In this article, I will explore the essential facts surrounding consumer finance companies and credit. By examining the relationship between consumers and these specialized institutions, we can gain valuable insights into the world of personal finance. From understanding the role of credit in our lives to debunking common misconceptions, this piece aims to provide a comprehensive overview of consumer finance companies and their impact on individuals’ financial well-being. So, let us unearth the truth behind these intriguing entities and discover how credit helps shape our financial journeys.

Consumer Finance Companies

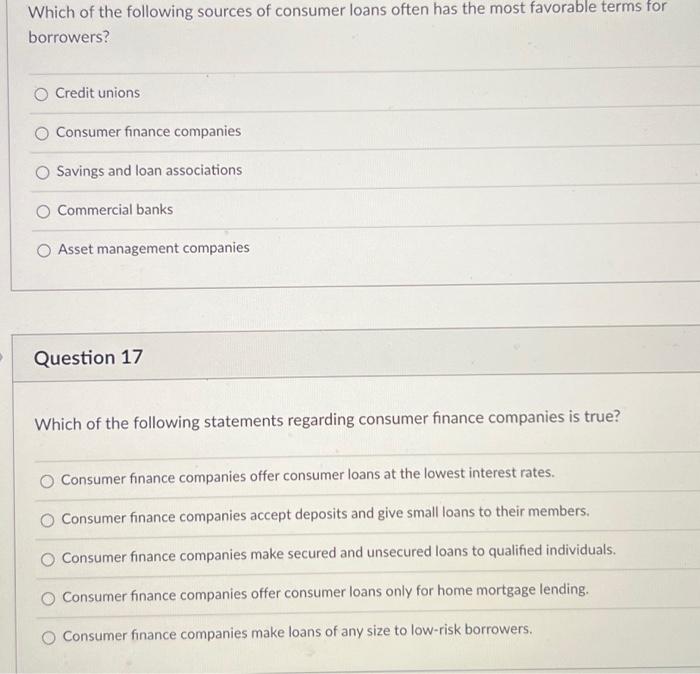

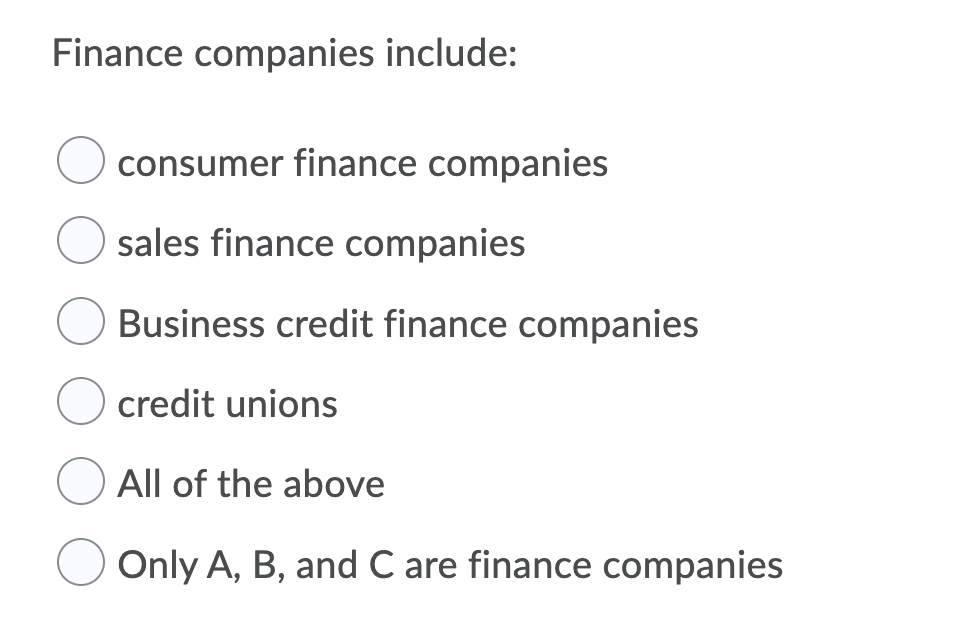

Consumer finance companies play a crucial role in the financial industry by providing various services to consumers. These companies specialize in offering loans, credit, and other financial products to individuals. Understanding consumer finance companies and credit is essential for individuals seeking financial assistance and for those interested in the functioning of the financial sector.

