In this article, I will explore the world of investments, finance, and credit from an analytical perspective. Through a detailed examination of market trends, risk assessment, and financial analysis, I aim to provide a comprehensive understanding of the intricate workings behind successful investment strategies. By adopting a systematic approach to decision-making, individuals and businesses can navigate the complexities of the financial landscape, make informed investments, and optimize their credit opportunities. Join me as we delve into the world of investments finance and credit, armed with analytical tools to unlock its potential.

Understanding Investments

Investments play a crucial role in finance as they offer individuals and organizations the opportunity to grow their wealth and increase their financial security. By investing wisely, one can potentially earn returns that outpace inflation and achieve long-term financial goals. However, before diving into the world of investments, it is essential to understand the various types of investments, the associated risks and returns, and the importance of asset allocation.

Types of Investments

There are several types of investments available in the financial markets, each catering to a different set of objectives and risk appetite. The most common investment options include stocks (equities), bonds, derivatives, and commodities. Equities represent ownership in a company and offer the potential for capital appreciation and dividends. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and return the principal amount at maturity. Derivatives are financial contracts whose value is derived from an underlying asset, while commodities involve investing in tangible assets such as gold, oil, or agricultural products.

Risk and Return

Investing entails a trade-off between risk and return. Generally, investments with higher potential returns also carry higher levels of risk. It is crucial to evaluate one’s risk tolerance and investment horizon before selecting investment options. Risk refers to the possibility of losing some or all of the invested capital, while returns reflect the gains or losses generated from investments. A diversified portfolio can help mitigate risk by spreading investments across different asset classes and industries.

Asset Allocation

Asset allocation plays a key role in achieving an optimal balance between risk and return. This strategy involves dividing investments among different asset classes, such as stocks, bonds, and commodities, based on their expected performance and risk characteristics. By diversifying investments, investors can reduce the impact of poor performance in a single asset class on their overall portfolio. A well-calibrated asset allocation can provide stability, generate steady returns, and help achieve long-term financial goals.

Analyzing Financial Markets

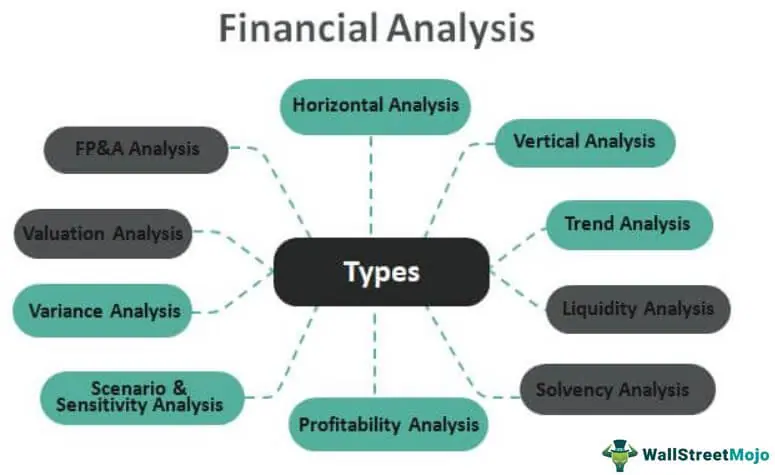

Analyzing financial markets is a fundamental aspect of making informed investment decisions. It involves evaluating market trends, assessing intrinsic values, and understanding the efficiency of market mechanisms. Two primary approaches are commonly used to analyze financial markets: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis aims to determine the intrinsic value of an investment by analyzing financial statements, economic indicators, and industry dynamics. This approach involves studying the financial health of a company, including its revenue, expenses, and profitability. By conducting a comprehensive assessment of a company’s fundamentals, investors can estimate its future earning potential and make informed investment decisions.

Technical Analysis

Technical analysis, on the other hand, focuses on market trends and price patterns. It involves analyzing historical price and volume data to identify patterns that can help predict future market movements. Technical analysts use various tools and indicators, such as moving averages, support and resistance levels, and chart patterns, to make investment decisions. While technical analysis is primarily used for short-term trading, it can also complement fundamental analysis by providing insights into market sentiment and turning points.

Market Indicators

Market indicators provide valuable information about the overall performance and direction of financial markets. These indicators include measures such as stock market indices, bond yields, exchange rates, and economic indicators. By monitoring market indicators, investors can gauge market sentiment, identify trends, and make informed decisions about their investments. Key market indicators include the S&P 500 Index, the yield on the 10-year Treasury bond, and the Consumer Price Index (CPI).

