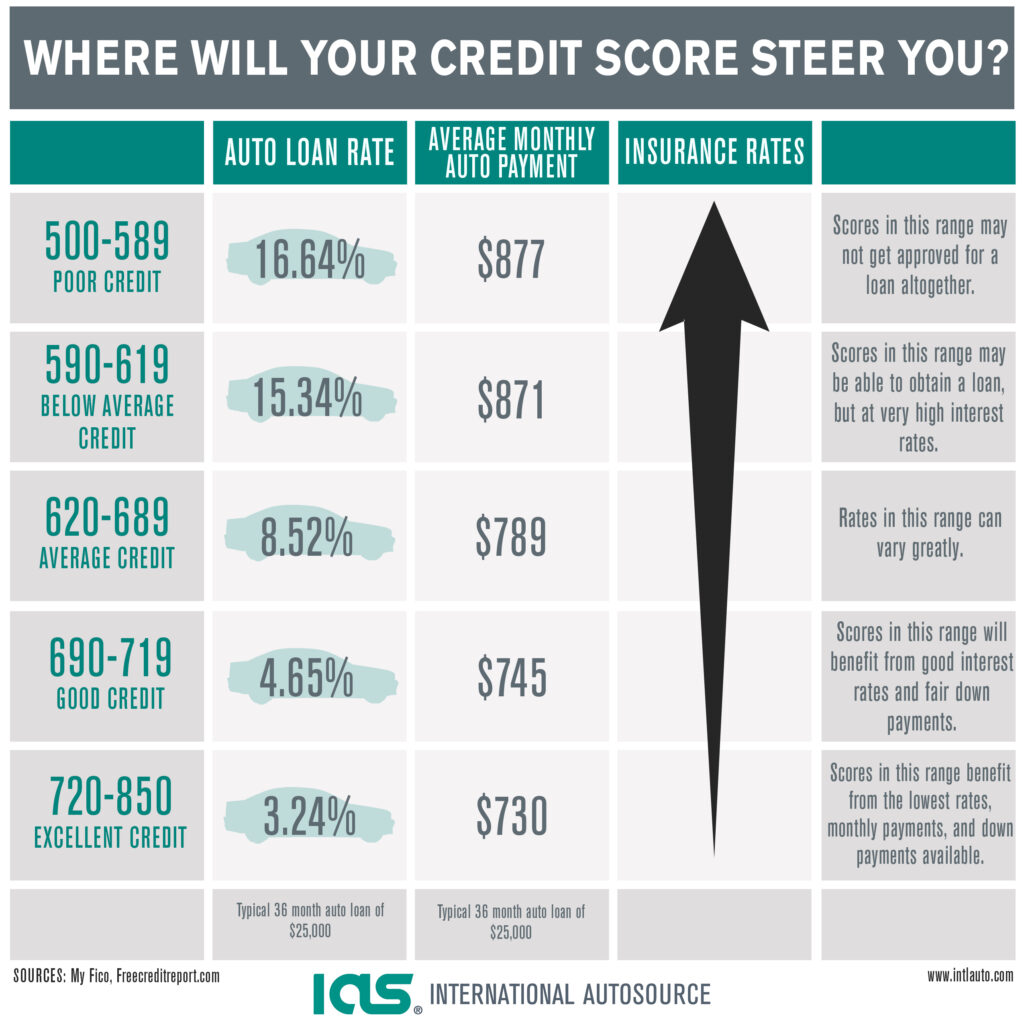

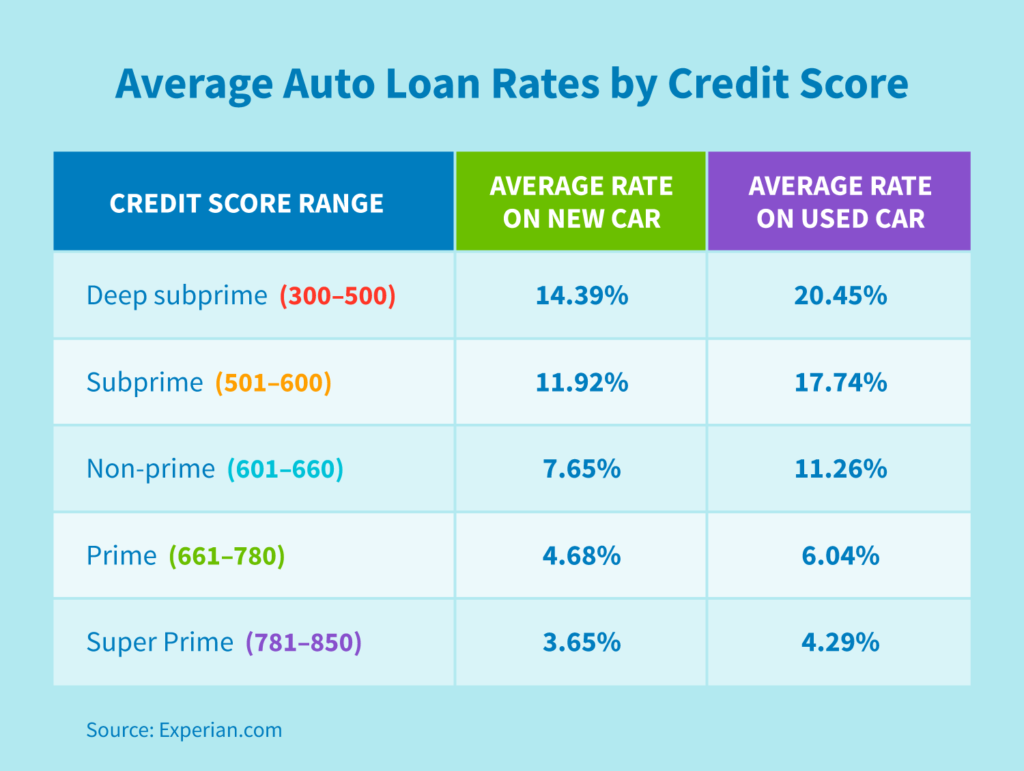

Interest rates and loan terms based on credit score

Credit score has a direct impact on the interest rates and loan terms offered by lenders. Individuals with higher credit scores typically qualify for lower interest rates, allowing them to save money over the life of the loan. On the other hand, individuals with lower credit scores may be offered higher interest rates, which can increase the overall cost of the car purchase.

Loan terms, such as the duration of the loan, can also be influenced by credit score. Higher credit scores may enable borrowers to secure longer loan terms, spreading the payments over a more extended period. This can result in lower monthly payments, making the car finance more manageable.

Impact on getting approved for car finance

In addition to influencing the interest rates and loan terms, credit score also plays a significant role in getting approved for car finance. Lenders consider credit scores as an indication of an individual’s ability to manage debt responsibly. A higher credit score demonstrates a lower risk and increases the chances of approval for car finance.

Individuals with lower credit scores may face challenges in getting approved for car finance. In such cases, it may be necessary to explore car finance options specifically designed for individuals with poor credit, but these options often come with higher interest rates and more stringent terms.

By understanding how credit score affects car finance, individuals can take steps to improve their credit scores or explore alternative car finance options if needed.

Improving Credit Score for Better Car Finance

Checking and understanding credit report

