I am pleased to introduce the finance and credit degree, a comprehensive program that equips students with the knowledge and skills needed to excel in the dynamic world of finance. This degree goes beyond traditional finance programs by offering a specialized focus on credit management, providing graduates with a competitive edge in the industry. With an emphasis on practical application and real-world scenarios, students will gain a deep understanding of financial analysis, risk management, and investment strategies. Whether you aspire to work in banking, financial advisory, or corporate finance, this degree will pave the way for a successful and rewarding career in the ever-evolving field of finance.

Finance and Credit Degree

What is a Finance and Credit Degree?

A Finance and Credit degree is an academic program that focuses on providing students with a strong foundation in finance principles and practices, as well as an understanding of credit management. This degree equips individuals with the knowledge and skills necessary to navigate the complex world of finance, including investment analysis, financial planning, risk management, and credit analysis.

Benefits of a Finance and Credit Degree

Pursuing a Finance and Credit degree offers numerous benefits to individuals interested in the field of finance. Firstly, it provides a comprehensive understanding of financial concepts, enabling graduates to make sound financial decisions. This degree also equips students with critical analytical skills, allowing them to evaluate financial data and make informed judgments. Additionally, a finance and credit degree provides individuals with a competitive edge in the job market, as employers value the specialized knowledge and expertise obtained through this program.

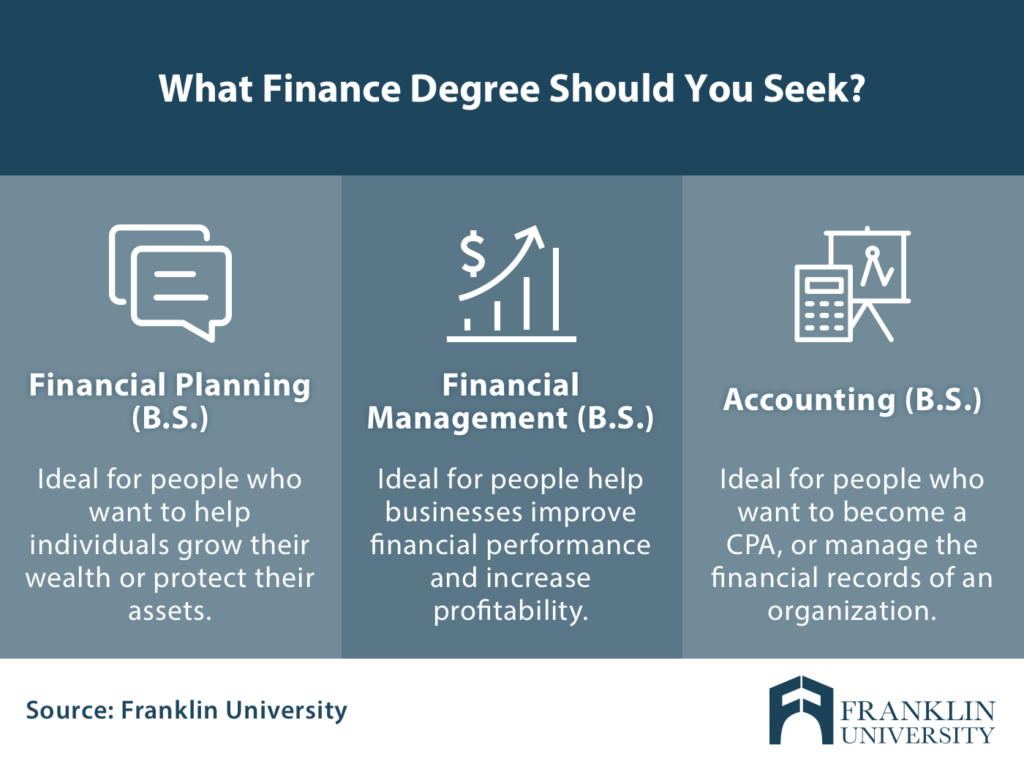

Types of Finance and Credit Degrees

There are various types of Finance and Credit degrees available to aspiring finance professionals. One option is a Bachelor’s degree in Finance and Credit, which typically takes four years to complete. This undergraduate program provides students with a broad understanding of finance principles and prepares them for entry-level positions in the finance industry. Another option is a Master’s degree in Finance and Credit, which offers a more in-depth study of finance and credit management. This advanced degree is suitable for individuals seeking higher-level positions or specialization in specific areas of finance.