Market Efficiency

Market efficiency refers to the degree to which financial markets reflect all available information in asset prices. Efficient markets are characterized by fair prices and rapid adjustment to new information, making it difficult for investors to consistently outperform the market. The efficient market hypothesis suggests that it is challenging to generate excess returns by actively picking stocks or timing the market. However, proponents of behavioral finance argue that market inefficiencies exist due to investor biases and psychological factors, providing opportunities for skilled investors to outperform the market.

Financial Instruments

Financial instruments are tradable assets that represent a legal obligation or claim on an entity. They enable investors to participate in the financial markets and earn returns on their investments. The most common financial instruments include equities, bonds, derivatives, and commodities.

Equities

Equities, commonly known as stocks, represent ownership in a company. By buying shares of stock, investors become shareholders and are entitled to a portion of the company’s earnings and assets. Equities offer the potential for capital appreciation and dividend income, making them attractive long-term investment options. However, they also come with higher risks compared to other financial instruments, as their value can fluctuate significantly depending on market conditions and company performance.

Bonds

Bonds, also known as fixed-income securities, are debt instruments issued by governments, municipalities, and corporations to raise capital. When investors purchase bonds, they effectively lend money to the issuer in exchange for regular interest payments (coupon payments) and the return of the principal amount at maturity. Bonds are generally considered less risky than equities, as they offer fixed income and have a defined maturity date. They are often preferred by risk-averse investors seeking stable income and capital preservation.

Derivatives

Derivatives are financial contracts whose value derives from an underlying asset or financial benchmark. Common types of derivatives include options, futures, and swaps. Derivatives provide investors with opportunities to hedge against potential losses or speculate on future price movements. Options give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a predetermined period. Futures contracts oblige the parties involved to buy or sell an asset at a specified price on a future date. Swaps enable parties to exchange cash flows based on predetermined terms.

Commodities

Commodities are tangible assets with intrinsic value, such as gold, oil, natural gas, agricultural products, and metals. Investing in commodities allows investors to gain exposure to the prices of these essential goods. The commodity market provides a platform for producers and consumers to hedge against price fluctuations and for speculators to profit from price movements. Commodities are often seen as a way to diversify investment portfolios, as their returns are typically uncorrelated with traditional asset classes, such as equities and bonds.

Investment Strategies

Investment strategies are systematic approaches designed to achieve specific financial goals, whether it be long-term growth, regular income, or asset preservation. Different investment strategies cater to varying risk profiles and investment objectives.

Value Investing

Value investing involves identifying undervalued stocks or assets that are trading below their intrinsic value. Value investors believe that the market can occasionally misprice assets, presenting opportunities for long-term gains. They conduct fundamental analysis to identify stocks with strong underlying fundamentals, such as low price-to-earnings ratios or high dividends. Value investing is often associated with a “buy and hold” approach, as it requires patience for the market to recognize the underlying value of the investment.

Growth Investing

Growth investing focuses on identifying stocks or assets that have the potential for above-average growth compared to the broader market. Growth investors target companies with strong earnings growth, innovative business models, and competitive advantages. They often prioritize companies in the technology, healthcare, or consumer sectors that demonstrate the potential for exponential growth. Growth investing typically involves higher levels of risk, as investors pay a premium for companies expected to generate future value.

Income Investing

Income investing, also known as dividend investing, involves seeking investments that generate regular income through dividends, interest payments, or rental income. Income investors often prioritize assets that provide a consistent cash flow, such as high-dividend stocks, bonds, or real estate investment trusts (REITs). This strategy is often favored by investors looking for ongoing income to cover living expenses or enhance their overall investment returns.

Index Investing

Index investing, also known as passive investing or index tracking, involves investing in a portfolio that replicates the performance of a specific market index, such as the S&P 500. Index investors aim to match the returns of the index rather than attempting to outperform it. This strategy reduces the need for active management and lowers investment costs, as index funds typically have lower expense ratios compared to actively managed funds. Index investing is popular among investors seeking diversification and a long-term, low-maintenance investment approach.

Diversification

Diversification is a risk management strategy that involves spreading investments across different asset classes, industries, and geographical regions. By diversifying their portfolios, investors aim to reduce the impact of poor performance in a single investment on their overall returns. Diversification can enhance the risk-return profile of a portfolio by maximizing potential returns while minimizing potential losses. It allows investors to capture the performance of various investments that may perform differently under different market conditions.