One of the first steps in improving credit score is to check and understand the credit report. Individuals can obtain a free copy of their credit report from credit bureaus such as Equifax, Experian, or TransUnion. Reviewing the credit report allows individuals to identify any errors or inaccuracies that may be negatively affecting their credit score.

If any errors are found, individuals should promptly report them to the respective credit bureau to have them corrected. It is also important to understand the factors contributing to the credit score, including payment history, credit utilization, and any negative remarks. This understanding offers insight into which areas to focus on for improvement.

Paying bills on time

One of the most crucial factors in improving credit score is making timely payments on bills and debts. Late payments can have a significant negative impact on credit score, so it is essential to prioritize paying bills on time. Setting up automatic payments or reminders can help ensure that payments are made promptly.

Reducing debt and managing credit utilization

Another effective strategy for improving credit score is to reduce existing debt and manage credit utilization effectively. Paying down debt, especially outstanding credit card balances, can improve credit utilization ratios and positively impact credit score.

Additionally, individuals can manage credit utilization by keeping balances on credit cards below 30% of the available credit limit. This demonstrates responsible credit management and can contribute to an improved credit score.

Avoiding new credit applications

While it is essential to have a mix of credit types for a healthy credit score, it is generally advisable to avoid making multiple new credit applications within a short period. Each new application results in a hard inquiry on the credit report, which can slightly lower the credit score. Instead, individuals should focus on maintaining their existing credit accounts and making regular payments.