Core Courses in a Finance and Credit Degree

In a Finance and Credit degree program, students can expect to take a range of core courses that cover various aspects of finance and credit management. Some of the fundamental courses include financial analysis, investment management, financial markets and institutions, risk management, corporate finance, and credit management. These courses provide students with a solid foundation in finance theory and its practical application in the business world.

Skills Acquired in a Finance and Credit Degree

Earning a Finance and Credit degree equips individuals with a wide range of valuable skills. Firstly, students develop strong analytical skills, enabling them to critically evaluate financial data and make sound financial decisions. They also gain proficiency in financial modeling and forecasting, which are vital skills for financial analysts. Communication skills are also emphasized in this program, as finance professionals need to effectively convey complex financial information to clients, colleagues, and stakeholders. Furthermore, students acquire skills in risk assessment, credit analysis, and investment evaluation, which are essential for successful careers in finance.

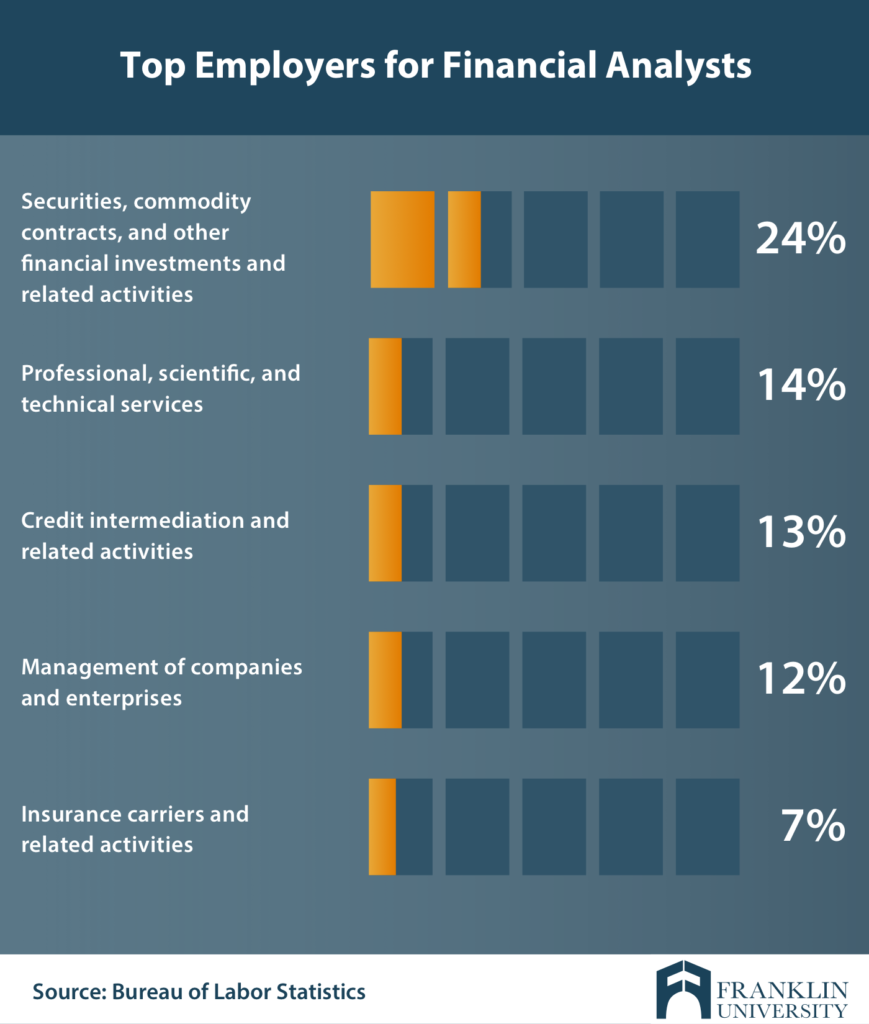

Career Opportunities with a Finance and Credit Degree

A Finance and Credit degree opens up various career opportunities in the finance industry. Graduates can pursue roles such as financial analyst, credit analyst, investment banker, financial planner, risk manager, and financial consultant. These positions can be found in a wide range of industries, including banking, investment firms, insurance companies, and consulting firms. With the increasing importance of financial management in organizations, the demand for finance professionals is expected to grow, providing abundant career opportunities to Finance and Credit degree holders.