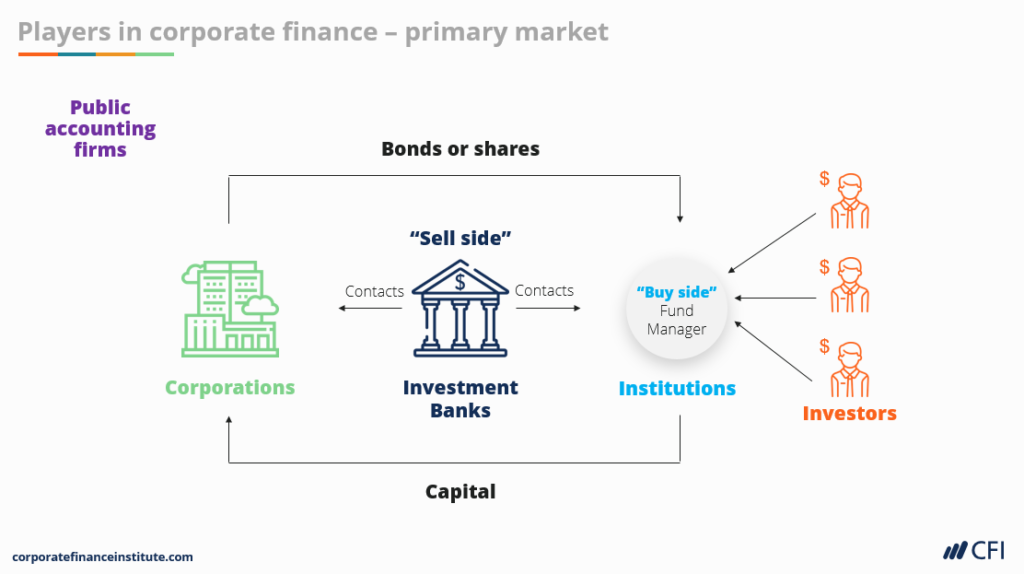

Credit Analysis

Credit analysis is a critical aspect of assessing the creditworthiness of borrowers and managing credit risk. It involves evaluating borrowers’ ability to repay their debt obligations and the potential risks associated with lending to them.

Credit Risk

Credit risk refers to the potential of a borrower defaulting on their debt obligations or failing to make timely interest or principal payments. Lenders and investors assess credit risk by analyzing the borrower’s financial health, repayment history, cash flow, and collateral. The assessment of credit risk helps determine the interest rate charged on loans or the price of bonds issued by corporations or governments.

Credit Rating Agencies

Credit rating agencies play a crucial role in the credit analysis process. These agencies assign credit ratings to borrowers based on their ability to repay debt. The three major credit rating agencies are Standard & Poor’s, Moody’s, and Fitch Ratings. Credit ratings provide investors with an indication of the creditworthiness of bonds or other debt instruments issued by companies or governments. Higher credit ratings imply lower credit risk and often result in lower borrowing costs for issuers.

Credit Default Swaps

Credit default swaps (CDS) are financial instruments that allow investors to hedge against the risk of default by a specific borrower or debt issuer. CDS act as insurance contracts, where the buyer of the swap pays regular premiums to the seller in exchange for protection against potential credit events. If a credit event occurs, such as a borrower defaulting on their debt, the seller of the CDS is obligated to pay the buyer the full face value of the bond or the agreed-upon amount.

Credit Derivatives

Credit derivatives are financial instruments whose value is derived from the credit risk of an underlying asset, such as a bond or loan. These derivatives enable investors to take a position on credit risk or hedge against potential losses due to credit events. Examples of credit derivatives include credit default swaps, collateralized debt obligations (CDOs), and credit-linked notes (CLNs). These instruments provide investors with opportunities to manage credit risk exposure and optimize their investment strategies.

Financial Ratios

Financial ratios are quantitative metrics used to evaluate a company’s financial performance and assess its overall health. These ratios provide insights into a company’s liquidity, profitability, solvency, and efficiency, enabling investors to make informed investment decisions.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet short-term obligations and convert assets into cash without significant difficulty. Common liquidity ratios include the current ratio, quick ratio, and operating cash flow ratio. The current ratio compares current assets to current liabilities, providing an indication of a company’s ability to cover its short-term commitments. The quick ratio, also known as the acid-test ratio, focuses on a company’s most liquid assets, excluding inventory. The operating cash flow ratio assesses a company’s ability to generate sufficient cash flow from its operations to cover its obligations.