Definition

Consumer finance companies can be defined as financial institutions that specialize in providing loans and credit to individuals. These companies are different from traditional banks as they focus primarily on serving the needs of consumers. They offer a range of financial products and services such as personal loans, auto loans, and credit cards.

Services Offered

Consumer finance companies offer a wide range of services to cater to the diverse financial needs of individuals. Some of the common services offered by these companies include:

-

Personal Loans: Consumer finance companies provide personal loans to individuals for various purposes, such as consolidating debt, making home improvements, or covering unexpected expenses. These loans are typically unsecured, meaning they do not require collateral.

-

Auto Loans: Consumer finance companies also offer auto loans to individuals looking to purchase a car. These loans can be secured by the vehicle itself, which acts as collateral to secure the loan.

-

Credit Cards: Many consumer finance companies issue credit cards to consumers. These cards allow individuals to make purchases on credit and repay the amount over time. Credit cards can be used for everyday expenses, emergencies, or for building a credit history.

Regulation

Consumer finance companies are regulated by both federal and state laws to ensure fair practices and protect consumers. These regulations aim to maintain transparency, prevent predatory lending, and promote consumer rights.

Credit

Credit is a fundamental aspect of personal finance and plays a significant role in the modern economy. Understanding credit and its various components is essential for individuals who wish to make informed financial decisions.

Definition

Credit refers to the ability of an individual or entity to borrow money or access goods and services with the understanding that they will repay the borrowed amount at a later date. It involves a lender providing funds to a borrower, who agrees to repay the loan with interest or fees.

Types of Credit

There are various types of credit available to individuals, depending on their needs and financial circumstances. Some common types of credit include:

-

Revolving Credit: Revolving credit allows individuals to borrow and repay funds, up to a predetermined credit limit. Credit cards and lines of credit are examples of revolving credit. The borrower can choose to repay the borrowed amount in full or make minimum monthly payments while carrying a balance.

-

Installment Credit: Installment credit involves borrowing a fixed amount of money upfront and repaying it in regular installments over a specified period. Auto loans, mortgages, and personal loans are examples of installment credit. The borrower agrees to make fixed payments, usually on a monthly basis, until the loan is fully repaid.

Factors Affecting Creditworthiness

Creditworthiness refers to an individual’s ability to repay borrowed funds and the level of risk associated with lending to that individual. Several factors influence an individual’s creditworthiness and the terms they may be offered when applying for credit:

-

Payment History: One of the most crucial factors affecting creditworthiness is an individual’s payment history. Lenders assess whether the borrower has a history of making timely payments on credit obligations. Consistently making payments on time demonstrates responsible financial behavior and positively impacts creditworthiness.

-

Credit Utilization Ratio: The credit utilization ratio measures the amount of available credit an individual uses compared to their total credit limit. Lenders prefer to see a lower credit utilization ratio, as it indicates that the borrower is not overly reliant on credit and is more likely to manage their finances responsibly.

-

Length of Credit History: The length of an individual’s credit history also influences creditworthiness. Lenders prefer individuals with a longer credit history as it provides a more comprehensive picture of their financial behavior and repayment patterns. Having a longer credit history can contribute to a higher credit score and increased creditworthiness.

In conclusion, understanding consumer finance companies and credit is crucial for individuals navigating the financial landscape. Consumer finance companies offer a range of services to meet the diverse financial needs of individuals, while credit is a fundamental aspect of personal finance and the modern economy. By being informed about the various services offered by consumer finance companies, the types of credit available, and the factors affecting creditworthiness, individuals can make informed financial decisions and manage their finances effectively. Furthermore, the regulation of consumer finance companies ensures fair practices and protects consumers from predatory lending, promoting a transparent and trustworthy financial environment.