By taking these steps to improve credit score, individuals can increase their chances of qualifying for better car finance terms, such as lower interest rates and longer loan terms.

Considerations for Bad Credit Car Finance

Options for individuals with bad credit

Individuals with bad credit may think securing car finance is out of reach. However, there are options available specifically designed for people with lower credit scores. Some common options for individuals with bad credit include:

-

Subprime lenders: Subprime lenders specialize in providing car finance options to individuals with poor credit. These lenders consider other factors in addition to credit score when assessing the creditworthiness of borrowers.

-

Buy Here Pay Here (BHPH) dealerships: BHPH dealerships offer in-house financing, eliminating the need to go through traditional lenders. These dealerships often finance cars directly to individuals with bad credit, giving them an opportunity to purchase a vehicle and work on improving their credit.

Higher interest rates and down payments

Individuals with bad credit should be aware that car finance options for them typically come with higher interest rates. Lenders consider individuals with bad credit to be higher-risk borrowers, and the higher interest rates compensate for this increased risk.

In addition to higher interest rates, individuals with bad credit may be required to make higher down payments. This reduces the overall loan amount and provides some security for the lender.

Building credit while financing a car

While individuals with bad credit may have limited car finance options, securing a car loan can also be an opportunity to start rebuilding credit. By making timely payments on the car loan, individuals demonstrate their ability to manage debt responsibly, which can gradually improve their credit score.

It is important for individuals with bad credit to carefully consider the terms and conditions of the car finance option and ensure that it fits within their budget. By making regular payments and diligently working towards improving their credit, individuals with bad credit can position themselves for better car finance options in the future.

Importance of Pre-Approval

What is pre-approval for car finance?

Pre-approval refers to the process of obtaining preliminary approval for a car finance loan from a lender before actually selecting a car. During the pre-approval process, lenders evaluate an individual’s creditworthiness and determine the maximum loan amount for which they qualify.

Advantages of getting pre-approved

There are several advantages to getting pre-approved for car finance:

-

Budgeting: Pre-approval helps individuals understand their purchasing power and set a realistic budget for purchasing a car. By knowing the maximum loan amount they qualify for, individuals can narrow down their search to vehicles within their budget.

-

Price negotiation: Pre-approval gives individuals an advantage when negotiating the price of a car. Knowing that they are already approved for a certain loan amount, individuals can negotiate confidently with car dealerships and potentially secure a better deal.

-

Time-saving: Pre-approval saves time during the car buying process. With pre-approval, individuals can focus on finding the right car without the added pressure of securing financing at the dealership. This streamlines the purchasing process and can lead to a smoother transaction.

How pre-approval affects credit score

When individuals apply for pre-approval, the lender typically performs a hard inquiry on their credit report. This hard inquiry can have a slight negative impact on credit score. However, the impact is typically minimal and temporary.

It is important for individuals to limit their pre-approval applications to a short timeframe to minimize the impact on credit score. Multiple applications made within a short period will usually be treated as a single inquiry by credit scoring models, minimizing the negative effects.

By getting pre-approved for car finance, individuals can gain a clear understanding of their budget, improve their negotiation position, and streamline the car buying process.

Choosing the Right Car Finance Option

Researching different lenders

When choosing a car finance option, it is essential to research and compare different lenders. Each lender may have different terms, interest rates, and requirements. By researching and understanding the options available, individuals can make more informed decisions.

Comparing interest rates and loan terms

Interest rates and loan terms can significantly impact the overall cost of car finance. It is important to compare the interest rates offered by different lenders and understand the associated loan terms. Lower interest rates can lead to substantial savings over the life of the loan, making it crucial to secure the most favorable rates possible.

Loan terms, such as the duration of the loan, should also be considered when choosing a car finance option. Longer loan terms can result in lower monthly payments, but it is important to assess the overall cost of the loan over time.

Considering monthly budget

One of the most critical considerations when choosing a car finance option is the impact on monthly budget. Individuals should carefully evaluate their financial situation and determine how much they can comfortably allocate to car finance payments each month. This ensures that the car finance option chosen aligns with their financial capabilities and does not cause unnecessary financial strain.

By carefully researching and comparing different lenders, interest rates, loan terms, and considering their monthly budget, individuals can make an informed decision on the right car finance option for their needs.

Negotiating with Car Dealerships

Understanding dealership financing options

Car dealerships often offer their own financing options to customers. These options may come in the form of loans or leases. Understanding the specifics of dealership financing options is crucial when negotiating.