Profitability Ratios

Profitability ratios evaluate a company’s ability to generate profits in relation to sales, assets, and equity. Key profitability ratios include the gross profit margin, operating margin, net profit margin, return on assets (ROA), and return on equity (ROE). The gross profit margin compares gross profit to sales, measuring the efficiency of a company’s production process. The operating margin assesses a company’s ability to generate operating income relative to sales. The net profit margin indicates the level of profitability after all expenses and taxes have been deducted. ROA examines how efficiently a company utilizes its assets to generate profits, while ROE measures the return generated for shareholders’ equity invested in the company.

Solvency Ratios

Solvency ratios assess a company’s ability to meet its long-term debt obligations and remain financially stable. These ratios include the debt-to-equity ratio, interest coverage ratio, and debt service coverage ratio. The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity, indicating its reliance on debt financing. The interest coverage ratio measures a company’s ability to cover interest payments with its operating income. The debt service coverage ratio evaluates a company’s ability to service its existing debt through its cash flow, considering both principal and interest payments.

Efficiency Ratios

Efficiency ratios assess the efficiency of a company’s operations and its utilization of resources. Examples of efficiency ratios include inventory turnover, accounts receivable turnover, and total asset turnover. The inventory turnover ratio measures how quickly a company sells and replaces its inventory. The accounts receivable turnover ratio evaluates the effectiveness of a company’s credit policy and the speed at which it collects payments from customers. The total asset turnover ratio assesses how effectively a company generates sales revenue from its total assets.

Valuation Techniques

Valuation techniques are essential tools for estimating the fair value of investments and determining whether they are overpriced or underpriced. Various valuation models can be used depending on the nature of the investment and the available information.

Discounted Cash Flow

The discounted cash flow (DCF) method is a widely used valuation technique that estimates the present value of a company’s future cash flows. This approach involves projecting a company’s expected cash flows over a specific period and discounting them back to their present value using a discount rate. The discount rate, often based on the company’s cost of capital, reflects the time value of money and the risk associated with the investment. The DCF method provides a comprehensive framework for valuing companies by considering the time value of money and the company’s expected cash flow generation ability.

Dividend Discount Model

The dividend discount model (DDM) is used to value stocks by estimating their fair value based on the present value of expected future dividends. The DDM assumes that the intrinsic value of a stock is the present value of its future dividend payments. This valuation method is particularly relevant for income-oriented investors who prioritize dividend income. By discounting expected future dividends, the DDM can help investors assess whether a stock is overvalued or undervalued in relation to its dividend-paying potential.

Price-Earnings Ratio

The price-earnings (P/E) ratio is a popular valuation metric used to assess the relative value of a company’s stock. The P/E ratio compares the market price per share to the company’s earnings per share (EPS). A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may indicate that it is undervalued. However, the interpretation of P/E ratios should take into account the industry, company growth prospects, and other qualitative factors that may influence valuation.

Book Value

Book value is the value of a company’s assets minus its liabilities and intangible assets. It represents the net worth of the company on its balance sheet. The book value per share is calculated by dividing the book value by the number of outstanding shares. Book value can be used as a valuation tool to determine whether a stock is trading above or below its intrinsic value. However, book value may not fully capture the company’s earning potential or intangible assets, such as intellectual property or brand value.

Market Capitalization

Market capitalization, often referred to as market cap, is a measure of a company’s size and value in the stock market. It is calculated by multiplying the company’s share price by its number of outstanding shares. Market cap provides information about a company’s relative size compared to other companies in the market. It is often used as a factor in index composition and investment strategies, as large-cap companies tend to exhibit different risk-return characteristics compared to mid-cap or small-cap companies.

Risk Management

Risk management is a crucial aspect of investing that involves identifying, assessing, and mitigating potential risks. By adopting effective risk management strategies, investors can protect their portfolio from significant losses and increase the likelihood of achieving their investment objectives.

Risk Identification

Risk identification involves identifying and understanding the various risks associated with an investment. These risks can include market risk, credit risk, liquidity risk, operational risk, and geopolitical risk. By conducting a comprehensive risk assessment, investors can make informed decisions about their investments and develop appropriate risk management strategies.

Risk Assessment

Risk assessment involves quantifying the potential impact and likelihood of different risks occurring. This process allows investors to prioritize risks based on their severity and probability and devise mitigation strategies accordingly. Risk assessment techniques include scenario analysis, stress testing, and sensitivity analysis. These methods enable investors to evaluate the potential impact of various risk factors on their portfolios and make informed decisions to manage risk exposure effectively.