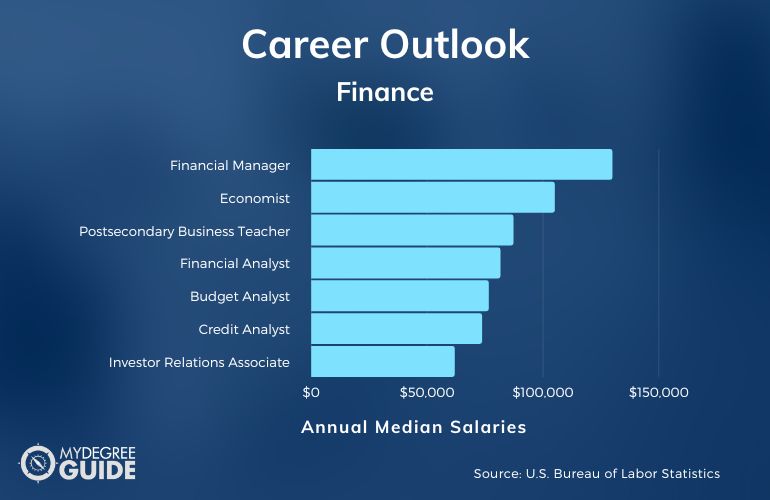

Salary Potential with a Finance and Credit Degree

One of the significant advantages of obtaining a Finance and Credit degree is the potential for high salary earnings. The finance industry offers competitive salaries to individuals with the right qualifications and expertise. Entry-level positions, such as financial analysts, can expect to earn a starting salary ranging from $50,000 to $70,000 per year. As professionals gain experience and progress in their careers, their earning potential increases significantly. Senior-level positions, such as investment bankers or financial managers, can earn six-figure salaries or even more, depending on their expertise and the organization they work for.

Top Universities Offering Finance and Credit Degrees

Several prestigious universities offer excellent Finance and Credit degree programs. Some of the top institutions known for their finance curriculum include Harvard University, Stanford University, Massachusetts Institute of Technology (MIT), University of Pennsylvania, and University of California, Berkeley. These universities provide comprehensive finance programs taught by esteemed faculty members who are experts in the field. Studying at these top universities not only provides students with quality education but also enhances their career prospects through networking opportunities and access to industry connections.

Admission Requirements for a Finance and Credit Degree

Admission requirements for a Finance and Credit degree program may vary depending on the university and program level. In general, applicants are required to have a high school diploma or equivalent for undergraduate programs, while a bachelor’s degree is typically necessary for entry into a master’s program. Universities may also require standardized test scores, letters of recommendation, a statement of purpose, and a resume demonstrating relevant experience. It is essential for prospective students to carefully review each university’s admission requirements and submit a strong application to increase their chances of acceptance.

Scholarship Opportunities for Finance and Credit Students

Financing a degree can be a significant concern for many students. Luckily, there are several scholarship opportunities available specifically for Finance and Credit students. Many universities offer scholarships for academic excellence, leadership potential, and financial need. Additionally, numerous financial institutions and organizations provide scholarships and grants to students pursuing finance-related degrees. It is advisable for students to explore these opportunities and apply for scholarships that match their qualifications and aspirations. By securing scholarships, students can alleviate the financial burden of their education and focus on their academic and career goals.

In conclusion, pursuing a Finance and Credit degree offers numerous benefits, including a comprehensive understanding of finance principles, valuable analytical skills, and a wide range of career opportunities. Graduates of this program can expect competitive salaries and have the chance to study at prestigious universities known for their finance curriculum. With careful preparation, including meeting admission requirements and applying for scholarships, individuals can embark on a rewarding educational journey that will pave the way for a successful finance career.