It is important to carefully review and compare dealership financing options with other external lenders. While dealership financing may be convenient, it may not always offer the most favorable terms and interest rates.

Negotiating interest rates and terms

When negotiating with car dealerships, individuals should focus on negotiating the interest rates and loan terms. By demonstrating knowledge of external financing options and interest rates, individuals may be able to negotiate lower interest rates with the dealership.

Negotiating loan terms can also be advantageous. Longer loan terms can result in lower monthly payments, but individuals should consider the overall cost of the loan and aim for the shortest term possible that fits within their budget.

Avoiding predatory lending practices

While negotiating with car dealerships, it is important to be aware of predatory lending practices. Some dealerships may try to take advantage of individuals by offering unfavorable terms or charging unnecessary fees. It is crucial to carefully review all loan documents and ensure that the terms agreed upon are fair and within industry standards.

By effectively negotiating with car dealerships, individuals can secure more favorable financing terms and potentially save money over the life of the car loan.

Effects of Car Finance on Credit Score

Making regular payments and building credit

One of the positive effects of car finance on credit score is the opportunity to build a positive credit history. By making regular payments on time, individuals demonstrate responsibility in managing debt. This can have a positive impact on credit score and improve creditworthiness for future financial endeavors.

To maximize the positive impact on credit score, it is crucial to make all car finance payments in full and on time. Late or missed payments can have a significant negative effect on credit score, potentially undoing the progress made.

Consequences of missed or late payments

Missed or late payments on car finance can have negative consequences on credit score and overall creditworthiness. Late payments can result in penalties and fees, increasing the overall cost of the loan. Additionally, late payments can be reported to credit bureaus, resulting in a negative impact on credit score.

Repeated late or missed payments can severely damage credit score and make it challenging to qualify for future loans or credit. It is crucial to manage car finance payments responsibly and prioritize them to avoid negative consequences.

Impact of paying off car finance on credit score

Paying off a car finance loan can have a positive impact on credit score. It demonstrates the ability to fulfill financial obligations and manage debt responsibly. Once the car finance loan is paid off, individuals can enjoy the benefits of owning a car outright and potentially see an improvement in their credit score.

By making regular payments, avoiding late or missed payments, and paying off the car finance loan, individuals can positively impact their credit score and enhance their creditworthiness.

Rebuilding Credit after Car Finance

Reevaluating credit habits

After completing car finance, it is important to reevaluate credit habits and ensure responsible credit management going forward. This involves analyzing spending habits, budgeting effectively, and maintaining good financial practices.

Individuals should consider developing a solid plan for managing credit and debt, ensuring they are paying bills on time and keeping credit utilization low. Regularly reviewing credit reports and addressing any errors or discrepancies is also crucial in maintaining a good credit profile.

Maintaining good payment history

Maintaining a good payment history is essential for rebuilding credit after car finance. It is crucial to continue making all debt payments on time, including credit cards, loans, and any other financial obligations.

By consistently making timely payments, individuals can demonstrate their creditworthiness and build a positive credit history, which can enhance their overall credit profile.

Diversifying credit types

Another effective strategy for rebuilding credit after car finance is to diversify credit types. This involves having a mix of credit accounts such as credit cards, loans, and mortgages. By responsibly managing different types of credit, individuals can demonstrate their ability to handle various financial obligations and improve their creditworthiness.

It is important to carefully manage all credit accounts and avoid taking on more debt than can be comfortably managed.

Seeking professional help if needed

Rebuilding credit after car finance can be challenging, especially for individuals with a history of poor credit. In such cases, seeking professional help from credit counseling agencies or financial advisors may be beneficial. These professionals can provide guidance on responsible credit management, debt repayment strategies, and offer personalized advice based on individual circumstances.

By taking the necessary steps and seeking professional help if needed, individuals can rebuild their credit after car finance and position themselves for better financial opportunities in the future.

In conclusion, understanding car finance and its relationship with credit score is essential for individuals looking to purchase a car. By exploring different car finance options, considering credit score requirements, and taking steps to improve credit score, individuals can secure better car finance terms. Additionally, pre-approval, choosing the right car finance option, negotiating with car dealerships, and effectively managing car finance payments can all have a significant impact on credit score. With responsible credit management and timely payments, individuals can rebuild their credit and maintain good financial health after completing car finance.