Risk Mitigation

Risk mitigation involves implementing strategies to reduce the impact of potential risks on investment portfolios. These strategies can include diversification, hedging, investing in low-risk assets, and maintaining an appropriate asset allocation. Diversification is a common risk mitigation technique that involves spreading investments across different asset classes and sectors to reduce concentration risk. Hedging strategies, such as the use of derivatives, allow investors to protect their portfolios against specific risks, such as currency fluctuations or interest rate movements.

Hedging Strategies

Hedging strategies involve taking positions in financial instruments to offset potential losses in other investments. These strategies are commonly used to manage specific risks, such as currency risk, interest rate risk, or commodity price risk. For example, a company may use hedging strategies to protect against adverse movements in foreign exchange rates that could impact its profitability. Hedging can help minimize potential losses and stabilize investment portfolios during volatile market conditions.

Credit Analysis Models

Credit analysis models are quantitative tools used to evaluate the creditworthiness of borrowers and assess the potential risk of default. These models incorporate various financial ratios and statistical techniques to estimate the probability of default and the expected loss in case of default.

Altman’s Z-Score

Altman’s Z-Score is a widely used credit analysis model that assesses the likelihood of corporate bankruptcy. The model incorporates several financial ratios, including liquidity, profitability, solvency, and efficiency ratios, to calculate a single score. The Z-Score indicates the financial health of a company and provides a measure of its creditworthiness. A higher Z-Score suggests a lower probability of default, while a lower Z-Score implies a higher risk of bankruptcy.

Merton’s Model

Merton’s model, also known as the structural model, is used to estimate the probability of default for individual bonds or corporate debt. The model assumes that the value of the firm’s assets follows a stochastic process and that default occurs when the value of the assets falls below a certain threshold. By estimating the likelihood of the firm’s assets falling below this threshold, the model calculates the probability of default and the expected loss in case of default.

Moody’s KMV Model

Moody’s KMV, developed by Moody’s Analytics, is a widely used credit risk model that estimates the probability of default for individual companies or portfolios of loans. The model incorporates market data, financial ratios, equity prices, and other inputs to calculate a firm’s distance-to-default (DTD). The DTD represents the proximity of a company’s asset value to its default point. By comparing the DTD to default thresholds derived from historical default rates, the KMV model estimates the probability of default and provides insights into credit risk.

Economic Factors

Economic factors play a significant role in shaping financial markets and investment opportunities. Understanding key economic indicators can help investors make informed decisions and identify potential risks and opportunities.

Interest Rates

Interest rates influence the cost of borrowing, the attractiveness of investments, and the level of economic activity. Central banks, such as the Federal Reserve in the United States, set interest rates to manage inflation and maintain economic stability. Changes in interest rates can impact bond yields, mortgage rates, stock market valuations, and currency exchange rates. Investors closely monitor interest rate decisions and economic indicators related to interest rates to gauge the direction of the economy and make investment decisions accordingly.

Inflation

Inflation refers to the increase in the prices of goods and services over time. Inflation erodes the purchasing power of money, reducing the value of investments and savings. High inflation can be detrimental to fixed-income investments, such as bonds, as it erodes the real value of interest payments and principal. On the other hand, certain investments, such as stocks and commodities, may act as hedges against inflation, as their prices may rise along with inflationary pressures. Investors analyze inflation rates and economic indicators to understand the potential impact on their investments and adjust their portfolios accordingly.

GDP

Gross Domestic Product (GDP) measures the total value of goods and services produced within an economy over a specific period. GDP growth is a crucial indicator of economic health and is closely monitored by investors, policymakers, and central banks. Strong GDP growth often indicates a healthy economy, increasing consumer spending, and corporate profitability. Investors analyze GDP growth rates, as well as components such as consumption, investment, government spending, and net exports, to assess economic trends and identify investment opportunities.

Unemployment

Unemployment rates reflect the percentage of the labor force that is unemployed and actively seeking employment. High unemployment rates can be indicative of economic weakness and reduced consumer spending power. Conversely, low unemployment rates can signal a strong economy and increased consumer confidence. Investors analyze unemployment rates, as well as labor market indicators such as job creation, workforce participation, and wage growth, to assess the overall health of the economy and its potential impact on investments.

In conclusion, an analytical approach to investments, finance, and credit involves understanding the various types of investments, evaluating risks and returns, conducting thorough market analysis, assessing financial instruments, developing effective investment strategies, analyzing credit risk, utilizing financial ratios for evaluation, applying valuation techniques, managing risks, utilizing credit analysis models, and considering key economic factors. By adopting a comprehensive approach to investing and analyzing financial markets, individuals and organizations can make more informed decisions, optimize their portfolios, and increase their chances of achieving long-term financial goals.